The Tax Filing Platform Catering to America's Growing Expat Community

With tax season in high gear as millions of Americans navigate the complexities of the tax code, one segment of the population is often overlooked for the unique challenges they face when filing their tax returns. American expats living across the globe whether it be for work, pleasure or family obligations, contend with the same tax requirements as their fellow citizens living stateside except in some cases they often have to file additional paperwork as well as a more costly filing process.

When Nathalie Goldstein left California to move to Vienna with her Austrian husband, she discovered these challenges firsthand and recognized that technology was needed to solve the problem. The platform that she went on to co-found, MyExpatTaxes, began to grow like a rocketship and landed her on the Forbes 30 Under 30 list. As the expat lifestyle continues to grow in popularity among younger generations, the demand for the MyExpatTaxes platform will likely continue to grow as one of the only solutions dedicated to that unique subset of taxpayers.

Bootstrapping a High Growth Software Startup

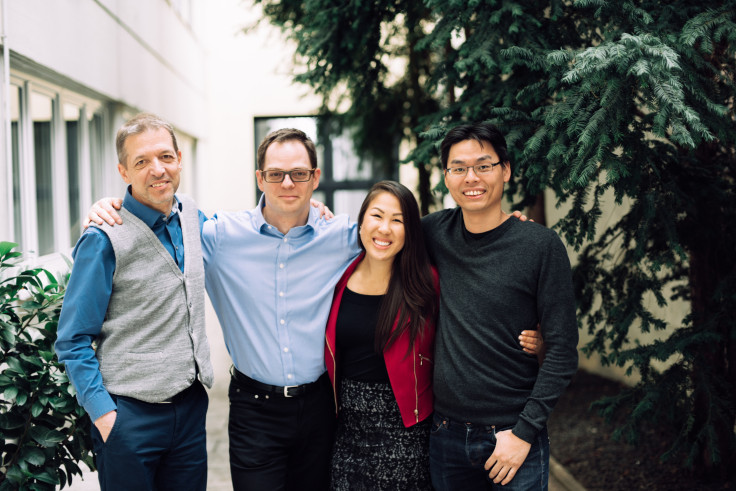

MyExpatTaxes is a unique success story in the world of tax preparation. The company was founded in 2018 by Nathalie Goldstein, Markus Finster, Joachim Niederreiter, and Degi Sea after they realized the burden of filing US taxes for Americans abroad. The team assembled organically and had a clear vision for a streamlined, automated tax filing platform that would meet the needs of Americans living abroad.

The company was self-funded from the start and has remained so to this day. This independence has allowed MyExpatTaxes to move quickly and efficiently, focusing solely on the needs of its customers. The company has not taken a single dollar of venture capital, and the founders fully own the business. This unique approach has proven to be a winning strategy, as MyExpatTaxes has grown rapidly in just five years.

Nathalie and her co-founders identified the need for a more automated and streamlined way to file US taxes from abroad after her personal experiences with filing taxes while living overseas. They saw the inefficiency and expense of traditional tax consultants and realized there had to be a better way. This need in the market led them to create MyExpatTaxes, which quickly became the go-to tax preparation platform for Americans living abroad.

Expat Taxpayers Often Felt Forgotten By Other Platforms

The most common challenges that expats face when filing taxes include not realizing they need to file, trying to avoid double taxation, and navigating complex tax treaties. MyExpatTaxes has simplified this process by analyzing all US tax treaties to identify the best usage for each individual user. While the process of filing taxes is mostly the same regardless of the country an expat is in, thanks to the Foreign Tax Credit and the Foreign Earned Income Exclusion, there is an optimal way to use or combine expat tax benefits to maximize your refund

The catalysts for the platform's rapid growth include the need for an affordable and simple solution and timing. Until MyExpatTaxes, most expat tax services could only offer one-on-one tax filing with a tax consultant, making the process lengthy and expensive. By automating the process, MyExpatTaxes made filing much quicker and at a fraction of the cost of competitors. When COVID prompted the US government to administer the first stimulus payments, thousands of expats who had failed to file their tax returns in the past were suddenly looking to get tax compliant so that they too could claim the payments. This event created a huge demand for MyExpatTaxes, which the company was able to fulfill quickly and efficiently.

MyExpatTaxes' growth strategy has always been to make filing US taxes from outside the US as quick and painless as possible. The company achieves this goal by continually improving its platform, offering better service and products every year. For example, the company launched its independent FBAR filing platform, MyExpatFBAR, last year. While the tax return service always includes FBAR filing, the company can now also file the FBAR for users who are not required to file a tax return.

MyExpatTaxes' success story demonstrates the power of innovation aimed at solving pain points for an underserved market. The co-founders identified a need in the market and created a solution that has helped thousands of Americans living abroad file their US taxes quickly and easily– building a loyal customer base along the way.