Tesla Earnings Highlight Rapid Model 3 Production Ramp-Up

Electric-car company Tesla's (NASDAQ:TSLA) second-quarter results are out. As expected, revenue soared and losses continued to mount. Beyond the quarter's financial results, Tesla's second-quarter update provided an important glimpse into other important areas, including Model 3 production, a forecast for cash to increase in the second half of the year, and more.

This article originally appeared in the Motley Fool.

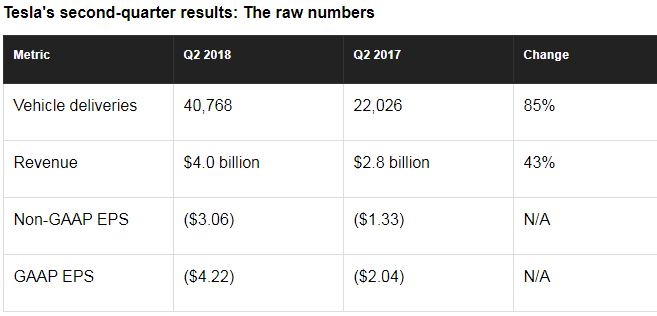

Here's an overview of the results.

Driven primarily by an 85% year-over-year increase in deliveries, Tesla's revenue increased 43% year over year to a record $4 billion. During the quarter, Tesla delivered 40,768 vehicles. Combined Model S and X deliveries amounted to 22,319 units, and Model 3 deliveries were 18,449.

Highlighting how sharp Tesla's ramp-up in Model 3 production and deliveries is, the important vehicle's deliveries increased 125% sequentially.

Tesla's non-GAAP loss per share of $3.06 was wider than its loss of $1.33 in the year-ago quarter, but it was narrower than its non-GAAP loss per share of $3.35 in Q1. Tesla's GAAP loss per share widened from a loss of $2.04 in the year-ago quarter to a loss of $4.22 in Q2, but this loss was nearly in line with its $4.19 loss per share in Q1.

Highlights

- Tesla highlighted a range of important updates on its business in its second-quarter shareholder letter, including the following:

- Tesla's automotive gross margin was 20.6% in Q2, up from 19.7% in the first quarter of 2018.

- Non-GAAP automotive gross margin was 21%, up from 18.8% in Q1.

- Model 3 gross margin went from negative in Q1 to "slightly positive in Q2, even though we were still ramping production and did not yet deliver any All-Wheel-Drive or performance models," Tesla said in its second-quarter shareholder letter.

- Tesla's Model 3 margin improvements were due to "dramatic reductions in manufacturing costs through lower labor hours per unit, reduction in ramp cost, higher leverage of fixed costs, and lower material costs."

- Tesla's Gigafactory battery production achieved an annualized production run rate of about 20 gigawatt hours, "making it the highest-volume battery plant in the world by a significant margin," Tesla said.

- Cash outflow from operating activities narrowed from $398 million in Q1 to $130 million in Q2.

- Model 3 gross profit when excluding non-cash items was positive for the first time.

- Negative free cash flow narrowed from $1.05 billion in Q1 to $738 million in Q2.

- Tesla maintained its recently achieved production rate of 7,000 vehicles per week (5,000 Model 3s and 2,000 combined Model S and X) "multiple times" during July.

Looking ahead

Management believes the second half of the year will be far better than the first, driven by soaring Model 3 production and profitability.

Expecting to achieve a Model 3 production rate of 6,000 units per week by the end of August, management anticipates seeing Model 3 production rise from 28,578 units in Q2 to 50,000 to 55,000 units in Q3. Model 3 deliveries are expected to be even higher during the period.

As Model 3 production and deliveries increase, Tesla expects to achieve improved economies of scale. Management said it expects a Model 3 gross margin of 15% in Q3 and about 20% in Q4. As a result, Tesla still expects to achieve GAAP profitability in Q3 and Q4 and believes its $2.2 billion in cash and cash equivalents will increase in both quarters.

Longer-term, Tesla says it's aiming to achieve a Model 3 production rate of 10,000 units per week sometime next year.

Daniel Sparks owns shares of Tesla. The Motley Fool owns shares of and recommends Tesla. The Motley Fool has a disclosure policy.