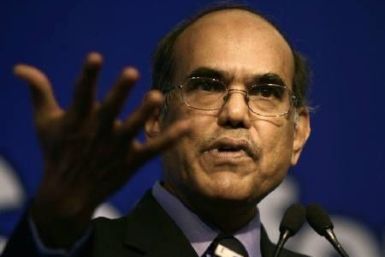

Reserve Bank of India (RBI) Governor Duvvuri Subbarao said on Tuesday that inflation remains too high and needs to fall further or risk more damage to the economy, dismissing criticism of the bank's hawkish policy stance.

China estimates a total national investment of 372 billion USD to be spent in the next three and a half years on improving energy efficiency, strengthening pollution control and expanding recycling economy.

According to Eurogamer, OnLive founder and CEO Steve Perlman has stepped down as head of the company, making way for new ownership in the form of Lauder Partners, an investment group specializing in technology.

Private sector deposits fell by nearly 5 percent in July to €1.509, European Central Bank data showed, as public confidence in the banking system continued to plummet amid a worsening economic situation.

Best Buy Co, Aixtron SE, Nokia Corp, Sterlite Industries India, Pluristem Therapeutics, Seadrill and Zynga Inc. are among the companies whose shares are moving in pre-market trading Tuesday.

India and China pressed each other for greater market access for their products from medicines to Bollywood films at a meeting of trade ministers on Monday, seeking to expand commercial ties between the Asian giants as they battle a global downturn.

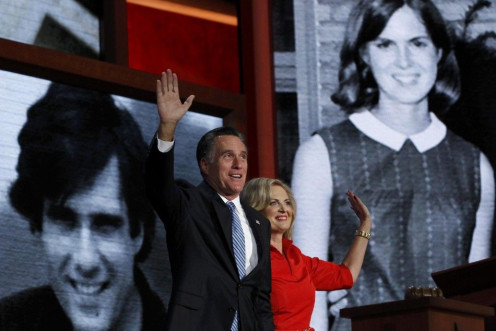

The Romneys love Costco, whose co-founder is a major backer of Barack Obama. The political leanings top executives gives no credence to the idea one party is the party of big business.

The miners – part of a 460-strong staff – have locked themselves 1,200 feet underground inside the Carbosulcis di Nuraxi Figus mine.

Chinese criminal gangs have spilled over into the African country of Angola. Now, their illicit activities are threatening China’s presence in the region.

New Jersey Gov. Chris Christie didn't want to give up his position to run with Mitt Romney because he feared they would lose, the New York Post reported, citing tax returns and foreign gaffes among other factors

Plumes of thick, black smoke continue to rise from the inferno that has engulfed Venezuela's main oil refinery and left at least 41 people dead and dozens more injured, following the country's worst oil accident on record.

Investors feel that policy measures should be implemented to regain the growth momentum of the Japanese economy, which has been affected by the soft global demand and the worsening crisis in the euro zone.

Bill Ackman, the mercurial hedge fund manager of Pershing Square Capital LLP and activist investor, is at it again. Ackman said in a regulatory filing Thursday that his company had been in talks with Simon Property Group Inc. (NYSE: SPG), the largest U.S. mall owner, regarding a takeover of General Group Properties Inc. (NYSE: GGP), its next largest rival.

According to CNN Money, Best Buy has been having difficulty with founder Richard Schulze regarding his attempts at buying out the company’s remaining shares.

In spite of a cheery assessment recently from the country's central bankers that led projections of 2012 GDP to be raised -- to 3.5 percent -- while views on inflation were lowered, recent days have seen growing signs of economic distress emanating from Australia.

India approved a $180 million foreign direct investment plan by U.S. media group Walt Disney, part of a new push to clear a backlog of investment proposals as the finance ministry seeks to inject new life into the slowing economy.

Plaintiffs for the class-action lawsuit filed against Rex Venture Group, ZeekRewards, and the company's found and CEO Paul Burks are being represented by James "Cal" Cunningham, a local politician and former member of the North Carolina Senate.

Newly-released documents confirm criticisms of Republican presidential candidate Mitt Romney’s road to enduring riches. What emerges is a system that exploits several weaknesses in tax laws regarding overseas investments, as well as backdoor methods of swapping assets behind the government’s back. How politically damning any of this may be remains to be seen. But in the case of the Bain files, we know being “Romney Rich” isn’t simple. But it’s a lot more profitable than working a 9-to-5 with a...

While the world braces for the next euro zone fiscal crisis flare-up, an analyst at Japanese financial conglomerate Nomura suggests that whatever bad news is just around the corner will not damage global economies as much as such crises once did.

Puerto Ricans decide its future in November, weighing options that include remaining a U.S. territory or becoming a state. While some say Puerto Rican statehood is bad business for the U.S. others say the nation might be looking at the next swing state.

India's Finance Minister P Chidambaram Wednesday approved a proposal to raise foreign direct investment (FDI) ceiling in insurance and pension sectors to 49 percent from the existing 26 percent to boost investor confidence.

China's manufacturing activity fell in August compared to that in July, according to the preliminary HSBC Flash Purchasing Managers Index released Thursday.