The Federal Reserve on Wednesday offered a gloomier view of the economy as the labor market showed no sign of improvement since its last meeting. However, despite mounting signs of a sharp slowdown in the U.S. economy, central bank officials decided to take more time to make up their mind and refrained from enacting another monetary stimulus.

The financial situation in Iraq, one of the world's largest reservoirs of crude oil, has become grave.

The U.S. private sector added more jobs than forecast in July, ADP reported on Wednesday, giving the market some relief after three sluggish months as it awaits Friday's government employment report.

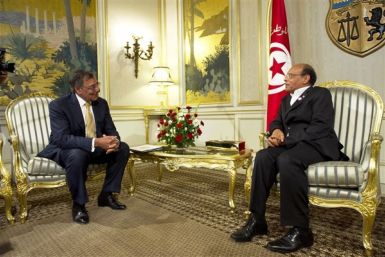

U.S. Defense Secretary Leon Panetta praised Tunisia's transition to democracy Monday and said the U.S. is prepared to provide the country with economic and military support.

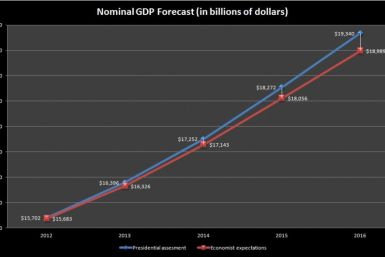

The numbers released by the White House Friday on a Friday report of the future direction of the U.S. economy look optimistic when compared to economist predictions also included in the report.

The jobless rate in the U.S. has stubbornly remained above 8 percent for more than three years, and the labor market likely saw little improvement in July, economists say in anticipation of the July nonfarm payrolls report due Friday.

Brooklyn's hot pink-blazer wearing Senate hopeful Mindy Meyer has endorsed Mitt Romney for president. The high-spirited 22-year-old is running against 10-year Democratic incumbent Sen. Kevin Parker for the New York State Senate in the 21st District.

The number of unemployed people across all 17 euro zone countries soared 11.2 percent to 17.8 million in June -- up 1 percentage point from the year before, Eurostat, the European Union's statistical agency, reported Tuesday. Euro zone unemployment among people younger than 25 rose to 22.4 percent.

Some of the results for specific councils are quite shocking,? said Judy Aldred, managing director of SSentif.

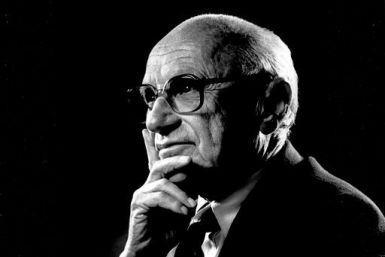

If Milton Friedman were alive today, he would be 100 years old. The Nobel-prize winning economist has transformed the way many people think about the government and economic policy.

Despite rising income at the end of the second quarter, U.S. consumer spending fell in June by 0.1 percent from the month before, the Commerce Department said on Tuesday.

While Greece awaits the latest round of bailout cash from international lenders, the country is fast approaching a new payment deadline and has until the end of August to repay a ?3.2 billion ($2.6 billion) bond or face the catastrophic consequences of defaulting on its debts.

Blitz USA is out of business, not because of a product defect, but because of consumer misuse.

If you're looking for some uplifting European economic news, that search will likely take you outside the euro zone and into Stockholm.

The week is chock-full with data releases that will confirm if the summer malaise continued in July. As always, Friday's employment report will carry the most weight. Another highlight of this week is the much anticipated Federal Open Market Committee meeting on Tuesday and Wednesday.

Asian stock markets advanced Monday on renewed hopes that policy makers in U.S. and Europe will announce further stimulus measures to spur economic growth when they hold policy meetings later this week.

Crude oil futures advanced Monday as sentiment was buoyed on speculation that major central banks around the world would act to tackle the deteriorating global economic conditions.

The hefty $7.25 billion settlement that Visa and MasterCard have agreed to, in response to a 2005 class action lawsuit over credit card swipe fees, will disadvantage retailers further and restrict consumer spending in an economy that relies heavily on credit card use and personal expenditure.

The U.K. Home Office's hard-nosed line on immigration cuts new avenues for job growth and business investments, further jeopardizing an economy that is under the sway of a double-dip recession.

Asian markets are expected to begin the week on upswing gains on the speculation of further stimulus measures from the central banks around the world to boost the fragile global economy. Most Asian markets ended last week on a negative note as investor confidence was weighed down by the mounting concerns over the euro zone debt crisis.

Big spending is alive and well at Saratoga, and it's part of why people keep coming back.

The influx of millions of conscientious and low-cost Chinese graduates in the global job market could exacerbate the woes of a U.S. job market that is already staggering from high unemployment.