'Too Big To Fail' Banks Doing Worse Than The Rest in Key Areas: New York Fed

The 20-page report by the U.S. central bank branch, which contains data about the period leading up to the second quarter of 2012, was billed by the institution as providing a broader picture than the more comprehensive quarterly banking industry report published by the Federal Deposit Insurance Corp. The Fed report looks at bank-holding companies, and not just banks (which are all that the FDIC report examines).

"The distinction between the two concepts is important, because "around 30 percent of aggregate banking industry assets are held outside firms’ bank subsidiaries," the New York Fed said in a blog post announcing the report's release.

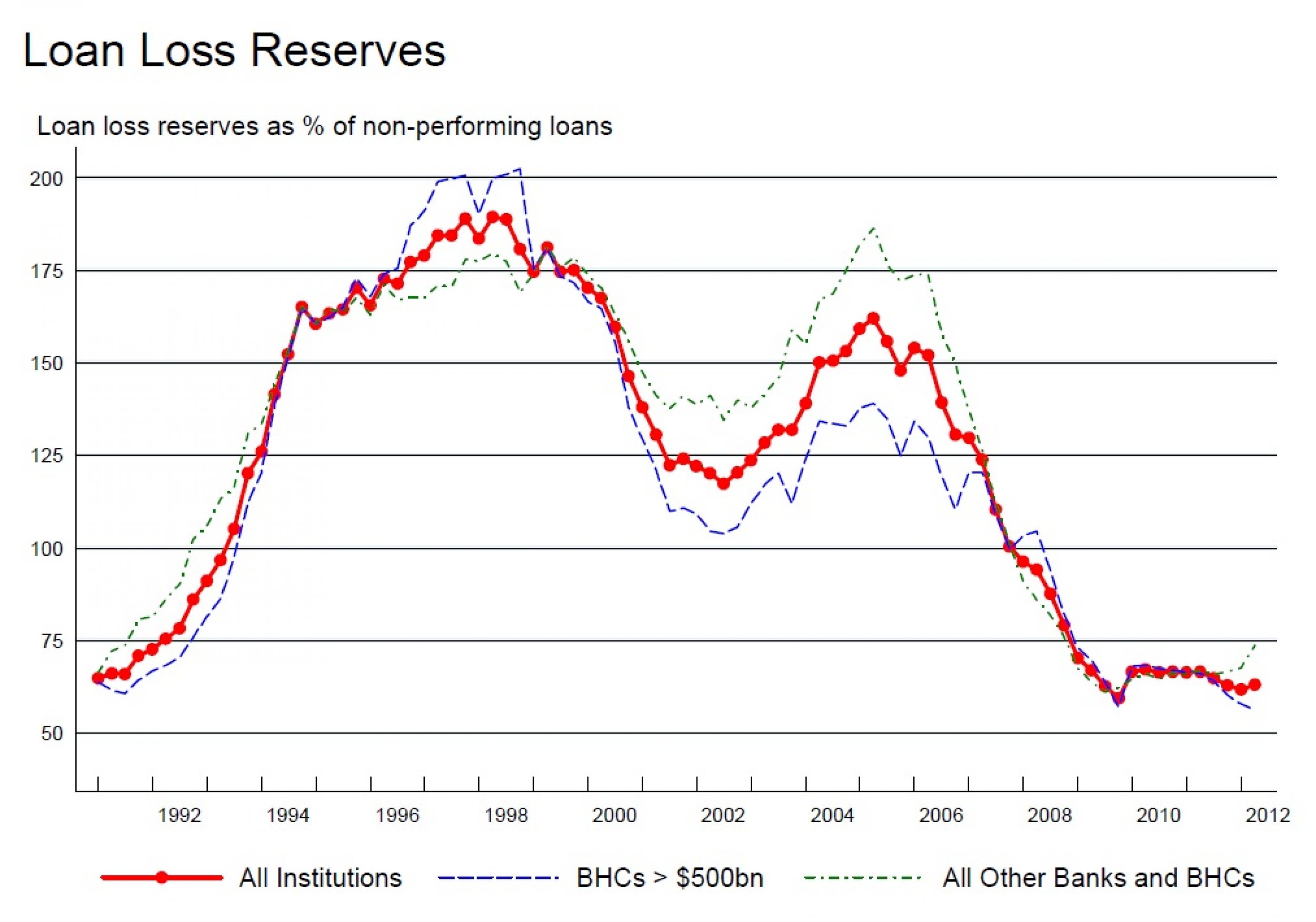

