Credit ratings agency S&P Friday, like Moody's Thursday, warned that the U.S.'s credit rating could be downgraded, if an agreement on raising the debt ceiling is not reached soon. Meanwhile, the Reid/McConnell 'last chance' debt deal plan appeared to gain momentum Thursday, raising hope that a debt deal agreement will be reached soon.

Wall Street was heading for its worst week in nearly a year, with index futures little changed on Friday as macroeconomic concerns keep markets volatile and overshadow the start of U.S. corporate earnings season.

Federal Reserve Chairman Ben Bernanke warned on Thursday that overzealous cuts to government spending in the short term could derail a shaky recovery and said a debt default could wreak financial havoc.

The economy may not see a strong pick-up in growth in the second half of 2011 as the number of Americans filing for first-time jobless benefits remained high last week and retail sales barely rose in June.

The U.S. economy will struggle to regain speed this year, data on Thursday suggested, as the number of Americans filing for first-time jobless benefits remained high and retail sales barely rose in June.

China Thursday called on the United States to adopt responsible policies and measures to guarantee the interests of investors -- a communique that highlights the rising concern about a possible U.S. Government default. Meanwhile, modest debt talk progress was noted on Day 5, with bipartisan agreement on at least $1.5 trillion in spending cuts over 10 years.

U.S. Federal Reserve Chairman Ben Bernanke warned Congress on Thursday that overzealous cuts to government spending in the short term could derail an already fragile recovery and said a U.S. debt default may wreak financial havoc.

The following are highlights of Federal Reserve Chairman Ben Bernanke's testimony on Thursday to the Senate Banking Committee as part of his semiannual testimony on the U.S. economy and monetary policy. Bernanke repeated prepared testimony he delivered to a House of Representatives panel on Wednesday.

Federal Reserve Chairman Ben Bernanke warned Congress on Thursday that overzealous cuts to government spending could derail an already fragile recovery and said a U.S. debt default could wreak financial havoc.

The number of Americans claiming initial unemployment benefits dropped last week, but remained elevated and retail sales barely rose, suggesting the economy would struggle to regain speed in the second half.

Stocks were little changed on Thursday as Federal Reserve Chairman Ben Bernanke delivered congressional testimony for the second day and worries about hitting the U.S. debt ceiling dogged investors.

Longtime Federal Reserve antagonist U.S. Rep. Ron Paul, R-Texas, was at it again on Wednesday, criticizing Federal Reserve Chairman Ben Bernanke, the head of world's most powerful central bank, for a faltering economic recovery and suggested the country would be better off investing in gold.

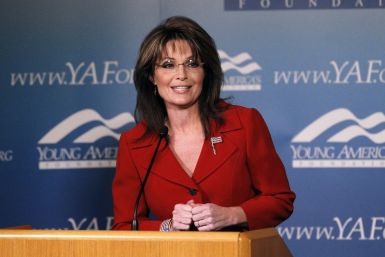

Former Gov. Sarah Palin, R-Alaska, redeployed her controversial gunplay rhetoric Wednesday, saying conservatives should not compromise and agree to raise the U.S. debt ceiling. Palin also said she isn't convinced that a U.S. Government default would be a calamity.

The United States may lose its top-notch credit rating in the next few weeks if lawmakers fail to increase the country's legal borrowing limit and the government misses debt payments, Moody's Investors Service warned on Wednesday.

Federal Reserve Chairman Ben Bernanke renewed his promise on Thursday that the central bank could put more monetary stimulus into play if the economic recovery stumbles.

U.S. Federal Reserve Chairman Ben Bernanke said on Wednesday that the Fed was prepared to take action to reverse any slowdown in the economic recovery, including another round of quantitative easing.

Wall Street stocks rose on Thursday as higher profit from JPMorgan offset concern after Moody's threatened to downgrade the United States' top credit rating if the federal borrowing limit is not raised.

Wall Street was set to rise on Thursday as higher profit from JPMorgan offset concern about closing the U.S. budget deficit after Moody's threatened to downgrade the United States' top credit rating.

Moody's Investors Service has placed the Aaa bond rating of the U.S. Government on review for a possible downgrade, due to the debt deal talks stalemate in Washington, and the possibility of a U.S. debt default, the credit rating agency announced. Fed Chairman Ben Bernanke also said a default would trigger a major crisis.

Stock index futures rose on Thursday as higher profit from JPMorgan offset concern about the U.S. budget deficit talks and Europe's sovereign debt crisis.

Japanese Finance Minister Yoshihiko Noda warned on Thursday that recent yen strength does not reflect economic fundamentals, escalating a verbal campaign to cool the rising yen although traders saw little immediate chance that authorities would intervene directly in the market.

A Chinese-government affiliate ratings agency, Moody's, Warren Buffett, and Federal Reserve Chairman Ben Bernanke all warned lawmakers and Obama on the looming US debt ceiling.