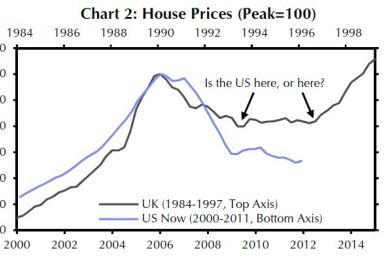

U.S. housing prices won't just hit the bottom this year -- they'll rise by 2 percent, according to a report by Capital Economics released this week. But that doesn't mean the market is in great shape.

European markets fell Thursday as investors were disappointed the U.S. Federal Reserve failed to announce any quantitative easing measures on Wednesday.

Most Asian markets fell Thursday as investors felt let down by the U.S. Federal Reserve, which did not announce a further round of quantitative easing.

Asian stocks struggled and commodities fell broadly on Thursday after the Federal Reserve ramped up monetary stimulus by expanding Operation Twist, but disappointed some investors who had been hoping for more aggressive measures.

Asian markets rose Wednesday amid speculation that the U.S. Fed will announce monetary easing measures to rejuvenate the economy.

The surprise decision Monday by the Reserve Bank of India to hold its interest rate steady because of inflation concerns puts fresh pressure on the ruling Congress Party to find a fiscal solution to the country's flagging economy.

The Reserve Bank of India disappointed the industry as it left the repo rate and cash reserve ratio unchanged at 8 percent and 4.75 percent, respectively, in its mid-quarter policy review Monday. The reverse repo rate, at which banks lend money to the RBI, also remains unchanged at 7 percent.

The Reserve Bank of India will hold its mid-quarter monetary policy review June 18 amid strong demands from the industry and economists for a cut in interest rates. However, the central bank is still weighing the options on rate cuts as curtailing inflation remains top priority.

India's wholesale price index (WPI) rose to 7.55 percent in May, mounting pressure on the Reserve Bank of India ahead of its highly anticipated rate cuts.

Helicopter gunships aren't the only things Russia is giving Syria; now the Kremlin is printing money for the cash-strapped Damascus regime. But whereas the former makes Assad's regime stronger militarily, the latter may be contributing to an inflation rate that is now more than 30 percent.

European markets rose Wednesday following an overnight rally in the Wall Street amid anticipation that the U.S. Federal Reserve would announce further quantitative easing to support the economy.

China's May data dump over the weekend and on Monday painted a mixed picture of the economic health of the world's second-largest economy.

The Reserve Bank of India is expected to ease rates at the forthcoming mid-quarter review June 18 to lift constraints on lending as it seeks to tackle the shortage of cash in the banking sector and the slowing economy.

China's inflation cooled in May, giving Beijing more wiggle room to loosen policy and stimulate growth. Its consumer price index rose by 3 percent, and its producer price index fell by 1.4 percent.

Home prices are stagnant, crude oil is tumbling and copper has fallen to a seven-month low. Inflation is not the problem. What is the problem is inflation's evil twin, deflation.

Eurozone producer price inflation was flat in April and gained 2.6 percent on the year, Eurostat reported on Monday. Economists had expected a 0.2 percent increase and an increase of 2.7 percent on the year.

Falling global oil prices as well as declining core inflation and growth in India give the Reserve Bank of India room to adjust interest rates, a deputy governor said, two weeks before a policy review for which expectations have been growing for a rate cut.

A third straight month of disappointing job data clearly suggests that the U.S. labor market conditions are deteriorating again, which economists say will undoubtedly prompt more speculation that a third round of quantitative easing by the U.S. Federal Reserve is coming soon.

Euro zone annual inflation is expected to be 2.4 percent in May, down from 2.6 percent in April, a report from the European Union's Eurostat statistics office said Thursday.

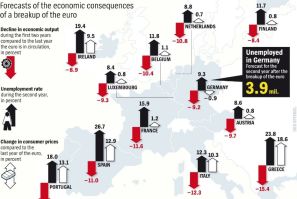

In economic news, the euro data was overwhelmingly negative, which interestingly enough did not propel the euro lower.

Home prices in China fell in April, indicating that the government's efforts to curb the property market boom are gaining further momentum.

India's inflation accelerated in April to 7.23 percent, higher than expected and amid sluggish growth, as food and manufacturing costs jumped.