As the U.S. economy slouches toward another recession and confidence in policymakers erodes, investors are coming to grips with the notion that the country may already be several years into a Japan-style lost decade.

Gold prices rebounded Friday, along with other safe-haven investments, literally hours after dropping sharply on word that the world's biggest central bankers were jointly moving to protect the eurozone's commercial financial institutions.

Gold and silver prices moved higher late Thursday after posting big losses in the New York futures market.

Gold and silver fell hard Thursday after five major central banks announced a coordinated plan to inject U.S. dollars into European banks straining under the load of the continent's sovereign debt crisis.

The world's major central banks, led by the European Central Bank and the U.S. Federal Reserve, in a coordinated effort Thursday intervened to provide dollar loans to commercial banks in an effort to maintain liquidity in Europe and check institutional investor concern about Europe's private sector banks. What will be the impact on U.S. stocks?

The new loan offers will be conducted in October, November and December.

Gold prices steadied in volatile trade on Tuesday after briefly extending the previous session's 2.5 percent slide below $1,800 an ounce, as the dollar's gains versus the euro put fresh pressure on the precious metal.

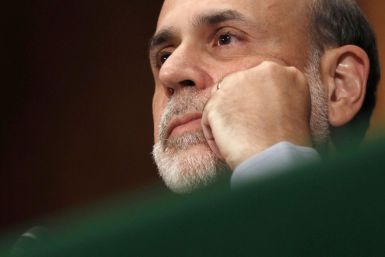

Investors are agonizing over the prospect of another round of quantitative easing that could come from the Fed chairman Ben Bernanke’s Jackson Hole summit later this week.

Moves by the Swiss National Bank to curb strength of the Swiss franc will fuel investors' insatiable demand for gold, adding to its relentless rise to new record highs as confidence in the franc as a safe store of value dwindles.

Asian stocks fell Thursday on profit-taking by nervous investors, while the Swiss franc stayed firm after plans to curb the currency disappointed those looking for more drastic action.

Japan's economy shrank much less than expected in the second quarter as companies made strides in restoring output after the devastating earthquake in March, but a soaring yen and slowing global growth cloud the prospects for a sustained recovery.

One of the world's leading economists says don't get giddy over the July jobs report, which indicated the U.S. economy created a better-than-expected 117,000 jobs. NYU Professor Nouriel "Dr. Doom" Roubini, who accurately predicted the housing crisis four years ago, says U.S. GDP will be sub-par in 2011 and the risk of a recession is real.

Japanese Finance Minister Yoshihiko Noda on Friday repeated that he was closely watching yen moves, signalling Tokyo's readiness to continue with its yen-weakening intervention that media said reached a record 4 trillion yen ($50.6 billion).

Japan intervened in currency markets on Thursday to curb the yen's gains that officials fear threatened to derail the economy's recovery from a slump triggered by a massive earthquake in March.

Asian shares fell on Tuesday on concerns about a downgrade of the United States credit rating and economic worries after sluggish data, while the yen gave some gains on jitters over the possibility of intervention by Bank of Japan.

Japanese Finance Minister Yoshihiko Noda signalled on Tuesday that Tokyo is in close touch with European and U.S. counterparts on the yen's strength, but declined to say if it would sell the yen to rein in its surge in value.

Republicans and Democrats rushed to rework rival deficit reduction plans on Wednesday, but with the fate of both proposals heavily in doubt top lawmakers pursued a behind-the-scenes compromise to avert a crippling U.S. default.

A Republican proposal to cut the U.S. deficit faced delay and stiff opposition on Wednesday, raising the risk of a debt default and a ratings downgrade as the clock ticks toward a deadline less than a week away.

Japanese authorities know there is not much they can do to turn a broad weak-dollar tide so will judge any intervention a success if it keeps speculative action from driving up the yen too far and too fast.

Assuming President Barack Obama and Congressional Republicans can not resolve the debt deal dispute in eight days, the unfathomable will happen -- a default by the U.S. Government. But that begs the question: what will the U.S. Federal Reserve do, if the U.S. Government defaults?

Japanese Finance Minister Yoshihiko Noda kept up his warning to markets against pushing up the yen too much, saying that he was aware of demands from the business sector for authorities to act against yen rises that hurt the export-reliant economy.

Japanese trade minister Banri Kaieda said on Tuesday that the Ministry of Finance and the Bank of Japan should consult and make an appropriate decision on intervening in the foreign exchange market, Jiji news agency reported.