Indian gold demand is likely to recover near to its pre-credit crunch level following the fall in demand in 2009, said World Gold Council (WGC) on Friday in a report titled India: Hear of Gold.

Indian economy is likely to grow 8.5 percent in the current financial year and 9 percent in 2011-12, said Prime Minister Manmohan Singh on Friday in a speech at the plenary session of the G20 summit in Seoul.

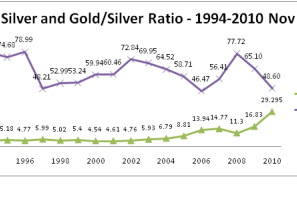

A study on charts shows that silver may not continue to enjoy the status of better investment alternative over gold in the short to medium term period.

British private equity firm 3i Group Plc reported a profit and a rise in net asset value for the first half, and it lifted its interim dividend by 20 percent to 1.2 pence.

Britain’s Prime Minister David Cameron and South Korean President Lee Myung-bak agreed to increase trade and investment between the two countries in a meeting prior to Thursday’s opening of the G-20 summit in Seoul.

The president of South Korea, Lee Myung-bak, has called for more corporate investment into Africa and other poverty-stricken regions of the world, as part of a comprehensive program to encourage the private sector to spur sustained global economic growth.

To the dismay of policy makers, the newly-printed dollars of the Federal Reserve has not found its way to the real U.S. economy in the form of loans to small businesses and consumers. A key question is if they are sitting in the U.S. financial system or flowing to emerging market economies.

Gold prices rose above the $1,400 an ounce barrier for the first time ever today. New fears sparked by the latest Irish debt problems drove investors to seek security in the eternal metal. Comments from World Bank President Robert Zoellicks earlier today, in which he suggested that major global economies should return to a new gold standard, helped push investors towards gold, where gold set a new record high at $1408.10 an ounce.

With our debt coming to maturity in the next ten years, which we cannot afford to pay, printing money seems to be our only option, which we feel is going to spur inflation, if not hyperinflation. We also feel if we adjusted gold for the inflationary highs of the 80's, gold bullion should already be at $2,200 an ounce, so we feel very strongly about a further drive up in gold over the next five years.

he first U.S. exchange-traded fund (ETF) investing in companies that produce rare-earth elements and other strategic metals began trading this morning on the NYSE.

Health regulators plan to spend millions of dollars to step up their scientific prowess in a move that officials say will help quickly get new treatments to patients and protect the public against possible health threats.

An influential U.S. senator on Tuesday raised the prospect of an industry-wide moratorium on foreclosures as he pressed three banks accused of fraudulent practices to outline steps they are taking to fix their procedures.

Wall Street banks facing dwindling trading volumes may find that they have just one option left to boost profits: paying less of their revenue to many of their employees.

Connecticut's attorney general on Friday called on state courts to freeze home foreclosures for 60 days after borrowers claimed that major lenders may be making misstatements in the foreclosure process.

The United Auto Workers health care trust and the governments of Canada and Ontario may not participate in General Motors Co's upcoming IPO in order to avoid taking a cut on the price of their shares

Jobless claims unexpectedly rose in the latest week, a sign the labor market still faces headwinds. Existing-home sales rose in August, but from depressed levels .

U.S. billionaire Warren Buffett could deliver some tough talk to BYD Co Ltd when he visits the Chinese automaker

Health insurers should be able to exclude most federal taxes, but not all, in calculating spending rates to meet new healthcare law requirements, an insurance advisory group has proposed.

David Robinson, an NBA Hall of Fame star, is venturing further into the real estate investment world.

US fund manager Franklin Templeton plans to invest heavily across the Asia-Pacific region aims to launch a new Asian property fund of funds. It also intends raising about $300 million from institutional investors in Europe and Australia, a Reuters report said.

Listed below are five such qualities that we believe will help you make that informed decision and boost your fortunes:

Foreign Direct Investment (FDI) in China spiked up for 13th straight month in August, despite complaints from the US and European companies over alleged unfair business environment and the Chinese government's favors for domestic firms.