Zimbabwe has licensed five independent power producers whose projects are aimed at helping a struggling power sector by doubling current electricity output to 4,450 megawatts, a government minister said on Friday.

China has offered Zimbabwe $3 billion for vast platinum reserves, a local private newspaper reported on Friday but said the deal was likely to be rejected by the government over its terms.

Proposed changes to revenue sharing within the Southern African Customs Union (SACU) are unacceptable because they place an unfair burden on its poorer members, a senior Namibian official said on Friday.

From Wall Street to the City of London, doughnuts are on the menu this bonus season.

Investors from China and Libya are interested in buying agribusinesses in Ukraine to secure food supplies, a newspaper quoted top Austrian investment bankers as saying.

New JPMorgan fund will buy distressed real estate debt, even though many critics believe that the firm itself is, in part, responsible for much of the distressed real estate in the U.S.

The top pre-market NASDAQ stock market gainers are: JDS Uniphase, Silicon Image, Orexigen Therapeutics, China MediaExpress Holdings and Entropic Communications. The top pre-market NASDAQ stock market losers are: Power-One, Coinstar, Toreador Resources, YRC Worldwide and GT Solar International.

Google Android Honeycomb tablets are expected to end Apple iPad's monopoly. Here are seven reasons why Honeycomb tablets will fare better than iPads:

The top after-market NYSE gainers on Thursday are: Alliant Techsystems, Goodyear Tire & Rubber, Tyson Foods, Vonage Holdings and China Yuchai International. The top after-market NYSE losers on Thursday are: DHT Holdings, Teekay Tankers, RealD, Las Vegas Sands and Netsuite.

Billionaire hedge fund manager John Paulson wrote in his 2010 year end firm report that US stocks will continue to rise.

Experts can argue all they want about the causality relationship between food inflation and QE2. What cannot be denied, however, is the correlation.

JPMorgan Chase & Co executives stood by silently as their client Bernard Madoff ran his epic Ponzi scheme, hoping to protect the bank's investments and continue doing business with him, a newly released $6.4 billion lawsuit claims.

JPMorgan Chase & Co executives were concerned that Bernard Madoff was running a Ponzi scheme, but they silently stood by for years to protect the bank's investments, the trustee for Madoff's investors said.

Gold rose over 1 percent in choppy trade on Thursday, with a sudden jump by over $20 per ounce within minutes as large buy orders were apparently triggered in the future markets. This comes unexpected to precious metals experts, as the gold price was supposed to be kept low by the usual large Wall Street players during todays speech by Bernanke, and was set to rally on Friday, when unexpectedly bad labor market numbers will come in and drive gold prices higher.

Sudan's north will continue to use the Sudanese pound after the oil-producing south secedes on July 9, a central bank official said on Thursday, dousing reports that Khartoum may adopt a new currency.

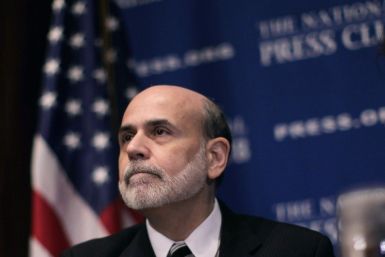

Federal Reserve Chairman Ben Bernanke's speech to the National Press Club on Feb. 3, 2011

South Africa's rand weakened more than 1.7 percent to near six-month lows against the greenback on Thursday, pushing through its long-term moving average as offshore hedge funds drained dollars off the market.

Nestle, the world's biggest food group, said on Thursday it would invest 1 billion Swiss francs expanding capacity in Africa over the next two years.

TD Ameritrade Holding Corp will reimburse about $10 million to customers to settle U.S. Securities and Exchange Commission charges it misled them about the safety of a mutual fund.

Answers Corp, owner of the popular Q&A website, agreed to be bought by private-equity firm Summit Partners for about $127 million in cash.

At least once a week during her young presidency, Dilma Rousseff has met with trusted advisers to try to solve an intractable problem -- China.

Saudi Arabia has eased its real estate and investment laws to allow foreigners residing and working in the kingdom to purchase and own properties there. The move is widely seen as a way to revive the country’s moribund real estate market.