Most Asian stocks ended lower Tuesday, following a slump in the Wall Street overnight as disappointing March employment report raised concerns about the strength of recovery in the world’s biggest economy.

Chesapeake Energy Corp, the second largest natural gas producer in the US, said on Monday that it has finalized three deals to sell its assets, which will raise $2.6 billion, as it faces cash crunch and a rising debt.

BG Group will take its first step toward becoming Brazil's largest foreign oil producer by 2020 with a $2 billion cash infusion for research and development, the Financial Times reported Monday.

Dataminr, a social media software developer that detected the attack on Osama Bin Laden’s compound and reported it first, said it established an alliance with Twitter.

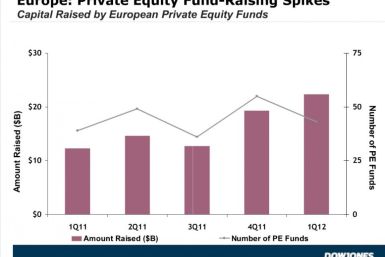

European private equity funds raised 82 percent more capital in the first quarter of 2012 compared to the same period last year, according to Dow Jones LP Source, a research service for the industry.

The world's demand for alternative energy sources is powering growth in German industry, or so a look at the list of fastest-growing public companies in that country would suggest. Already the world leader in solar panel manufacturing, Germany is also home to an array of booming companies whose business is on the more peripheral side of clean energy creation and conservation.

Korea Midland Power Co. Ltd., or Komipo, said Monday it struck a $3.4 billion deal with Switzerland's Vitol SA to buy liquefied natural gas for 10 years starting in 2015.

Shares of AOL (NYSE: AOL), the seventh-most-visited website, jumped nearly 50 percent in Monday trading after announcing a $1.1 billion patent deal with Microsoft.

Qatar's sovereign wealth fund has raised its stake in Xstrata Plc to a little over 5 percent, which is valued around $2.7 billion, in advance of the Anglo-Swiss miner's intended merger with Glencore International Plc.

China's love affair with American education is stronger than ever. Chinese families -- including those in the burgeoning middle class -- want to send their sons and daughters to be educated in another country, with most coming to U.S. institutions.

Russia, the world's ninth largest economy, cut its 2012 GDP forecast to 3.4 percent from 3.7 percent as investment growth is expected to decline, its economy minister said Friday.

Gold rose on Thursday, as investors covered short positions after a sharp two-day pullback, and a crude oil rally also buoyed the precious metal that sank early this week on disappointment about further U.S. monetary easing.

So far this week, U.S. industrial giants have announced nearly $3 billion will be invested in new operations and research in Brazil, China and India three cornerstone members of the BRICS countries.

Plug-in cars and hybrids are all the rage, but new information reveals that many of them don't save their owners money until decades after they are purchased.

China's auto industry will enjoy an $11.6 billion boost in the coming year, as Ford (NYSE: F) and Volvo try to increase output and market share in Asia.

Stocks were little changed on Thursday despite data showing ongoing improvement in the labor market, as a rise in Spanish bond yields renewed concerns about the euro zone's financial health.

China has further opened up its domestic share markets for foreign participation, in a bid to ease the tight controls for investments by qualified foreign institutional investors (QFIIs).

The top aftermarket NYSE gainers Wednesday were: Cinemark Holdings, Constellation Brands, E-Commerce China Dangdang, National Bank of Greece, Sprint Nextel Corp and Aviva plc. The top aftermarket NYSE losers were: Ruby Tuesday, McClatchy, CTS Corp, Standard Pacific Corp, InvenSense and MGIC Investment.

Asian shares fell Thursday after a weak Spanish bond sale heightened concerns about funding difficulties by lower-rated euro zone countries, further undermining sentiment hurt by fading expectations for more stimulus from the U.S. Federal Reserve.

Hedge fund manager Philip Falcone said in an interview on Wednesday he is seriously considering filing a voluntary bankruptcy for LightSquared, the struggling telecom startup in which his Harbinger Capital Partners is the majority owner.

Hedge fund manager Philip Falcone said in an interview on Wednesday he is seriously considering filing a voluntary bankruptcy for LightSquared, the struggling telecom startup in which his Harbinger Capital Partners is the majority owner.

Splurging on a vacation home shortly after the housing market meltdown was not an easy decision for Kathy and Dan Nikolai.