Tesla Gigafactory: Nevada Reveals More Details On Huge Tax Incentive Deal

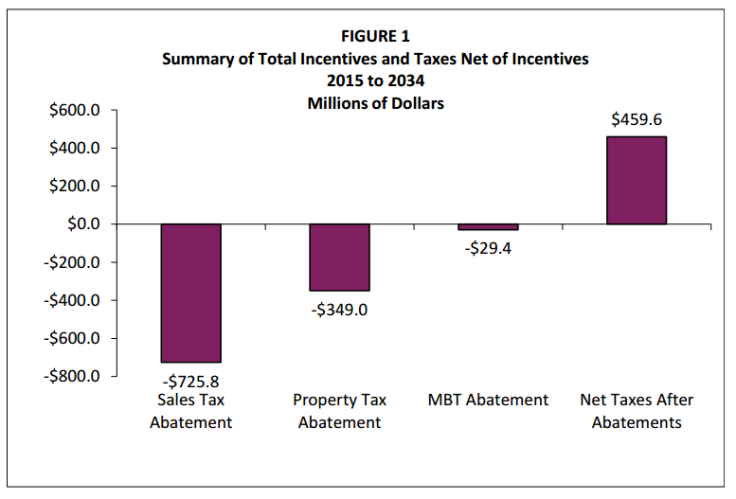

More details have been released about Tesla Motors Inc.'s (NASDAQ:TSLA) possible deal with Nevada to build its "Gigafactory" in the state in return for a $1.25 billion package of tax incentives. While the electric carmaker will operate for a decade without paying local property or state sales taxes, its thousands of employees would pay $818 million to local and state governments in the same period, according to an economic impact study released on Tuesday.

Last week, Nevada Gov. Brian Sandoval and Tesla CEO Elon Musk said a site 17 miles east of Reno for the $5 billion, 10 million-square-foot lithium ion battery factory has been selected, beating out four other states that were vying (with undisclosed offers) for the plant. Lawmakers in Nevada start a special legislative session on Wednesday to debate the incentive package.

The economic benefits, the governor says, more than justify giving Tesla a raft of tax abatements and credits that would let the automaker operate essentially tax-free for a decade. The Governor’s Office of Economic Development (GOED) released a short list of these benefits at last week's event, saying the factory would being about $100 billion worth of economic growth over 20 years, largely to an area in northern Nevada populated by about 435,000 people.

Critics of these and other state incentive megadeals argue that cost-benefit analyses commissioned by state development offices like the one released Tuesday are overly optimistic, and that giving tax breaks and credits to companies starves local sources of revenue while public services, such as roads and school systems, are burdened by these projects.

"The study confirms our argument that growth induced by Tesla will drive a burden shift. As summarized on pages 19-20 [of the report]: In the absence of revenue from Tesla, working families' sales and property tax revenues will have to pick up the slack,” Greg LeRoy, executive director of Good Jobs First, a public accountability group, said by email on Wednesday.

The economic impact report, produced by consulting firm Applied Economics in Phoenix, used “a widely accepted and utilized software tool that models the economic relationships between government, industry, and household sectors for a specific region so that when there is a change in any of these sectors, one can measure the effects/impacts that will happen to the other,” says the GOED.

Now that the 44-page report on the estimated economic impact of the factory is out, the public has more information to go on. It will take years to know whether these projections turn out to be accurate, but here are the finer points:

* Tesla (and it partner Panasonic) would operate the factory virtually tax-free for 10 years, but the study claims that in that period factory employees would pay $818 million in property and sales taxes.

* As the chart above indicates, Tesla will be waived of paying school, local and state taxes and will only be billed municipal franchise fees for use of the local services, like drainage and utilities.

* The 22,700 total jobs created by the factory would support 49,000 people, the report estimates.

* The first three phases of construction would take place 2015 through 2017, supporting 4,600 construction jobs a year paying an average annual salary of $57,000.

* Tesla would investing nearly $5 billion in construction, equipment and installation costs through 2018, supporting an additional 2,300 jobs a year to install the equipment inside the factory.

* By 2018, the state says the project would indirectly create 16,200 jobs, paying an average of $59,000 a year.

* Storey County, where the factory is based, and Washoe County, home to the Reno metro area where most of the workers would live, would benefit from $96.9 billion in economic growth over 20 years.

* Tesla says the plant will be supported by solar and wind energy, but it’s still estimated to spend $139.4 million for electricity and natural gas over 20 years.

© Copyright IBTimes 2024. All rights reserved.