German Chancellor Angela Merkel, having so far successfully fought off the idea of euro bonds, is besieged on all sides as leaders line up behind French President Francois Hollande and his appeals for the collective financial instrument.

Sarah Hughes, who an Olympic gold medal for the U.S. at the 2002 Winter Olympics, won't have the public skating rink in Great Neck, N.Y., renamed in her honor, the Great Neck Park Commission has ruled.

India and Myanmar will be sealing several bilateral pacts including one in the energy sector.

In this issue we talk to Greg Firtik of Global Ag, LLC, a registered CTA with NFA.

Lorenzo Thione believes in fate and approaches the world with a somewhat self-confident naivete. This outward optimism comes across most clearly when he talks about his new business: He wants to be an artist among the artists, unchaining fine art from wealthy collectors and setting it free among the hoi polloi.

Sam Zell, the Chicago real-estate mogul, has become so well-known for feasting on distressed assets that he's been called the grave dancer. This week, Zell took the nickname to the next level: He's about to receive $70 million from a ghost.

Investing in Brazil's booming economy has turned another page as foreign companies, especially Japanese firms, move from putting money into the nation's financial industry to putting it into the real economy of South America's largest nation.

The hard reality is that companies involved in global trade are almost always exposed to exchange rate risk. Using very simple tools, uncertainty can be effectively stripped out of a transaction.

The European Union has filed a suit with the World Trade Organization against Argentina?s import restrictions, raising the dispute between the EU and the South American nation only weeks after Buenos Aires nationalized Spanish oil firm Repsol?s subsidiary in the country.

China's growing hunger for the RV is providing further evidence for the theory that the Middle Kingdom is trying to become more American -- at least in its pastimes.

Moving swiftly from the realm of tin foil-hat conspiracy to a bullet point being openly talked about as a fait accompli by international financiers, an exit by Greece from the European common currency dominated conversation this week. But what would actually happen if Greece left the euro?

Faced with the disastrous fallout from the initial public offering of Facebook (Nasdaq: FB), the No. 1 social network, other technology companies that had been waiting to go next may reconsider.

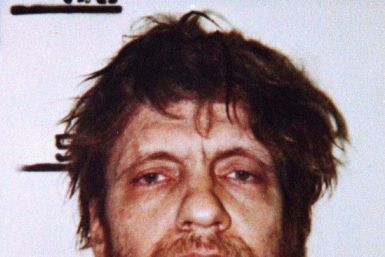

Ted Kaczynski, Harvard class of 1962, can't make the 50th reunion -- he's in federal prison for life, as the Unabomber. But he still managed to submit an entry for the alumni report.

Even as a possible Greece exit from the euro zone is creating ripples of fear in the global economy, it seems that the Asian countries, especially India, is better placed to face the euro zone breakup storm than other regions.

Speaking at a summit in Brussels, the heads of Germany and several EU institutions all urged the debt-stricken country to stick to the deeply unpopular tax hikes, labor reforms and welfare cuts that have divided Greece and pushed it to the brink of exiting the currency union.

China's manufacturing activity fell in May compared to April and continued to contract for the seventh straight month, according to the preliminary HSBC Flash Purchasing Managers Index (PMI) released Thursday.

As European leaders struggled to hold the euro zone together at a nighttime summit in Brussels, a widening gap emerged between Germany and France, which are now under new management.

Business Review Weekly named Australian mining tycoon Gina Rinehart the World's Richest Woman, surpassing Wal-Mart heiress Christy Walton.

Ifeadi called the Chinese scavengers who were taking jobs that should be the exclusive preserve of Nigerian people.

According to a new report from the Global Business Travel Association, 12- to 15-hour flights to China may soon become the norm for U.S. and European business travelers.

Japanese restaraunt chain Benihana Inc. (Nasdaq: BNHN) has agreed to be taken private and sold to Angelo, Gordon & Co.'s private equity group for around $296 million after profits fell in the past year because of increased costs.

An annual GDP growth rate of 8 percent would be an economic miracle in most of the world. In China, it has the government looking for ways to help the economy grow more -- but not by spending indiscriminately for stimulus plans.