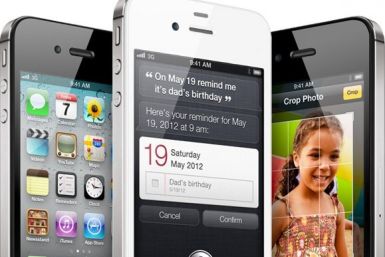

Apple Inc. has more than $81 billion of cash on its books with about one-third held in the U.S. This is because of its continuing success of products like iPhone, iPad, iPod and Mac. So what will Apple do with all the cash hoard?

Barclays Capital believes Apple Inc. may launch two iPads in 2012 - one with better cameras, higher resolution display, an A5 processor and Siri in March and another, coming later in the year, perhaps incorporating a faster processor and 4G LTE.

Arsenal manager Arsene Wenger said Friday that former France captain Thierry Henry will sign for the team in a two-month loan deal once an insurance agreement is reached with the New York Red Bulls, the Major League Soccer club Henry currently plays for, according to reports.

The consensus among investment bankers and many traders is that gold prices will continue to climb in 2012.

The iPhone is Apple Inc.'s largest and most profitable product line. Analysts are expecting Apple Inc. to unveil the next-generation 4G LTE iPhone 5 in the second half of 2012.

The inflows into gold-backed exchange-traded funds that helped drive bullion demand sharply higher during the financial crisis have more than halved this year, according to Reuters data, and are unlikely to recover in 2012 as appetite grows for other assets.

Several brokerages have lowered their profit estimates of Oracle Corp. (NASDAQ:ORCL) after the business software maker reported lower-than-expected quarterly results.

Current speculation among investors include deals with Dish Network, Sprint Nextel and Clearwire.

Last week Federal Reserve chairman Ben Bernanke told federal lawmakers that no bailout of Europe was forthcoming and ended a monthly meeting of the central bank’s top decision-making body by pointedly rejecting a new round of quantitative easing. Data released by the Fed reveals that, at least partially, the organization spent the week engaging in exactly those actions.

Canadian fertilizer giant Potash Corp. of Saskatchewan is seeking approval from the Israeli government to increase its stake in rival Israel Chemicals Ltd. to 25 percent, according to media reports.

The top aftermarket NYSE losers on Friday were: Gol Linhas Aereas Inteligentes, Genpact, Advantage Oil & Gas, Skilled Healthcare Group, Lender Processing Services, CoreSite Realty, Williams Companies, Western Asset Bond and Luby's.

A months-long delay in Research in Motion's new BlackBerrys and a dreary quarterly report sent RIM shares tumbling again on Friday and pushed some analysts to sound the death knell for the mobile device that once defined the industry.

PricewaterhouseCoopers LLP, one of the “Big Four” accounting firms, is being investigated by a U.K. regulator over possible accounting scheme in the firm’s auditing of investment bank Barclays Capital Securities Ltd. In January, the FSA fined Barclays Capital £1.1 million ($1.7 million) for putting client money at risk over an eight year period.

Several brokerage firms trimmed their price targets on Research in Motion shares and questioned the BlackBerry maker's ability to recover, after the company delayed the launch of its new line of smartphones.

European shares were slightly higher on Friday at mid-day amid thin trading as miners tracked rising metal prices, offset by lingering concerns over the Eurozone debt crisis and reservations ahead of U.S. inflation data.

The threat of Europe's financial crisis drifting overseas, slowing the U.S. recovery, remains. The Federal Reserve noted this week that Europe's debt crisis remains a threat to the U.S. economy, which it said is expanding moderately. Concerns linger over the health of the European banking sector and possible ratings downgrades in debt-ridden European countries.

Several brokerage firms trimmed their price targets on Research in Motion shares and questioned the BlackBerry maker's ability to recover, after the company further delayed the release of its new line of smartphones.

World stocks rose on Friday after upbeat U.S. data and corporate results, while concerns over the European banking sector and nervousness about potential ratings downgrades in European sovereign debt underpinned German government bonds.

Fitch Ratings, the third-biggest of the major credit rating agencies, downgraded seven global banks based in Europe and the United States, citing "increased challenges" in the financial markets.

The estate of Lehman Brothers has sought to match Sam Zell's $1.33 billion bid for a 26.5 percent stake in Archstone, sharpening the rivalry for the multifamily housing giant.

Thomas Cook will close 200 underperforming shops and 500 hotels and is lining up further disposals, as it battles to cut debt and restore confidence among investors and customers after a bailout by its banks.

European shares rose on Tuesday, bouncing from a steep sell-off in the previous session, though strategists said investors would need to feel more confident about a resolution to the Eurozone crisis before the market could break out of a recent range.