Tenants Struggle To Pay Rent But A Long Coronavirus Rent Pause Could Deepen Economic Devastation

KEY POINTS

- At least 34 states have issued moratoriums on evictions over failure to pay rent

- Defaults could hit marketability of mortgage bonds in which pension funds are major investors

- Some suggest deducting rent for the pandemic period from the security deposit

While the mounting job losses and financial crisis are real for the working class, a simplistic holiday on rent and mortgage payments could worsen the larger economic ravage of the COVID-19 pandemic affecting about 15 million homeowners, according to some reports.

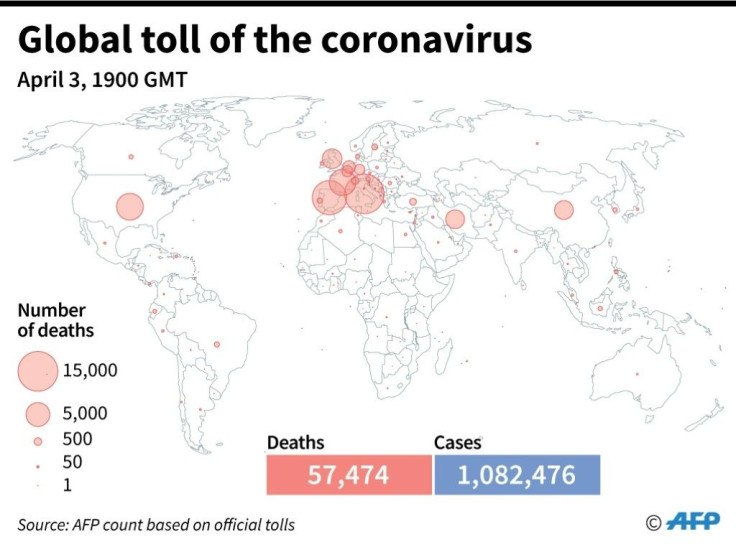

The latest federal data show a sharp rise in jobless claims, indicating a situation worse than the financial crisis of 2008-2009. With no signs of the new coronavirus infections flattening, there have been calls for rent and mortgage holidays to lessen the burden on the people who might end up jobless.

Brooklyn landlord

There are reports of intensifying demands for a rent holiday even as some advocacies have called for Congress to step in to implement the holiday. A Brooklyn landlord’s decision to waive the April rent for hundreds of tenants, meanwhile, strengthened demand for relief for the tenants. The WSB-TV reported that New York property owner Mario Salerno posted signs on his 18 buildings in the Brooklyn borough suspending April’s rent.“My concern is everyone’s health,” Salerno said. “I told them just to look out for your neighbor and make sure that everyone has food on their table.”

At least 34 states and many cities have issued moratoriums on evictions, some up to 90 days that apply to all rental units, according to a report by the USA Today. Courts are not in session in most states, which may prevent the landlords from getting eviction orders. Eviction cases have been suspended in Virginia until late April.

Apart from the rent holiday, the suggestions include allowing the homeowners to deduct the rent from the security deposit, according to a report on the CityLab website.

New York Mayor Bill de Blasio wants to let New Yorkers in the worst-hit boroughs use their existing security deposits to pay their rent, Bloomberg reported. There are advocacy groups like ParentTogether that have called for Congress to suspend rent, mortgage and utility payments until the coronavirus pandemic is controlled.

The Bloomberg report said New York Gov. Andrew Cuomo had received letters from borough presidents of Brooklyn and Manhattan and some New York City Council members. “Giving tenants the option to move their security deposits toward rent provides a cushion as the rent-relief programs are discussed on the state and federal levels,” the letters said.

However, some economists think a rent and mortgage holiday could have a cascading effect on the economy. “Those mortgages are often securitized,’ the CityLab report quoted Carol Galante, faculty director for the Terner Center for Housing Innovation at the University of California-Berkeley, as saying. “They’re packaged up into bonds and they’re sold as investments, and those investors are expecting a certain interest payment off of those securities on an ongoing basis. If they don’t get those, then those investors suffer.”

Long-term pain

Giving short shrift to the investors could have an impact on the larger economy because the investors are mostly pension funds. “But the fact is that many of those investors are things like pension funds,” the report quotes Galante as saying. The pension funds support teachers, first responders and others in ways in a complex chain of the financial networks, according to the report.

Therefore, a rent pause could impact the economy for years. Mortgage-backed securities could collapse as the rent holiday could drive away from the insurance companies and pension funds that are the principal investors in mortgage bonds. Common people depend on these entities to remain solvent, the report says.

What is apparent on the face need not be as such for many government policies, according to Kathleen Engel, a research professor at law at Suffolk University. “Oftentimes policies look good on their face, but there are effects that stem throughout the whole society, and can even hurt the people who are benefiting in the short term by the jubilee,” the report quoted Engel as saying.

Although Fannie Mae and Freddie Mac cover the default risk for most mortgage-backed securities and the Federal Reserve has pledged support to mortgage-backed bonds, the pandemic fallout has triggered margin calls, media reports said.

© Copyright IBTimes 2024. All rights reserved.