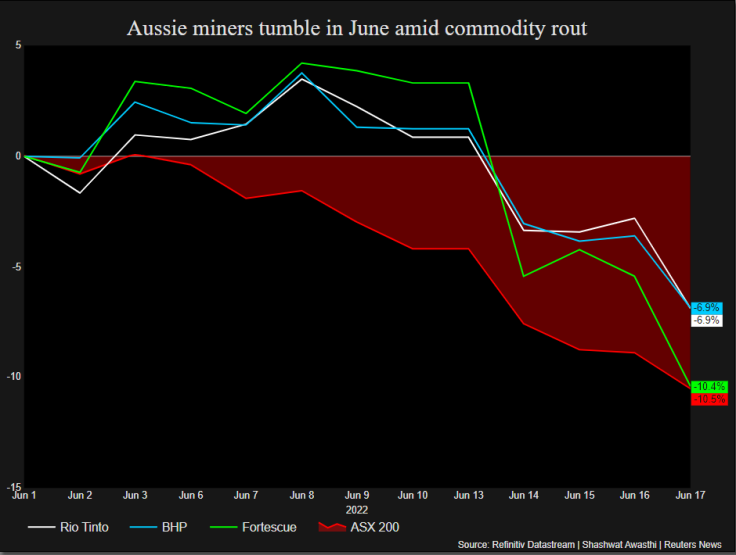

Top Three Aussie Miners To Shed $11 Billion In Market Value As Commodity Rout Accelerates

Australia's big three miners were on track to lose more than A$16 billion ($11.12 billion) in combined market value on Monday at current levels, as a commodities selloff over easing China demand and fears of a global recession deepened.

Rio Tinto's Australia-listed shares were set to shed nearly A$2 billion in value, BHP more than A$10 billion, and Fortescue Metals over A$4 billion.

Lower output from Chinese steel mills has hit demand for iron ore, while prices of commodities like copper and aluminium have slumped on worries that aggressive interest rate hikes by the U.S. Federal Reserve's and other central banks could tip the global economy into a recession. [MET/L]

The three Australian mining behemoths, so far this month, have already lost roughly A$30 billion of their combined market value, and are facing a third straight week of losses after hitting multi-week lows on Monday.

Rio Tinto and BHP are trading at a one-month low, while Fortescue is at a three-month low.

"Are we doomed? Or is it darkest before dawn?," Jefferies analysts wrote on Saturday with reference to recent economic data, China's COVID-19 lockdowns and the Fed's policy narrative.

They seemed to lean towards the latter, confident that the slowdown in demand for commodities would be followed by a recovery that would be led by miners, adding that recession fears and inflation would give way to recovery.

Analysts at JP Morgan also echoed risks to the sector but said fresh policy support along with easing COVID-19 lockdowns in China would spur a rebound in the second half of 2022, and maintained their "neutral" view on Rio Tinto and BHP.

Graphic: Aussie miners tumble in June amid commodity rout -

($1 = 1.4382 Australian dollars)

© Copyright Thomson Reuters 2024. All rights reserved.