Gold prices recovered in Asian trade Wednesday after an overnight plunge of nearly two percent mainly on global stocks rally.

Gold for immediate delivery was seen trading at $ 1163.51 an ounce at 12.00 noon Singapore time after hitting a near three-month low on Tuesday.

Even after allowing unlimited gold imports, Vietnam is likely to face supply shortages as the country also exported around 36 tons of the precious metal in the first six months of this year.

According to Vietnam Gold Business Association there will be a shortage in gold supplies for production in Vietnam.

Gold rose briefly back above $1,200 an ounce on Thursday as financial markets rallied broadly, with U.S. stocks jumping 1 percent at the open, European shares higher and oil prices climbing 2.3 percent.

The precious metal quickly slipped back below that level, however, as it struggled to break out of the relatively tight range it has kept to ahead of the results of European bank stress tests on Friday.

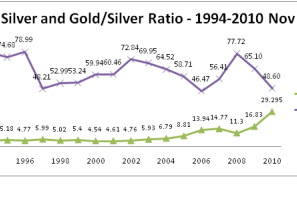

At a time gold is glittering at above $1,200 per ounce level, nobody is interested in its poor cousin silver. But, the truth is different. Those who want to invest in precious metals should now keep a close watch on silver.

Gold pared losses to turn higher after hitting its lowest in about two months in Europe on Tuesday as risk aversion returned to the wider markets after Goldman Sachs earnings disappointed investors.

A weak technical picture is weighing, but interest from physical buyers is helping limit losses, analysts said.

Gold held above $1,180 an ounce in Europe on Tuesday as lower prices tempted some buyers back to the market after prices slipped to two-month lows in the previous session, but the technical picture remained weak.

Gold has been pressured by concerns over deflationary signals from the United States and other economies, analysts said, while a recovery in appetite for assets seen as higher risk has also deflected some investment from the precious metal.

Gold eased below $1,190 an ounce in Europe on Monday, extending the previous week's 1.5 percent fall, due to lower investment demand for the precious metal as appetite for other assets improved.

Spot gold was bid at $1,189.55 an ounce at 1112 GMT, against $1,193.10 late in New York on Friday. U.S. gold futures for August delivery rose $2.00 an ounce to $1,190.20.

Gold rose on Thursday, benefiting from a retreat in risk appetite after soft U.S. economic data knocked stocks, the dollar and industrial commodities lower.

Spot gold was bid at $1,211.70 an ounce at 1528 GMT against $1,207.50 late in New York on Wednesday. U.S. gold futures for August delivery rose $5.40 to $1,212.40.

Gold edged up on Thursday after China's growth data for the second quarter was slightly weaker than expected, helping revive the precious metal's allure as a hedge at a time of economic uncertainty.

Meanwhile, economists expect Beijing to make no dramatic policy response to Thursday's data, which is seen as positive for the precious metal's demand in China, analysts said.

In all likelihood, India is set to go for commercial exploration of platinum following very promising discovery of the precious metal along the 150-km belt in Tamil Nadu and adjoining Kerala. Once the government takes a deeper exploration of 100-200 metres, the researchers expect the find to be even more substantial, which could lead to viable commercial exploration. Till now, the exploration has been carried out only up to 30 metres and it is very promising.

Last week, Commodity Online had reported that several central banks had pawned their gold reserves to the Bank for International Settlements (BIS) to raise cash and this may impact the gold market in the coming days.

Gold eased in Europe on Monday, falling for the fourth time in the last seven sessions, as improved investor confidence boosted the dollar and sapped investment flows into the precious metals complex.

Spot gold was bid at $1,203.85 an ounce at 1440 GMT, against $1,211.85 late in New York on Friday. U.S. gold futures for August delivery eased $5.60 an ounce to $1,204.20.

Gold slipped in Europe on Monday, surrendering some of the previous session's more than 1 percent gains, as the dollar firmed and investment flows into the metal dried up as concerns over euro zone risk receded.

Gold demand in the global market is set to go up following the State Bank of Vietnam's decision to allow companies to import gold again.

Since Vietnam does not import gold regularly, foreign partners have not prepared gold for delivery. So, the Vietnam importers are expected to buy gold from the global bullion markets which will make some price movements.

Gold slipped in Europe on Monday, surrendering some of the previous session's more than 1 percent gains, as the dollar firmed and fresh investment flows into the metal dried up and concern over euro zone risk receded.

Gold prices recovered to follow oil towards north in Asian trade Friday, boosted by bargain buying as some investors jumped back to the precious metal from stocks and currencies.

Gold edged higher on Wednesday, rising back above $1,190 an ounce, as fresh demand emerged for the precious metal after its correction from recent record highs, which helped offset pressure from a firmer dollar.

Gold recovered in afternoon trade on Wednesday, but a firmer dollar and a report that China would not make gold a major part of its reserves undermined sentiment.

Physical interest in the metal at lower prices and strong chart support after its recent correction helped limit early losses, analysts said.

Gold eased in Europe on Wednesday, extending the last session's losses, due to a stronger dollar and a report that China would not make gold a major part of its reserves undermined sentiment.

Physical interest in the metal at lower prices and strong chart support after its recent correction were likely to limit further losses, analysts said.

When Reserve Bank of India bought 200 tonnes of International Monetary Fund (IMF) gold in November last year, the bullion market received one of the biggest boosts ever and the gold prices soared in the subsequent weeks to new record heights. Reason for this was that all central banks across the globe have been increasing their gold holdings fearing the recession looming large over the world.

Gold rose back above $1,210 an ounce in Europe on Tuesday as physical demand for the precious metal recovered after last week's price dip, and as the weaker dollar encouraged some buying.

Spot gold was bid at $1,210.15 an ounce at 7:37 a.m. EDT (1137 GMT), against $1,206.95 late in New York on Monday. U.S. gold futures for August delivery firmed $2.30 an ounce to $1,210.00.

Gold rose back above $1,210 an ounce in Europe on Tuesday as physical demand for the precious metal recovered after last week's price dip, and as the weaker dollar encouraged some buying.

Spot gold was bid at $1,210.85 an ounce at 0952 GMT (5:52 a.m. EDT), against $1,206.95 late in New York on Monday. U.S. gold futures for August delivery firmed $3.90 an ounce to $1,211.60.