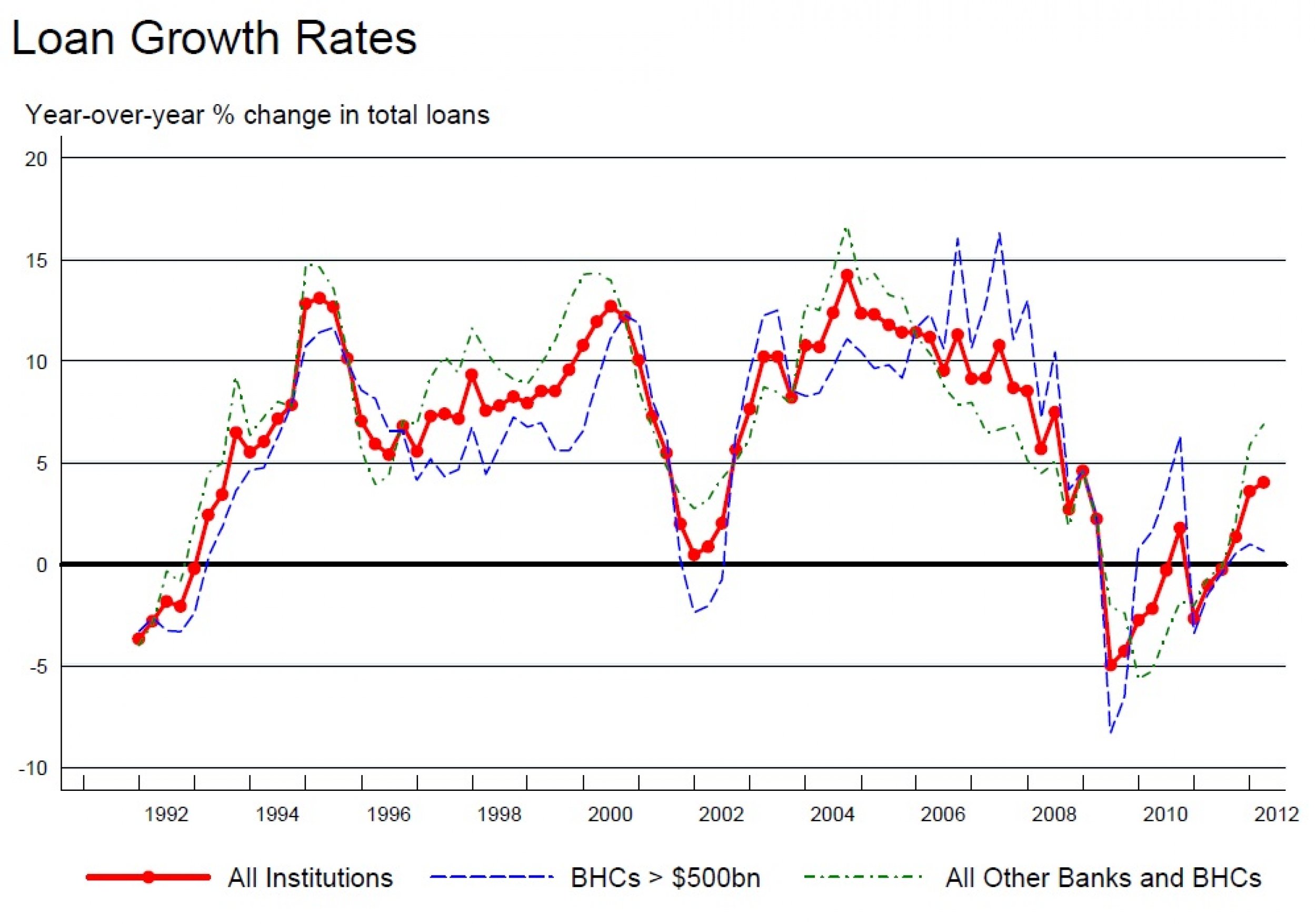

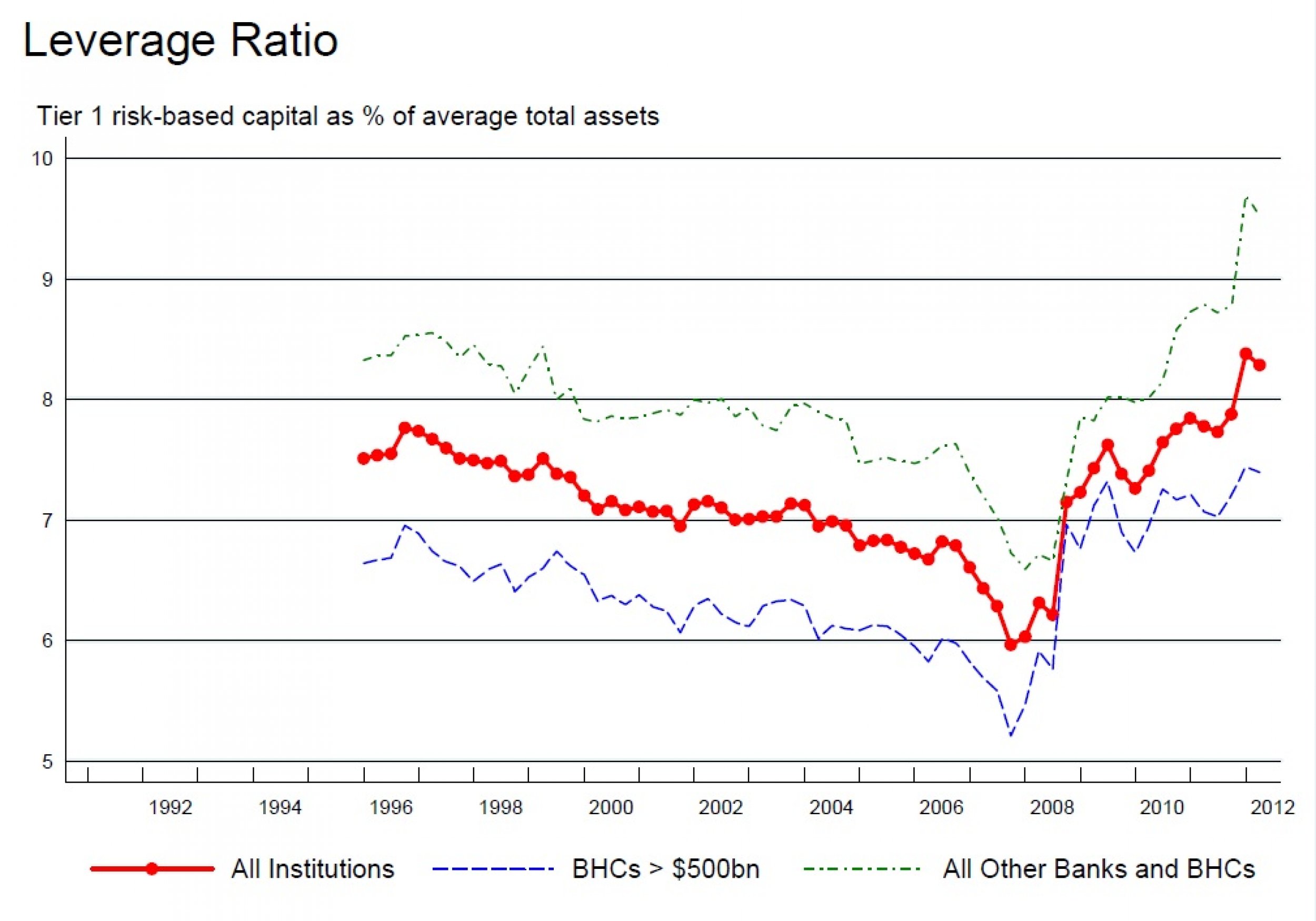

Even more important was the Fed's useful take on the momentum within the banking industry, in which it illustrated how general trends in capital reserve ratios and leverage and loan book performance are affecting the largest banks in the country, comparing their performance to the sector as a whole.

