The US Federal Reserve may be on track to bring down inflation while avoiding a damaging recession, a senior policymaker said Thursday.

Walmart narrowly lifted its full-year forecast on Thursday following solid quarterly results as it continued to navigate a market challenged by elevated pricing that has depressed demand for some goods.

U.S stocks and bonds moved in the opposite direction on Wednesday following the release of mixed data on the state of the U.S economy.

The S&P 500 closed at 4,415.25, up 1.1 % for the week; the Dow Jones at 34,283.10, up 0.53%, and the tech-heavy Nasdaq at 13,798.1, up 2.07%.

The US Federal Reserve is prepared, if needed, to hike interest rates further in order to bring inflation down to its long-term two percent target, Fed Chair Jerome Powell said Thursday.

Halfway through an eight-year stint as head of the European Central Bank, Christine Lagarde has cause to cheer as inflation finally slows after an unprecedented streak of interest rate hikes.

The Federal Reserve will likely announce it is holding interest rates at a 22-year high on Wednesday, as it looks to tackle inflation without damaging the resilient US economy.

Both Coca-Cola and Kimberly-Clark improved their forecast for results in 2023.

The nation's central bank should get inflation right and stop raising interest rates.

Procter & Gamble's recent product price hikes represent an unrecorded form of inflation facing the American consumer.

For the investor and financial education advocate, inflation erodes the purchasing power of the dollar savings of the poor and the middle class who depend solely on it.

Inflation remains elevated above the Federal Reserve's official targets -- no matter how you measure it -- complicating the Fed's interest rate policy.

The US Federal Reserve's fight against inflation seems to be heading in the right direction, while the US economy remains resilient, a senior Fed official said Wednesday.

Inflation raises the cost of producing goods and services, recorded in the second line of the income statement, and therefore, cuts into gross margins. Interest rates raise the cost of credit, and therefore, reduce net earnings.

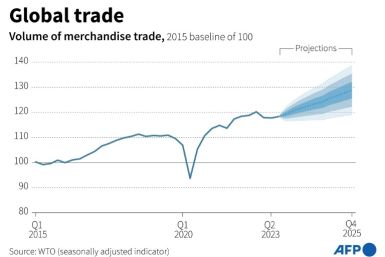

Global trade growth will be sharply lower than forecast this year as stubborn inflation, high interest rates and the war in Ukraine pressure economies around the globe, the World Trade Organization said Thursday.

Turkey's annual inflation rate held steady near 60 percent last month, official data showed Thursday, offering the first evidence that President Recep Tayyip Erdogan's economic policy U-turn was working.

The pause comes after 14 consecutive increases as consumer prices in the UK rise less than expected.

After 11 interest rate increases since March last year, inflation has fallen sharply but remains stuck stubbornly above the Fed's long-run target of two percent per year -- keeping pressure on officials to consider further policy action.

Retail sales in the United States accelerated slightly in August, government data showed Thursday, as a spike in gas prices boosted sales at service stations.

In June, IMF provided a $3 billion bailout package to cash-strapped Pakistan. At the time, Pakistani officials nodded to a significant increase in electricity costs as part of the bailout package.

A key US inflation measure used by the Federal Reserve to set interest rates rose in July, due largely to another jump in the cost of services, according to government data published Thursday.

When bond yields rise, the opportunity cost of capital committed to equities rises, and therefore, the expected return on equities decreases. As a result, equities command lower valuations.