Top U.S. Companies Hoarding Profits Overseas To Avoid Taxes

U.S. Senator John McCain (R-AZ) just accused Apple (NASDAQ:AAPL) of being “among America’s largest tax avoiders” as the tech giant's CEO takes the hot seat at a Congressional hearing to examine its practice of hoarding money overseas. This isn’t the first time the company has been in the limelight for using creative accounting strategies to avoid taxes.

In April 2012, Apple's use of a strategy dubbed the “Double Irish With a Dutch sandwich” -- in which a company can avoid paying taxes pretty much everywhere by routing profits through a combination of Irish, Caribbean and Dutch subsidiaries -- was noted by the New York Times.

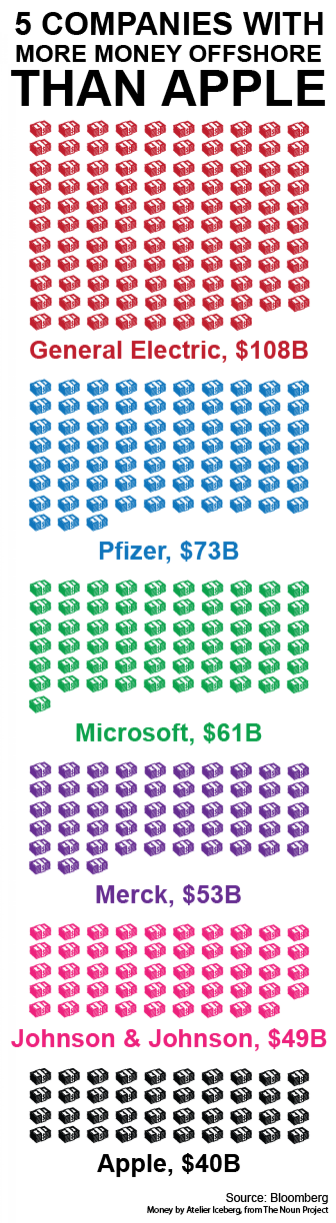

As of December 2012, Apple had $40 billion in accumulated profits held in offshore accounts, up approximately $30 billion from 2010, according to Bloomberg.

But Apple is far from being the only company that’s discovered such loopholes in international tax structures and employed them liberally. Bloomberg recently compiled a list of the top five U.S. companies by total profits accumulated and currently held in offshore accounts, as of December 2012. And while Apple isn’t in this top five, it isn’t far off.

Check it out:

© Copyright IBTimes 2024. All rights reserved.