Eurozone finance ministers aim to agree a second financing package for Greece on Monday, a decision they hope will boost market confidence in euro zone public finances and help contain the two-year-old sovereign debt crisis.

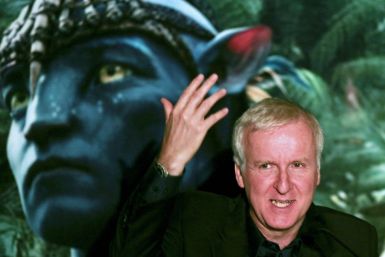

James Cameron just might be looking for a more simple life.

U.S. 30-year fixed-rate mortgage rates dropped to another record low of 3.87 percent in the week ending Feb. 2, down from 3.98 percent in the previous week, according to Freddie Mac.

Facebook filed for an initial public offering with the U.S. Securities and Exchange Commission Wednesday, for the first time doing a public financial strip tease.

Royal Dutch Shell, Europe's largest oil and natural gas company, posted fourth quarter earnings that despite less than favorable market conditions, exceeded analyst expectations thanks to increased natural gas sales.

For many Americans, 2011 ended on a somewhat pessimistic note. Income barely rose and consumers tapped their savings during the crucial Christmas season. Despite things looking ahead for 2012, chances of an economic recession have urged many people to lookout for a job with better perks.

Gold prices rose for a second straight day on Wednesday in correlation with the euro. It came on the same day that the Global Investor Confidence index measured by State Street Global Markets fell just more than two points, suggesting that the continuing economic turbulence is fueling investors to seek out more stable assets like gold.

The Supreme Court on Thursday revoked all 122 telecoms licences issued under a scandal-tainted 2008 sale, a fresh embarrassment for the government and plunging the mobile network market of Asia's third-largest economy into uncertainty.

Football fans looking for a sneak peek at The Dark Knight Rises or The Amazing Spider-Man on Sunday are in for a disappointment.

The favorite to win Mexico's presidential election this July said on Wednesday the country must favor local investors over foreign competitors in strategic sectors of the economy, including telecommunications.

JPMorgan Chase & Co has agreed to drop almost all of a $710 million claim against Lehman Brothers Holdings Inc's bankruptcy estate, freeing up more money to be distributed to creditors, Lehman said on Wednesday.

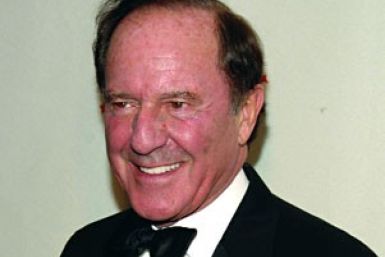

Mort Zuckerman, the venerable real estate developer and media mogul, has a taste for urbanism. He attributed the strong fourth quarter and 2011 for his real estate investment trust Boston Properties, Inc. (NYSE:BXP) to its focus on major cities.

Shares of London-based Hochschild Mining closed Wednesday up 5.91 percent to £523.50 ($829.24), solidly outpacing the rise in the price of silver.

Gold rose on Wednesday as the dollar slipped against the euro and on strong global manufacturing data, while analysts said profit taking could pressure the precious metal after its biggest January gain in 32 years.

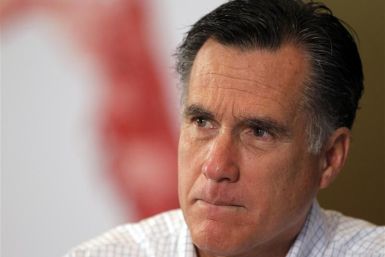

Romney has shown a propensity for making tone-deaf statements that remind voters of his immense wealth and corporate background. Here is a list of the five most cringe-worthy.

In an e-mail reply to a fan, Apple CEO Tim Cook said that the company's newest hire, senior VP of retail John Browett, was the best by far among the candidates eligible for the position.

Amazon.com Inc's shares slid 12 percent in early trade on fears that heavy spending would hurt the retailer's profits even as revenue growth falls short of Wall Street expectations.

Gold prices rose Wednesday, at one point topping the $1,750 mark, but generally stayed within a narrow range in the absence of any single dominant factor.

The top aftermarket NYSE gainers Tuesday were: Molina Healthcare, Brunswick, W.R. Berkley, Manitowoc Co and Gafisa SA. The top aftermarket NYSE losers were: Unisys Corp, Medical Properties Trust, Oasis Petroleum, Skilled Healthcare Group and E-Commerce China Dangdang Inc.

Hotel companies and real estate firms are optimistic that U.S. deal transactions will pick up this year despite concerns about Europe's economy and challenges in obtaining debt financing.

Amazon.com warned of a possible operating loss in the first quarter following a sharp drop in fourth-quarter profits, a sign that the online retailer is continuing to spend heavily on expansion and new ventures at the expense of shorter-term profits.

A leading indicator of the state of global industry -- whose biggest dips in the past have come just before the world economy fell into recession -- is dropping like a lead anchor. Some savvy market forecasters are saying this should be sounding alarm bells. But what do the experts who actually work in shipping have to say?