Tax-Free Weekend 2013: List Of States With No Sales Tax And Everything You Need To Know About The Holiday

Have some back-to-school shopping to do? If you get out there early -- this weekend -- you might just be able to save a few bucks, thanks to the state sales tax "holiday" starting today in many of the 17 participating states. Aug. 2-4 marks tax-free weekend in most of the states, when thousands of items will be tax-exempt.

Of the 45 states and the District of Columbia that impose sales taxes ranging from 2-12 percent on many goods, nearly half will not charge sales tax on purchases within that state this weekend. The five states that don't impose a sales tax – Alaska, Delaware, Montana, New Hampshire and Oregon – will, of course, continue their regular policies.

This year, many states are including everyday items as well as back-to-school items in the tax-free mix. In the past, many territories have also included energy-efficient appliances and items for hurricane preparedness as part of the tax-exempt period, which typically happens at the end of July or early August every year.

According to state tax department websites, purchases of items like back-to-school supplies, clothing, shoes and computers will not be subject to sales tax at checkout. However, each state has its own policy, so be sure to visit the Department of Revenue website for your state to see which items qualify.

There are no coupons or rebates required to participate in the tax-exempt states; sales tax will be automatically deducted on eligible items at checkout in the 17 participating states. Consumers who live in states that do not offer tax exemptions over the weekend can simply travel to states that do and shop there.

The Atlanta Journal-Constitution reported that shoppers in Georgia can save up to $10 million collectively without the 6-8 percent sales tax on items during the weekend.

The exemption period is generally held during the first two weekends in August in most states to attract back-to-school shopping before September. Some states include Friday as part of the weekend while others extend it to an entire week.

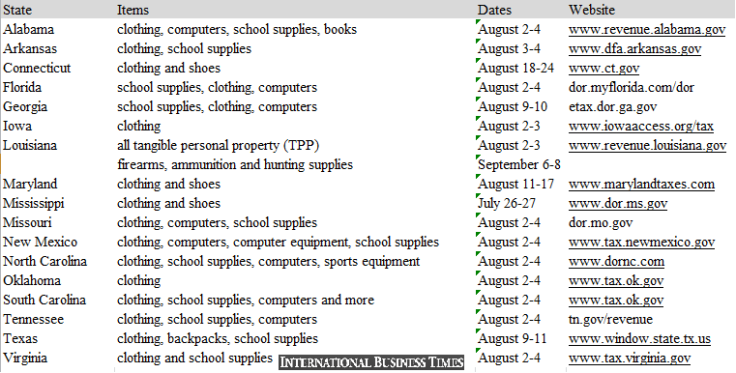

Below is a list of states offering the tax-free holiday as well as dates and a run-down of the rules and restrictions for the tax exemptions. Be sure to check your state’s Department of Revenue to review qualifying purchases and the time (generally beginning at 12:01 a.m.) the exemption period begins.

© Copyright IBTimes 2024. All rights reserved.