Aileen WangSHANGHAI/BEIJING - China's central bank has reportedly cut its 2011 lending target for banks by 10 percent from last year in a bid to slow down free-wheeling lending and tame inflation.

China's securities regulator will begin a trial programme that for the first time allows local fund houses to raise money offshore for investment in the domestic financial market, two sources said.

China's securities regulator will begin a trial programme that allows local fund houses to raise money offshore for investment in the domestic financial market, two sources said on Monday.

Goldman Sachs (NYSE: GS) said that its American clients will be excluded from buying shares of Facebook through the financial services giant’s private placement mechanism.

Tunisian state-owned Tunisie Telecom may not be able to go ahead with an investor roadshow for its planned listing in Paris and Tunis due to the political situation, investment and banking sources said on Monday.

Developing countries and economies in transition together attracted more foreign investment than developed countries in 2010 for the first time, a United Nations study showed on Monday.

U.S. bank stocks are flying high, and this week's earnings could give investors more reason to be optimistic about the sector.

PRC property developer Evergrande Real Estate Group made history last week with a Rmb9.25bn (US$1.4bn) synthetic renminbi bond - the biggest to date in the fast-growing market.

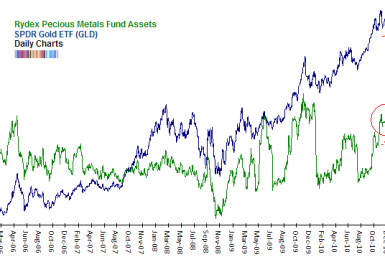

An upward sloping consolidation in Gold that began in October has, despite a lack of any real losses, been enough to improve various sentiment indicators.

The recapitalization of bailed-out insurer American International Group Inc

closed on Friday, leaving the government with a 92 percent stake and plans to sell its shares quickly.The recapitalization of bailed-out insurer American International Group Inc

closed on Friday, leaving the government with a 92 percent stake and plans to sell its shares quickly.Stocks rose modestly, boosted by strong corporate earnings from J.P. Morgan (NYSE: JPM) and Intel Corp. (Nasdaq: INTC), allowing the S&P 500 index to score its seventh consecutive week of gains.

Bullion rebounded on Friday as the euro lost strength despite better-than-forecast debt auctions by Spain and Italy, while purchases from jewellers and investors, which sent premiums for gold bars to two-year highs, offered additional support.

U.S. stock index futures pointed to a lower open on Friday after weak retail sales and a mixed reaction to JPMorgan Chase & Co's quarterly earnings.

The new council of U.S. regulators will face a major test on Tuesday when it unveils recommendations on how to enforce one of the most recognizable if inscrutable aspects of the six-month-old Wall Street reform law: the Volcker rule.

U.S. stocks are down slightly in Friday morning trading after the release of U.S. retail sales data and news of further monetary tightening from China.

As many as 7,936 memorandums of understanding (MoUs) were inked at the fifth edition of the two-day Vibrant Gujarat Summit 2011 in the western Indian city of Gandhinagar envisaging a whopping investment of $462 billion for Gujarat and expecting to create employment opportunities for about 5.2 million citizens.

Gold fell in Europe on Friday after China's central bank raised lenders' reserve requirements by 50 basis points, with softer haven demand for the metal after solid bond sales by Portugal and Spain also weighing on prices.

The top pre-market NASDAQ stock market gainers are: Cumberland Pharmaceuticals, Corinthian Colleges, ICAgen, KLA-Tencor, and Applied Materials. The top pre-market NASDAQ stock market losers are: Coinstar, Kandi Technologies, Hasbro, ARM Holdings, and Qiagen.

US futures are set to open lower on Friday after a disappointing jobless claims data, which could weigh on sentiment.

World’s largest coffee chain Starbucks Corp on Thursday signed a pact with Tata Coffee Ltd, part of India’s Tata group conglomerate, and Asia’s largest publicly traded coffee grower, to source beans and explore opening retail stores in India.

Goldman Sachs raised Infosys Technologies to buy from neutral on Friday, saying it believes a drop in the share prices offers an attractive entry point.