The view from the top of the balance sheets of the seven largest bankholding companies -- JPMorgan Chase and Co. (NYSE: JPM), Bank of America Corp. (NYSE: BAC), Citigroup Inc. (NYSE: C), Wells Fargo and Company (NYSE: WFC), Morgan Stanley (NYSE: MS), Goldman Sachs Group Inc. (NYSE: GS), and MetLife Inc. (NYSE:MET) -- reveal some distressing facts.

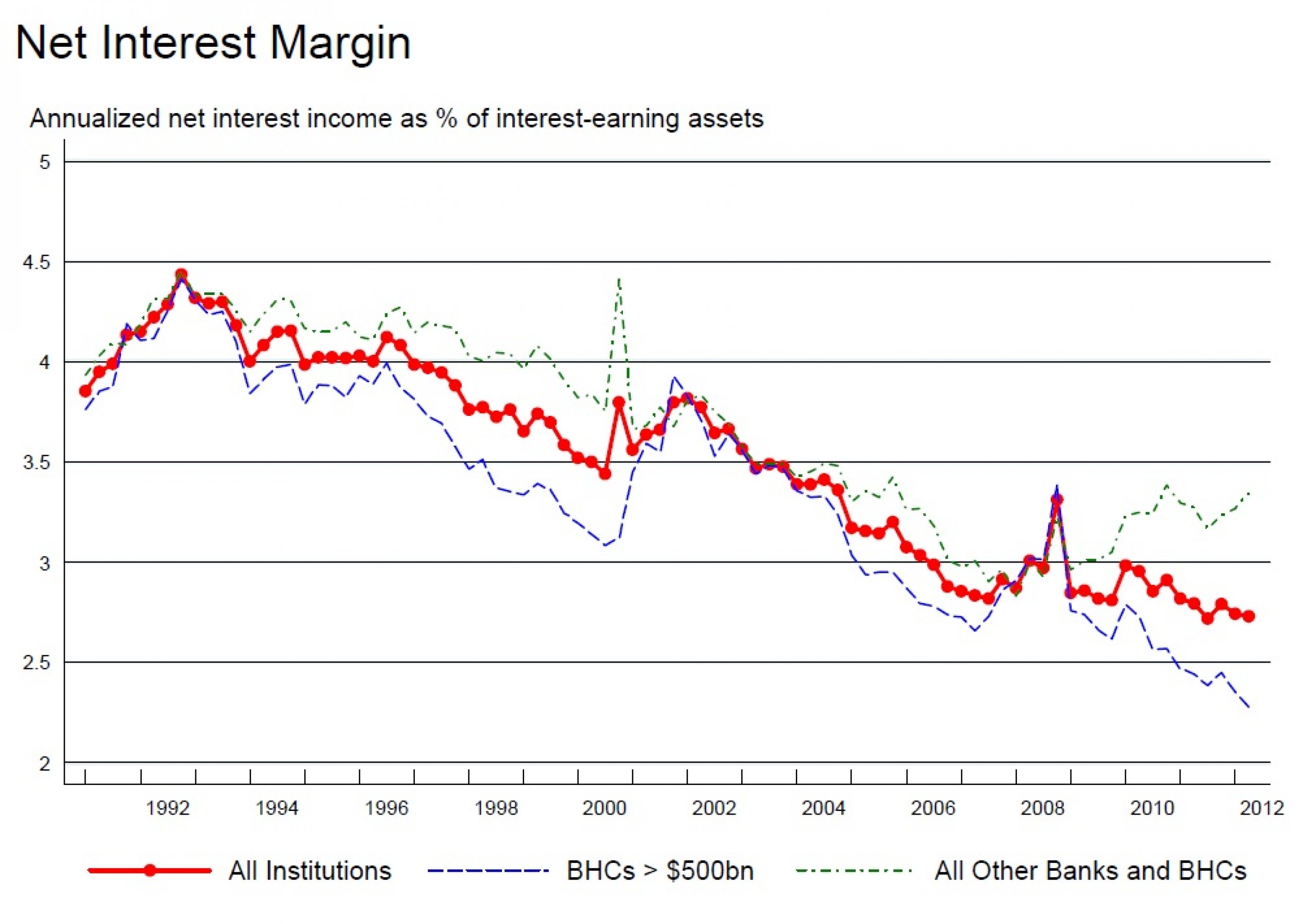

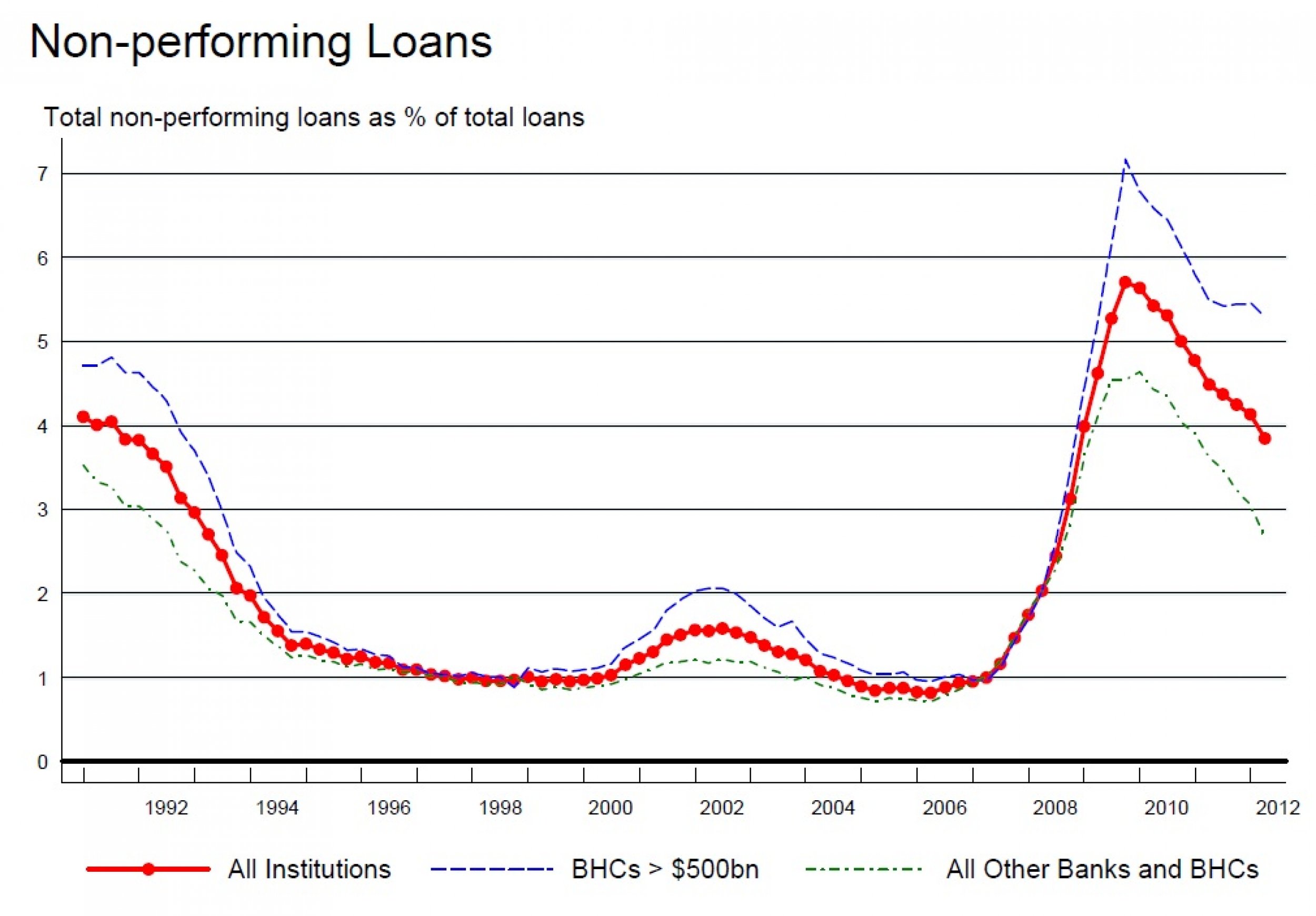

