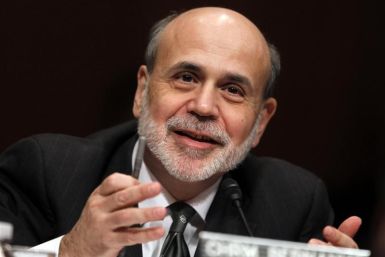

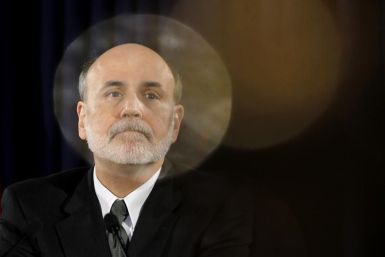

Claims for jobless benefits fell to 359,000, but Federal Reserve Chairman Ben Bernanke warned this week that recently improved employment data seem out of sync with the pace of U.S. economic growth.

Argentina’s economy expanded at a lower rate in the fourth quarter than in the previous quarter due to a slackening in the manufacturing sector and weaker consumer sentiment.

Window dressing, the practice of stock fund managers buying up top performers as the quarter ends to boost the appearance of success, failed Tuesday to lift the major indexes into positive territory.

Americans were more worried about inflation in March than at any time in the last 10 months and consumer confidence waned in the wake of higher gasoline prices.

Consumers are still confident about the state and medium-term trajectory of the U.S. economy, a highly-influential survey of consumer confidence indicated Tuesday, but an increasingly polarized view of the situation in the labor market -- as well as less-optimistic predictions about the future -- means they are expressing that optimism less emphatically than a month ago.

Americans this month ratcheted up their expectations on inflation to the highest level in 10 months and consumer confidence waned, though the economic recovery was still seen on track.

Consumer confidence dipped in March, while Americans ratcheted up their inflation expectations to the highest level in 10 months, according to a private sector report released on Tuesday.

Vietnam’s GDP for the first quarter declined to 4 percent from the last quarter growth of 6.1 percent, according to data released by the government.

Asian stocks rebounded Tuesday and the dollar eased after Federal Reserve Chairman Ben Bernanke said ultra-loose monetary policy was still needed to reduce unemployment even though the U.S. economy has shown signs of improvement.

The economy needs to grow more quickly to bring the unemployment rate down further, Federal Reserve Chairman Ben Bernanke said on Monday, defending the central bank's policy of very low interest rates.

Stock indexes gained 1 percent on Monday after Federal Reserve Chairman Ben Bernanke signaled a supportive monetary policy will stay even as the unemployment rate improves.

Stocks rose on Monday, rebounding from last week's decline, after Federal Reserve Chairman Ben Bernanke suggested the central bank would continue supportive monetary policies, even as the unemployment rate improves.

Gold prices rose 1 percent on Monday after comments from U.S. Federal Reserve Chairman Ben Bernanke that faster growth will be needed to boost employment supported expectations that further quantitative easing measures may be necessary.

After calling the recent recovery a puzzle, markets reacted enthusiastically to Fed Chairman Ben Bernanke's pronouncements

The Fed chairman said U.S. job market conditions remain weak despite three months of strong hiring and that the improved employment data seem to be out of sync with the overall pace of economic growth.

The increase in oil prices in recent weeks has caused some to fear that inflation in Asia will soon rise sharply. However, according to Capital Economics, even if oil prices stayed at current levels, inflation would continue to ease across the region.

Yields on 10-year inflation-linked Treasury bonds fell into negative territory Thursday -- only the second time that has happened -- ona flight to quality in U.S. notes, a belief that inflation will begin rising and the seemingly heady effect of the Federal Reserve's Operation Twist.

This week - March 26 to 30 - will highlight Wednesday's durable goods report and a busy policy calendar, including the core of the Federal Open Market Committee: Chairman Ben Bernanke and New York Fed President William Dudley. Wall Street will be closely monitoring the Fed officials' speeches, hoping to find clues of their latest views on the economic, inflation and policy outlooks.

Analysts, economists, and market participants were concerned with three things this week, and three things only: inflation, inflation, and inflation.

Gold-mining stocks may be the most attractive way for investors to boost their stake in gold, especially if they are concerned about inflation. Investing profitably is not simply a matter of picking an attractive asset -- the asset must also be purchased at an attractive price.

Another possible scenario, if the situation in Europe continues to improve and we are able to avoid any black swans, involves a robust economic growth period.

The MIT-trained Xie accurately predicted Japan's asset bubble of the 1980s, the 1997 Asian financial crisis, the deflation of the dot-com bubble and the U.S. subprime mortgage crisis.