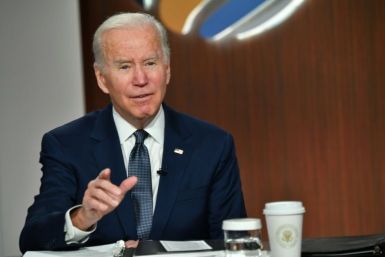

President Joe Biden made his first appearance on a late-night television show since taking office.

Inflation in the U.S. set another somber record on Friday as consumer prices shot up to levels unseen since 1982, led by the growth in energy prices.

Google announced they won't be raising pay to match inflation citing company benefits and that they will raise wages based on performance.

The U.S Federal Reserve has signaled that it is likely to hasten the pace of its tapering off of its asset purchasing over inflation concerns. Now speculation is rising that an interest rate hike may be here sooner than expected.

Dollar Tree will raise its prices by 25% amid inflation and supply chain issues.

New York Times best-selling author Robert Kiyosaki has said that he will be investing more in cryptos like Bitcoin and Ethereum, among other assets, as inflation keeps rising.

Business leaders expressed optimism at a meeting with the president that they were well stocked ahead of the holiday season and that they welcomed his help in easing ongoing supply chain bottlenecks.

Inflation continues to plague the U.S. economy amid rising concerns.

A survey found consumer sentiment at its lowest point since the aftermath of the Great Recession.

General Mills has announced they will begin raising their prices beginning in mid-January.

Americans may be concerned about rising prices, but that has not stopped them from continuing to do their holiday shopping.

The Federal Reserve, which would be responsible for fighting inflation if it stays too high for too long, insisted again on Nov. 3, 2021, that it’ll be temporary, in large part because it’s tied to the supply chain mess bedeviling economies, companies and consumers.

Inflation in the United States has defied expectations by hitting a three-decade high as prices for most basic goods registered hikes. In the most recent Consumer Price Index (CPI), prices were up by 6.2% in the last year, the highest increase since November 1990.

The total household debt in the U.S. rose to $15 trillion. The Federal Reserve Bank of New York reported the information Tuesday.

Wholesale prices in the United States reached a historic high after rising 8.6% over the last year in a sign that ongoing supply chain problems are continuing to drive up inflation.

The U.S. is seeing a continued decline in the initial unemployment claims, but there are still a number of signs that the labor market still has a way to go before it exits recovery mode.

The Federal Reserve announced that it would begin tapering its multibillion-dollar monthly asset purchases starting this month.

Personal income saw a 1.0% drop on Friday in the Department of Commerce's recently released Personal Consumption Expenditure (PCE) data. The overall PCE was higher by 4.4% in September, likely to add to fears of persistent inflation.

Food prices are up 3.7% so far in 2021, compared to a 20-year average of about 2.4%.

“I really think there will be a crisis the way we are going, the way we are printing money, the way we are going into inflation," Icahn said.

U.S. industrial output for September fell by 1.3% in a sign that ongoing supply chain problems are continuing to choke manufacturers and take a toll on the economy.

Consumer spending in September grew more than expected, defying predictions that squeezed supply chains would reduce the monthly total, according to the U.S. Census Bureau.