Technology Focus: Who Benefits From Big Data? Big Guns IBM, Oracle, HP, EMC

You don't have to be a genius to determine that in a world of petabytes of data, projected 2012 sales of 367.2 million PCs, 107.4 million tablets and 650 million smartphones, a few smart companies are going to prosper.

One is more than 100 years old.

Take a look at four huge technology companies -- Hewlett-Packard Co. (NYSE: HPQ), International Business Machines Corp. (NYSE: IBM), Oracle (Nasdaq: ORCL), the No. 1 database developer, and EMC Corp. (NYSE: EMC).

Had you invested in a portfolio of these four last Dec. 29, you'd be rather pleased now. HP, to be sure, is a special case, with its record $8.9 billion third-quarter writeoff, so its shares have eased 35 percent.

This year, shares of IBM are up 6 percent, Oracle's have gained 23 percent and EMC's 22 percent. EMC, of Hopkinton, Mass., is the biggest independent storage vendor, competing against the others who developed or acquired their own storage businesses. By comparison, the S&P 500 has advanced 12 percent.

(Investors who have confidence in new HP CEO Margaret (Meg) Whitman, might be wise to buy, especially if they believe she can duplicate the success Louis V. Gerstner Jr. had at IBM starting in 1993. Since Gerstner's writeoffs, IBM shares have surged nearly 1,400 percent!).

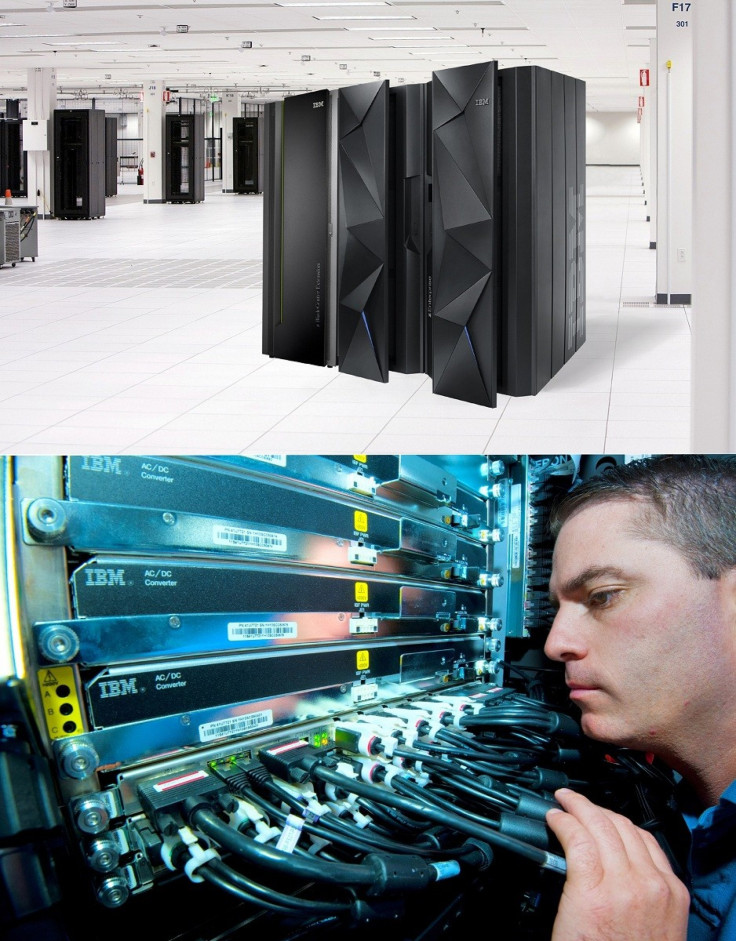

Last week, IBM, of Armonk, N.Y., announced its most powerful mainframe server for businesses, far more powerful than its predecessor, which fits into the same cabinet, doesn't require as much cooling and is far more efficient. It's key for big data.

Oracle, of Redwood Shores, Calif., is using its nearly three-year-old acquisition of Sun Microsystems to ship its Exadata servers that manage hitherto unimaginable amounts of data that can be stored and analyzed. Expect them to be refreshed in a few weeks.

Even at HP, of Palo Alto, Calif., business at the high-end server side, which fell about 4 percent in the latest quarter, looks good compared with IBM, where it fell 9 percent.

At EMC, which also controls VMware (NYSE: VMW), the top company in virtualization software that enables enterprises to essentially establish new data centers only in software, CEO Joe Tucci said recently, "having a strategy inside building the cloud, inside customers' data centers, the private cloud and working that in conjunction and building a big ecosystem of public cloud providers is a winning strategy."

You can bet your life on that: consider how frequently consumers tap the cloud now to download iTunes from Apple (Nasdaq: AAPL), the world's most valuable technology company; order a movie from Netflix (Nasdaq: NFLX) or use the smartphone to electronically deposit a check at a bank like Citigroup (NYSE:C). That's using, communicating with and storing big data.

Then consider the enterprise uses: businesses need products from other giants like Cisco Systems Inc. (Nasdaq: CSCO), the No. 1 provider of Internet gear, to interoperate, facilitate financial transactions, fulfill orders and share sophisticated programs for product design of engines and aircraft, as well as semiconductors.

Forgotten in the hype about new consumer products are these most advanced products and networks that run the global information system. That's the real big iron behind what the industry dubs "big data."

Americans take for granted their medical records can be instantly accessed from a hospital where they were diagnosed with a disease in 2009. In Mauretania or Cambodia, that's not the case yet.

To be sure, IBM said some of the first orders for the zEnterprise EC 12 are likely to come from customers in Senegal or Russia.

As well, margins for these high-end servers and software are much fatter than for laptop PCs. HP, the top PC maker, made pre-tax profit of nearly 11 percent on enterprise servers, storage and networking products last quarter compared with only 4.7 percent on PCs. No wonder the "big data" winners may likely be the big four: HP, IBM, Oracle and EMC.

© Copyright IBTimes 2024. All rights reserved.