Some of the most respected figures in investment management are addressing the prospect of hyperinflation in the United States and other Western countries.

Call us crazy, but the two most recent major economic data releases by China -- the consumer price index on Friday and the trade balance on Saturday -- indicate there could be a case to be made for monetary stimulus in the world's second-largest economy.

If inflation is a dragon that must be slain, China's Premier Wen Jiabao has shown he is willing to sacrifice a part of the country's most vital asset to do so -- growth.

The economic picture got considerably messier this week, as positive data on job creation battled with gasoline-price-fueled inflation concerns in economists', policymakers' and consumers' minds. Joyous declarations that the economy is finally getting better have turned into more studious critiques of how the incipient recovery is actually affecting poor, working-class and middle-class people.

Back in late 2010, billionaire hedge fund manager John Paulson told “a standing-room-only crowd at New York’s University Club” that US inflation could hit double-digits in 2012. His forecast on gold and inflation, however, haven’t panned out so far in 2012.

The week ahead -- March 12 to March 16 -- will feature the Federal Open Market Committee meeting and three inflation reports for February: import prices, the producer price index (PPI) and the consumer price index (CPI).

China's economy is on course for a soft landing, a clutch of indicators showed on Friday, easing investor fears of a sharp slowdown and revealing ample room for Beijing to loosen policy further to support growth.

Japan's government on Friday kept up pressure on the central bank to further support an economic recovery, but the Bank of Japan appears set to hold monetary policy steady at its regular policy meeting next week.

China's annual consumer inflation slowed sharply to a 20-month low in February, and factory output and retail sales also cooled more than forecast, giving policymakers ample room to further loosen monetary policy to support flagging growth.

The inflation rate of China reduced sharply to 3.2 percent for February, which is a 20 month low, according to data released on Friday, showing signs that the price pressure is gradually diminishing.

Central bankers around the world took their foot off the loose monetary policy throttle Thursday and kept benchmark interest rates steady on inflation concerns and the lack of new threats to gross domestic product growth.

My dear Aunt Louise’s husband of 52 years was dying.

The European Central Bank signaled its policy course was slowly turning on Thursday, delivering a surprise warning on inflation and calling governments and banks to build on its recent blitz of radical support measures to foster a full crisis recovery.

Two of Europe's main central banks announced Thursday they would be keeping their benchmark interbank lending rates unchanged, in an expected move that analysts see as an acknowledgement of creeping inflation and policy exhaustion.

The European Central Bank held interest rates at 1.0 percent for the third month running on Thursday, pausing to assess the impact of a dramatic sweep of measures that has unsettled some at the bank.

The Bank of England left its monetary policy unchanged on Thursday, deciding that February's extra 50 billion pounds ($79 billion) of quantitative easing was enough for now to support the economy through a period of fitful recovery.

The Bank of England left its monetary policy unchanged on Thursday, sticking with February's decision to do an extra 50 billion pounds of quantitative easing to support the economy through a period of fitful recovery.

Government bonds expensive, contribute to rise in pension fund deficits.

The pace of job creation by U.S. private employers accelerated more than expected in February, a report by a payrolls processor showed on Wednesday.

Poland's central bank kept its benchmark interest rate at 4.5 percent Wednesday, the ninth consecutive month of no change, as inflation remained high.

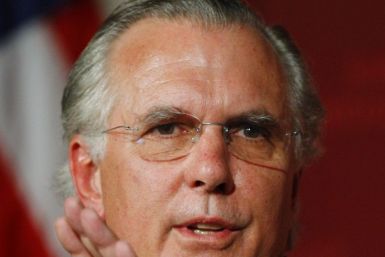

Decrying calls on Wall Street for further quantitative easing (QE3), Richard Fisher, President and CEO of the Federal Reserve Bank of Dallas called on the nation’s lawmakers to follow the fiscal examples set by Mexico and Texas in a speech Monday.

China lowered its economic growth target to an eight-year-low of 7.5 percent from an 8 percent goal in place since 2005, a signal that the country's leaders are determined to scale back the reliance on external demand and foreign capital, in favor of domestic consumption.