A broker has warned borrowers to be wary of chasing cheap fixed rates amid a wave of discounting that proliferate in the industry.

TCW's incoming CEO in 2009, Marc Stern, tried to sow discord and drive a wedge between Jeffrey Gundlach and his tight-knit mortgage-backed securities team, Gundlach testified on Thursday.

Jeffrey Gundlach said he never told anyone on his staff to download data from his former employer, Trust Co of the West, or copy valuable trading information -- though he did briefly consider such an action.

U.S. home mortgage interest rates fell again this week, and the average 30-year fixed rate is now at a low 4.19 percent -- which creates an opportunity for prospective home buyers with good credit histories.

Mortgage rates have fallen to a nine-month low, sending refinancing applications on the rise.

Casey Anthony, the woman accused and subsequently acquitted of killing her two-year-old child using chloroform and duct tape, came in at first place as "The Most Hated Person in America" in a survey conducted by research company E-Poll Market Research, polled 1,100 people aged 13 and older.The poll found that 53 percent of study participants knew who Casey Anthony was and that 94 percent of those who knew who she really disliked her. 57 percent of those polls said that she is "creep...

August's dramatic financial shock, which is now both feeding off and risks fueling another economic downturn, may well introduce a third phase of the four-year-old global credit crisis -- the infection of the ultimate creditors.

The stock market spent Wednesday tormenting investors, knocking the Dow Jones Industrial Average down 519.83 points and slamming media stocks.

Brokers should look to outsource as operating costs become more difficult, Vow Financial has said.

Fierce mortgage competition between the majors is seeing credit standards eroded, a lender has claimed.

Standard & Poor's, whose unprecedented downgrade of U.S. debt triggered a worldwide stocks sell-off, is pushing back against a U.S. government proposal that would require credit raters to disclose "significant errors" in how they calculate their ratings.

Jurors will finally have a chance to hear directly from Jeffrey Gundlach when the outspoken "king of bonds" takes the stand, expected as soon as Wednesday, in his high-stakes courtroom battle with his former employer, Trust Company of the West.

All eyes are on Bank of America (NYSE: BAC) ahead of Tuesday's opening bell after the banking giant suffered a 20 percent loss on Monday's trading.

The companies whose shares are moving in pre-market trade on Tuesday are: MetroPCS Communications, Bank of America, NYSE Euronext, AK Steel Holding, Regions Financial, Regions Financial, MEMC Electronic Materials, Halliburton, Duke Energy, Bristol Myers Squibb and Plum Creek Timber.

U.S. markets were poised to open higher Tuesday as futures rose based on anticipated action from the Fed.

FBR Capital Markets upgraded its rating on shares of Wells Fargo & Co. (NYSE: WFC) to "outperform" from "market perform" while maintaining its price target of $31 as valuation was too attractive to ignore.

New legislation for the reverse mortgage industry would enshrine in law many standards already applied by the industry body.

Mortgage giant Freddie Mac is seeking a $1.5 billion dollar bailout after announcing a $4.59 billion dollar loss in the most recent quarter.

The Dow lost four percent in trading mid-day Monday, while the Nasdaq and S&P lost five percent. President Barack Obama addressed downgrade Monday, but the markets dropped further after his comments.

Bank of America's stock tumbled Monday, down 16 percent as investors reacted to a lawsuit filed against the bank by AIG.

Trump believes the whole thing is a ?publicity stunt? by S&P.

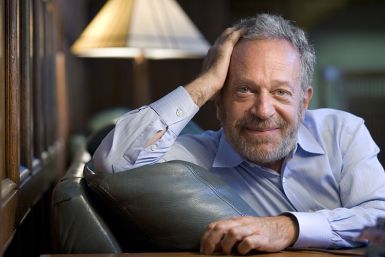

The former labor secretary described S&P?s downgrade maneuver as an ?ironic? intrusion into American politics.