British banks gave up a fight over compensating customers wrongly sold insurance, forcing Barclays Plc and HSBC to take a combined hit of more than $2 billion in the latest blow to the industry.

U.S. blue-chip stocks eked out a slim gain Monday but other market measures fell slightly as investors traded cautiously ahead of the first quarter corporate earnings season.

US stocks are mixed on global worries ahead of the unofficial start of first quarter earnings season.

U.S. blue-chip stocks eked out a slim gain Monday but other market measures fell slightly as investors traded cautiously ahead of the first quarter corporate earnings season.The Dow Jones Industrial Average closed up 1.06 points, or 0.01%, at 12381.11. The Nasdaq Composite shed 8.91, or 0.32%, to 2771.51. The Standard & Poor's 500-stock index slipped 3.71, or 0.28%, to 1324.46. The mixed activity came as investors looked ahead to the first-quarter earnings season, which kicked off unoffic...

U.S. stocks pared earlier gains as energy companies’ shares declined after a higher-than-expected increase in petroleum inventories and Monsanto Co. shares declined as its revenue fell short of expectations.

Asian stock markets advanced for the first time in five days on Friday as oil prices fell below $100 a barrel on easing concern about supply disruptions.

U.S. stock markets ended mixed in a volatile session on Thursday as oil prices eased and encouraging job data helped the market to stabilize in the final hours.

The Persian Gulf kingdom of Qatar has expressed some interest in investing in two major partially-nationalized British banks, Royal Bank of Scotland (NYSE: RBS) and Lloyds Banking Group (NYSE: LYG).

India's annual industrial output in December rose at its slowest pace in 20 months on a higher base last year and stretched capacities at factories, but the Reserve Bank will likely continue tightening monetary policy to tame high headline inflation.

Britain's smaller companies are reluctant to tap banks for financing due to negative perceptions of the sector, a survey said on Friday, as politicians continue to attack the industry for not lending enough to businesses. Britain wants banks to lend more money in order to stimulate the country's faltering economy, and this week it struck a deal

The British government has entered into a comprehensive agreement with the nation’s largest banks on matters related to lending, transparency and bonuses payments to executives, after four months of negotiations and wrangling.

A battle between large supermarket operators to tap into Southeast Asia's growing consumer wealth could trigger more acquisitions, with Indonesia, Vietnam and the Philippines seen as the next hot spots.

Nervous investors may begin liquidating some of their substantial positions in Egyptian equities and securities if the unprecedented political protests that thrashed the market on Wednesday gain momentum.

Half of bankers in Britain and the United States have received a higher bonus for 2010 than the year before, despite sluggish investment banking performances, according to a survey released on Tuesday.

Call it the price of success. China is starting to pass on the rising cost of labor and other manufacturing inputs as it restructures its economy, creating a potential new inflation headache for Western countries already grappling with surging commodity prices.

EU sanctions aiming to squeeze Ivory Coast incumbent Laurent Gbagbo's access to funding could hurt the nation's 40,000-barrel-per-day oil sector and may shut down its 80,000 bpd refinery within months, according to the head of the state oil firm.

Australian gaming and wagering company Tatts Group Ltd is considering refinancing its A$700 million in bank debt with its existing lenders after tapping the U.S. private market in December, its chief financial officer said on Wednesday.

Banks must be allowed to fail in order for capitalism to succeed according to Paul Tucker, the deputy governor of The Bank of England (BoE).

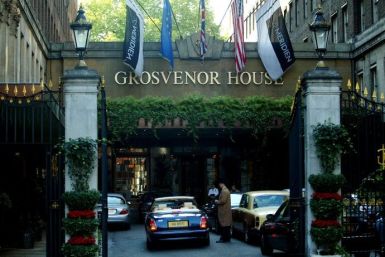

India's business conglomerate, Sahara India, announced on Thursday that the group acquired the iconic Grosvenor House hotel in London from The Royal Bank of Scotland Group plc for 470 million pounds.

The stock market rallied modestly on U.S. mergers and acquisitions (M&A) activities and China’s continued support for European Union’s (EU) sovereign debt market.

Paul Myners, the former Financial Services Secretary during the Labour government of Prime Minister Gordon Brown, has called for the break-up of UK partly-nationalized banking giants Lloyds Banking Group (NYSE: LYG) and Royal Bank of Scotland (NYSE: RBS).

Despite signs that the government of Ireland will receive a huge bailout package from the European Union (EU) and International Monetary Fund (IMF), Irish banks that trade in the U.S. as ADRs are getting hammered this morning in early trading.