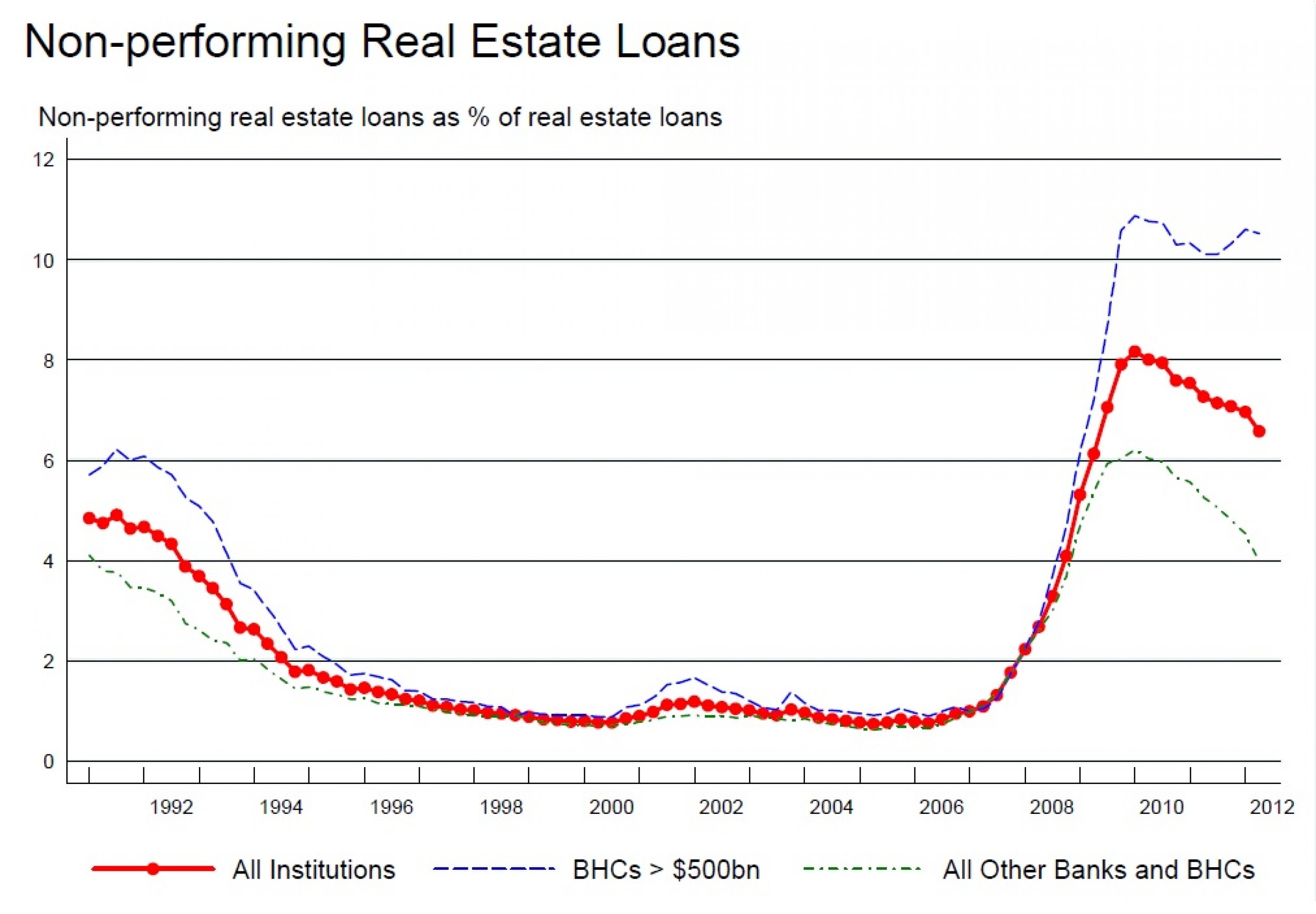

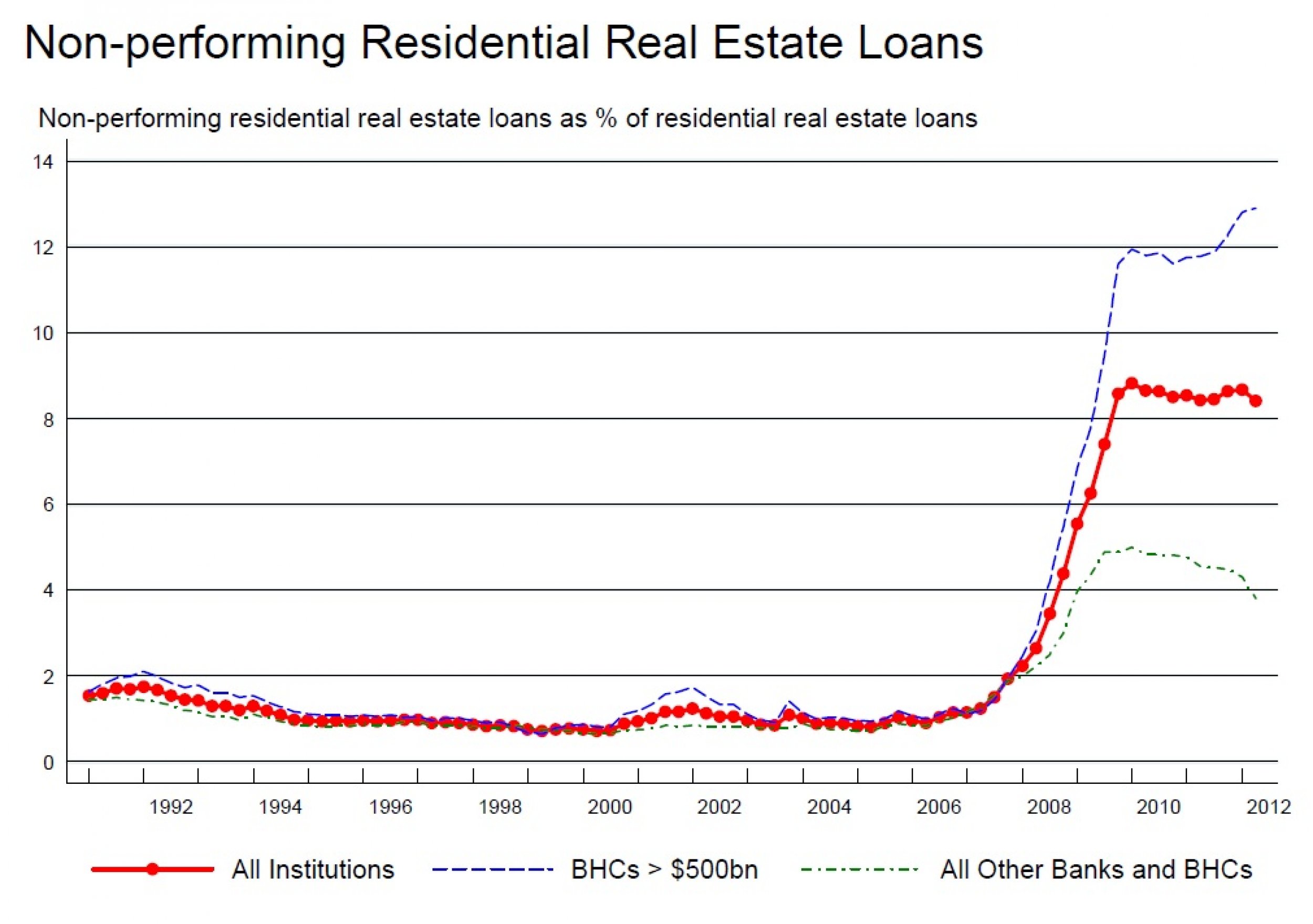

Compared to the rest of the banking industry, those companies are making proportionally fewer loans and deriving less interest income. The ratio of non-performing assets for those banks, again when compared to medium and small-size institutions, is noticeably high. Residential real estate, which is improving overall, appears to be a big problem for those financiers.

Perhaps most tellingly, loan growth at large banks has stalled, with other institutions driving nearly all of the spike in lending within the U.S. recently.

Not that large banks aren't making any money.

The six biggest banks -- that is, all the ones considered as the largest by the Fed with the exception of MetLife -- made $63 billion in profit during the first half of 2012, the highest amount earned since 2006. But a lot of those profits are coming from non-interest income (i.e., higher fees on services), cost-cutting initiatives, positive accounting tricks and other measures that improve the bottom line but are not sustainable.

Underneath, as the Fed report shows, things are not as happy as they would seem.

© Copyright IBTimes 2024. All rights reserved.