Occupy Wall Street has camped out at Zucotti Park in Lower Manhattan for weeks, but it probably isn't reaching as many bankers as it could. Which could have something to do with the fact that finance is no longer the area's biggest tenant.

Gawker posted Goldman Sachs CEO Lloyd Blankfein's cell phone number on its website, figuring the CEO might like some sympathy after revealing huge quarterly losses Oct. 18 to the tune of $428 million.

Nigeria's Access Bank said on Thursday it will spend 50 billion naira to acquire a 75 percent stake in rescued rival Intercontinental Bank and combine both firms' operations within 12 months of the merger.

Top Bank of America Corp lawyers knew as early as January that American International Group Inc was prepared to sue the bank for more than $10 billion, seven months before the lawsuit was filed, according to sources familiar with the matter.

Stock futures pointed to a slightly higher open for equities Friday after declines in the previous session, with futures for the S&P 500, for the Dow Jones and for the Nasdaq 100 all up 0.2 percent.

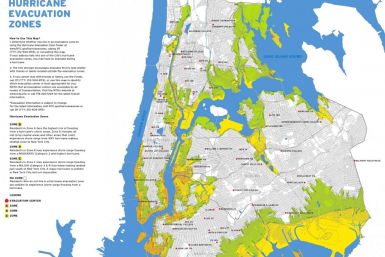

New York City is prepared to shut down its entire mass transit system if necessary Saturday as it braces for Hurricane Irene, officials said Thursday.

The last hurricane to pass directly over the new York, in 1821, caused tides to rise 13 feet in one hour, flooding all of Lower Manhattan up to Canal Street. According to official estimates, a storm similar to the great Long Island Express of 1938 would cause $40 billion in damage if it hit Long Island now.

New York is getting ready for Hurricane Irene, which is thrashing the Bahamas, moving toward the North Carolina coast, and expected to strike the densely populated U.S. Northeast Saturday and Sunday.

In the annals of natural disasters, it doesn't get much worse than a major hurricane directly striking New York City and Long Island.

Central bankers and economists from around the globe will once again flock to the Federal Reserve's annual gathering in Wyoming this week, and once again will meet against the backdrop of volatile markets and the prospect of further Fed support for a struggling U.S. economy.

Two former Marsh & McLennan Cos. executives, who had insurance-fraud charges against them dropped, sued former NY governor, Eliot Spitzer, with two multimillion dollar libel lawsuits over a column Spitzer wrote in Slate magazine.

After a week of wild gyrations that saw the Dow Jones Industrial Average rise or fall 400 points on four consecutive days, there?s word that a major bank in France with a funny-sounding name may be in trouble. Further, if you think a possible problem at France's Societe Generale won?t affect the value of the U.S. stocks you own, think again.

The 2010 U.S. Health Care Reform Act will likely be decided by the U.S. Supreme Court in 2012, in a case that pits individual liberties concerns versus the U.S. Government?s authority to limit public health care costs via universal insurance. If the court hears the case by the spring 2012, it could issue a ruling in June 2012.

The companies whose shares are moving in pre-market trade on Thursday are: Freeport Mcmoran Copper, News Corp, Ford Motor, PPL Corp, Regions Financial, Sara Lee, NYSE Euronext, American International Group, Alpha Natural Resources, Lincoln National Corp and Citigroup.

Jurors will finally have a chance to hear directly from Jeffrey Gundlach when the outspoken "king of bonds" takes the stand, expected as soon as Wednesday, in his high-stakes courtroom battle with his former employer, Trust Company of the West.

The Dow Jones Industrial Average and Bank of America both bounced back from disastrous Mondays to steady gains during Tuesday trading.

All eyes are on Bank of America (NYSE: BAC) ahead of Tuesday's opening bell after the banking giant suffered a 20 percent loss on Monday's trading.

The Dow Jones Industrial Average was rocked by investor fear on Monday, dropping 634 points during trading.

Amidst the slaughter in equities, Treasuries rallied and gold soared to a new all-time high.

As the Dow Jones Industrial Average dropped more than 500 points on Monday, banking giant Bank of America saw its share price get hammered.

Call it downgradeageddon, the fear sending U.S. markets sharply lower.

The Dow lost four percent in trading mid-day Monday, while the Nasdaq and S&P lost five percent. President Barack Obama addressed downgrade Monday, but the markets dropped further after his comments.