China's industrial output growth hit its slowest pace in more than two years in November and inflation tumbled as economic conditions deteriorated, raising expectations Beijing will ease monetary policy again.

Food inflation in the country has eased, sharply, to 6.60 percent from 8.00 percent in the previous week, in the year to Nov. 26, according to government data released on Thursday.

South Korean automobile manufacturers, Hyundai Motor (005380.KS), will raise prices of its cars in India by about 1.5 to 2 percent from January, the firm said on Wednesday, as it combats high inflation, rising fuel costs and a weaker rupee.

India gold, which traded steady Monday, is likely to near the all-time high helped by safe haven buying, and silver is likely to follow suit, analysts said.

India's moderating growth will help to ease inflationary pressure in the country, deputy governor of the Reserve Bank of India Subir Gokarn said on Saturday.

State-run oil firms will cut petrol prices by Rs. 0.78 (1.5 cents) a litre, or approximately 1.2 percent, from Thursday, Indian Oil Corp. (IOC) said. This will be the second cut this month, reflecting global prices and potentially easing near double-digit inflation.

India's Food Price Index rose 8 percent, which is its slowest pace in nearly 4 months, and the Fuel Price Index climbed 15.53 percent in the year (calculated till Nov. 19), government data released on Thursday showed.

U.S. workers in the nonfarm business sector increased their productivity between July and September by the most in a year and a half, but grew at a slower rate than initially expected.

A November note from the Conference Board placed consumer confidence in the U.S. at a four-month high of 56.0, from a low of 40.9 in July. Most startlingly, however, the Consumer Confidence Index (CCI) soared to its largest month-over-month percentage gain since April, 2009 and its largest single points gain since April, 2003.

Consumer confidence bounced back from a 2-1/2 year low in November as apprehension about job and income prospects eased, according to a private sector report released on Tuesday.

Simone Bora is contemplating the unthinkable - an Indian wedding without lavish amounts of gold - after record high prices and a sinking rupee dimmed her hopes of sparkling at the party.

Is the U.S. Federal Reserve likely to purchase more securities as part of a plan to help jump-start U.S. GDP growth? It is, if a survey of key bond dealers is accurate.

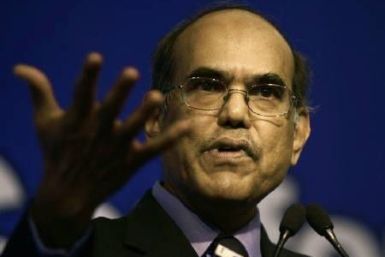

India's growth story is still credible and the move to open up the economy to global supermarket chains will help growth and control inflation, says RBI Governor Duvvuri Subbarao.

Japan's core consumer prices fell for the first time in four months in the year to October after a cigarette tax hike a year ago dropped out from calculations revealing persistent deflation caused by chronically weak domestic demand.

India gold prices are likely to fall more than 3.5 percent from its peak after a 16 percent rally last quarter as investors resort to year-end profit-taking while tepid wedding demand weighed.

The market is expecting that China would loosen its monetary policy in the coming months, and many believe a selective easing has already begun, and that more serious easing will come soon.

U.S. consumer spending growth slowed in October and business capital investment plans were weak, raising questions about expectations for solid economic performance in the fourth quarter.

South Africa's rand tumbled to its weakest level since May 2009 against the dollar on Wednesday, with market players seeing further losses as investors dump risky assets on worries that euro zone leaders are not getting to grips with the debt crisis in their region.

Consumer spending growth slowed in October and business capital investment plans were weak, raising questions about expectations for solid growth in the fourth quarter.

South Africa's inflation risks are skewed to the upside, with cost-push pressures and the sharp depreciation of the rand posing the primary threats to the outlook, the Reserve Bank said on Tuesday.

Kenya's central bank changed another key policy aim by almost-doubling this fiscal year's inflation target to 9 percent, just weeks after being driven to make a huge rate rise to combat soaring inflation and save the plunging shilling.

Monetary action may still be warranted from the Reserve Bank of India, RBI, to anchor inflation expectations in face of sustained high food inflation.