The Congressional Budget Office said earlier this year in a report that the unemployment rate is already on its way down and will gradually decline to around 7 percent by the end of 2015, before dropping to near 5.5 percent by the end of 2017.

In economic news, the euro data was overwhelmingly negative, which interestingly enough did not propel the euro lower.

The number of Americans lining up for new jobless benefits fell slightly last week to 370,000, but remained above levels posted earlier this year, the Labor Department said Thursday. While matching economists' forecasts, the figure suggests improvement in the labor market is stalling.

Futures on major U.S. indices point to a lower opening Thursday ahead of initial jobless claims and durable orders data.

A report issued Tuesday from the International Rescue Committee finds that in countries recovering from war in West Africa, domestic violence is the biggest threat to women's safety.

European consumers are tightening the purse strings as their confidence in the region's economy continues to fade amid concern that the recession may worsen.

The U.S. economy will likely dip into another recession in the first half of 2013 if planned tax increases and spending cuts are allowed to go into effect in January, the Congressional Budget Office said.

The G8 leaders also said that it is ?our imperative to promote growth and jobs?.

As Republicans take the words of Newark Mayor Cory Booker and other Democrats to slam Obama's attack on Mitt Romney's private-equity roots, Democrats would like to remind the public that prominent GOP politicians have gone after Bain Capital, too.

Teachers and students in Spain staged a mass strike on Tuesday in protest of government budget cuts that could put 100,000 substitute teachers out of work.

The United States and Japan are leading a fragile economic recovery among developed countries that could yet be blown off course if the euro zone fails to contain the damage from its problem debtor states, the OECD said on Tuesday.

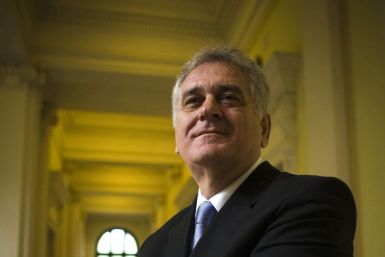

Tomislav Nikolic, a former extreme-nationalist who now leads the Serbian Progressive Party, was named the victor of Sunday's presidential elections in Serbia, beating incumbent President Boris Tadic of the Democratic Party.

I have never understood the public's obsession with the wealth and personal lifestyles of celebrities and the super-affluent

This week's economic calendar is relatively light in the U.S. with the releases of existing home sales, durable goods orders, and the University of Michigan consumer confidence survey. Attention will likely focus on data out of Europe. Euro zone PMIs, Germany IFO survey, and first-quarter gross domestic product data for the U.K. will be released.

Serbia's rightist opposition leader Tomislav Nikolic was leading in a presidential run-off on Sunday against liberal incumbent Boris Tadic by 50 percent to 47.7 percent, according to a preliminary unofficial projection.

In a talk at New York's Princeton Club, Nobel Prize-winning economist and New York Times Columnist Paul Krugman said the solution to create more jobs and get the U.S. economy to grow faster isn't rocket science: it's fiscal stimulus.

The ratio of bad debt held by Spanish banks increased in March and hit an 18-year high of 8.37 percent, or $187.5 billion, the country?s central bank announced on Friday. The number of nonperforming loans with payments that are 90 days overdue is now about 10 times larger than it was during the peak of the property boom in 1997.

A highly popular tranche of municipal debt issues is likely to feel the sting of a multi-notch ratings downgrade soon, a Wells Fargo credit strategist warned. The downgrade would wreak havoc on the portfolio strategy of a substantial number of investors in tax-exempt debt, and would also likely have noisy political repercussions in Puerto Rico, the municipality whose bonds are in the crosshairs.

Asian stock markets slumped Friday as renewed concerns over euro zone crisis and lackluster economic data from US dented investor sentiment.

Rating agency Moody's Investors Services sent yet another shockwave down the spine of the European financial industry on Thursday afternoon, downgrading 16 Spanish banks after equity markets had closed in New York.

A lack of new data or news saw markets run with previously established trends overnight.

More Americans than expected filed for jobless benefits last week, echoing comments in the minutes of the April Federal Open Market Committee meeting that suggested policymakers feel unsure about the true state of the labor market.

![New Democrat Ad: Republicans Attack Romney's Bain Background, Too [VIDEO]](https://d.ibtimes.com/en/full/689551/new-democrat-ad-republicans-attack-romneys-bain-background-too-video.jpg?w=385&h=257&f=f7099bbed00d6395b9c6188696fa5335)