The Obama administration wants Fannie Mae and Freddie Mac, which finance the bulk of U.S. mortgages, to start reducing loan balances for troubled borrowers, but with safeguards to prevent them from purposely defaulting to obtain relief.

A federal judge approved a $25 billion mortgage settlement with five top U.S. banks over allegations of foreclosure abuses and misconduct in servicing home loans, according to court documents.

A federal judge approved a $25 billion mortgage settlement with five top U.S. banks over allegations of foreclosure abuses and misconduct in servicing home loans, according to court documents.

The Federal Reserve's balance sheet shrank in the latest week, Fed data released on Thursday showed.

The Gingrich Group LLC, a consulting firm whose work repeatedly ensnared Newt Gingrich's presidential campaign in controversy, has filed for Chapter 7 Bankruptcy, the Atlanta Business Chronicle reported.

U.S. 30-year fixed-rate mortgages declined slightly to 3.98 percent in the week ending April 5 as recent economic indicators were mixed, mortgage finance giant Freddie Mac said Thursday.

Splurging on a vacation home shortly after the housing market meltdown was not an easy decision for Kathy and Dan Nikolai.

Who is Goldman Sachs? Wall Street's top investment bank, or a company that treats its clients like muppets in order to make as much profit as possible? And what does that mean for the rest of us?

Most of March's housing numbers were disappointing, with sales unexpectedly falling across all categories and prices hitting new lows, reversing February's optimism. But the winter market is usually the year's quietest, and spring could see a redemption for the housing market.

After recently posing nude for Closer magazine, the 36-year-old single parent had no choice but to turn to the government welfare for money even though she sounded very adamant in 2010 when she announced she would never take that option.

Two days after most of the media houses published Nadiya Suleman's almost-nude pictures, criticizing the mother of 14 for bragging about her body and seeking media attention, a rather annoyed Suleman has spoken to media again. This time, justifying her stand. Suleman, who has an Iraqi American father, gained media attention after giving birth to octuplets in January 2009. Soon after the birth of her octuplets, Suleman did not take time to bounce back to shape and was offered $1 million to wor...

Cavallari's parents owed a sum that almost exactly matches Jay Cutler's 2012 salary.

U.S. mortgage rates fell below 4 percent following disappointing housing data released in the past week, Freddie Mac said Thursday.

Experts believe 2012 could mark the beginning of a turnaround for the housing industry, albeit a slow one.

U.S. mortgage applications declined 2.7 percent in the week ending March 23, according to the Mortgage Bankers Association.

Octomom Nadya Suleman's topless photos for Closer magazine have been circulating the web, but it seems like Suleman didn't do the photo shoot to brag about her new body. TMZ is reporting that the mom of 14 is days away from being homeless.

More than $1 trillion in tax breaks are embedded in the U.S. tax code, but a new report highlights some of the difficulties in eliminating some breaks and finding savings.

The federal regulator of Fannie Mae and Freddie Mac is arguing that principal reductions for home loans would benefit the banks that hold secondary debt while weakening the mortgage giants' finances.

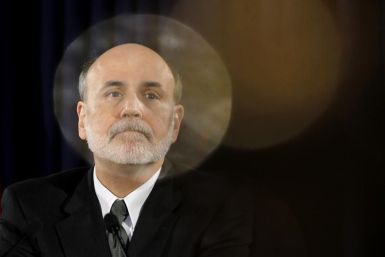

The Fed chairman said U.S. job market conditions remain weak despite three months of strong hiring and that the improved employment data seem to be out of sync with the overall pace of economic growth.

China Construction Bank , the world's No.2 lender valued at $193 billion, joined smaller rival AgBank in reporting earnings lower than the market had expected as China's slowing growth squeezes its top lenders.

In conducting an investigation of possible fraud in relation to Wells Fargo & Co.'s sale of almost $60 billion in residential mortgage-backed securities, the U.S. Securities and Exchange Commission on Friday requested that a federal court order the country's largest mortgage lender to comply with its subpoenas.

Analysis by the two government-backed lenders, which have cost taxpayers over $150 billion since their 2008 bailout, shows loan forgiveness would keep hundreds of thousands of Americans in their homes while saving money.