In this wealthy eastern Chinese city known for its shrewd merchants, the owner of a factory that makes spectacles faces a difficult task: closing his money-losing business and dismissing his workers.

The slowdown has begun. The economy has started to sputter and unemployment claims have tipped 400,000 for the last seven weeks. Manufacturing is cooling, the housing market is struggling and consumers are keeping a close eye on spending, meaning the U.S. economy might be on a slower path to full health than expected.

The Gold Price climbed to $1544 per ounce Thursday morning but then dropped sharply to $1520 and stabilized at $1532 per ounce, while stocks, commodities and US Treasuries were all hit after worse-than-expected US economic news and a further downgrade for Greece.

A double-dip in home prices, pessimistic consumers and a slowdown in regional manufacturing raised concerns on Tuesday that the economy's soft patch could become protracted.

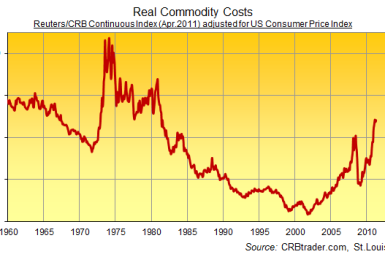

Three trillion dollars is a lot of cash to hoard up in barely 10 years. It's a lot of cash to unleash on the world's commodity markets, too. And peak oil or not, we monetary maniacs might just have a point. Real returns to cash do matter.

Consumer confidence slid in May as consumers turned more pessimistic on the outlook for the labor market and inflation worries rose, according to a private sector report released on Tuesday.

Data showing a double-dip in home prices, pessimistic consumers and a slowdown in regional manufacturing raised concerns on Tuesday that the economy's soft patch could become protracted.

Consumers turned more pessimistic this month, while home prices fell back below crisis-era lows in March, pointing to an economy that continues to struggle.

Euro zone inflation slowed in May largely thanks to lower oil prices, but the dip is likely to be temporary and will not stop the European Central Bank from raising interest rates in July.

Euro zone consumer prices grew slower than expected in May, though remained well above the European Central Bank's target, data showed on Tuesday, while unemployment held steady in April for the third month.

India's economy grew at its slowest annual pace in five quarters in January to March, as rising interest rates crimped consumption and investment, which some analysts say could temper the pace of central bank tightening to tackle inflation.

India's economy grew at its slowest pace in five quarters during the March quarter, as rising interest rates crimped consumption and investment, although the central bank is expected to continue tightening rates in its battle against inflation.

We're in no danger of hyperinflation because the Fed is not printing money. That's not what the program is all about. Instead it was a gamble meant to lift the prices of stocks and commodities, which it did - but which could now colapse very quickly when QE2 ends.

Russia's central bank surprised markets by raising its deposit rate on Monday, citing inflation expectations and risks to economic growth, and indicated that current rates will be acceptable in coming months.

The dollar hovered near a two-week low against a basket of currencies on Monday and Asian stocks were pinned in tight trading ranges as weak U.S. economic data and fears of a Greek debt default kept many investors on the sidelines.

Chinese gold demand is expected to exceed 700 metric tons in the next several years and sharply outpace domestic production. Annual gold production in China, world’s second largest consumer of precious metal, is expected to reach 400 tonnes by 2014 with demand at 700 tonnes, signaling room for a strong ramp up in imports.

The equivocal, baby step rhetoric of the SNB - together with Swiss exporters' reluctance to give up the benefits of a weaker Swiss Franc - suggest that we shouldn't expect Switzerland either to race away from the bottom just yet.

The Dollar Gold Price traded in a $3 range around $1526 per ounce on Friday morning in London, while stocks and commodities were up and the Euro rallied despite concerns the IMF may halt the latest payment of Greece's €110 billion bailout.

Pending sales of existing U.S. homes dropped far more than expected in April to touch a seven-month low, a trade group said on Friday, dealing a blow to hopes of a recovery in the housing market.

The U.S. economy stayed on a sluggish growth path early in the second quarter, with high gasoline prices constraining consumer spending and helping to push pending home resales to a seven-month low in April.

Consumer spending rose less than expected in April as high gasoline prices continued to squeeze household budgets, in government data on Friday which also showed annual inflation at its fastest pace in a year.

Consumer spending rose modestly in April, starting the second quarter on a soft note as high gasoline prices continued to squeeze household finances and keep inflation pressures simmering.