Asian equity indexes are getting whacked on Monday a lot like European and U.S. stock indexes got whacked on Friday, with all of those open at this time having shed between 1 percent and 3 percent in the early going.

Tea Party members and other conservatives would like Americans to believe that the United States? problems started in 2009, but nothing could be further from the truth. Three major policy errors by President George W. Bush last decade substantially worsened the U.S.?s fiscal condition, and the nation has been trying to recover ever since.

China's official news agency on Sunday warned US against muddying the waters in the disputed zones of South China Sea, responding to Washington's statement that it would increase its military presence in the region.

The U.S. had been losing industrial jobs to low-cost countries, particularly in Asia, for years, but its manufacturing sector appears to be staging a surprising turnaround. In 2009, manufacturing accounted for about 11 percent of U.S. gross domestic product; in 2011, the comparable figure was 12.2 percent.

American military machines are endangered by phony components from China. No one has been hurt yet as a result, but solving the problem will be a herculean task.

U.S. Defense Secretary Leon Panetta announced Saturday that the country will shift most of its warships to the Asia-Pacific region by 2020 as part of a new military strategy.

Asian markets declined this week due to increasing concerns about China's economic slowdown and heightened Spanish banking sector woes.

Sina Weibo, the popular Chinese social-media network and innovative microblogging service, has been running on new rules to restrict unlawful and disruptive discourse since May 28.

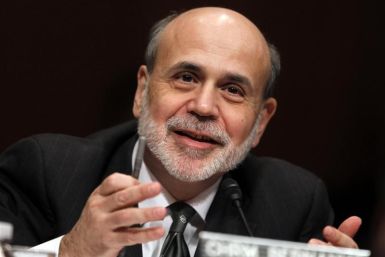

This backdrop of the weakening of the global economy could promote a broad round of coordinated central bank easing.

The United Nations Human Rights Commission officially condemned last week's Houla massacre in Syria.

Shares of big gold mining companies rocketed higher Friday as the yellow metal regained its status as a safe-haven amid growing fear that the American economy may not be able to offset the combined drag of the euro zone crisis and sharply decelerating growth in China and India.

U.S. stocks followed global equities down Friday as fears mount that the American economy may not be able to offset the combined drag of the euro zone crisis and sharply decelerating growth in China and India.

Yesterday morning the Chicago PMI Data came in quite weak with a reading of 52.7 versus and expectation of 56.7.

Following a high-volatility period over that past few days that has seen the political situation in Greece worsen, highly disappointing economic data prints in the U.S. and China and -- most prominently -- a surprise banking crisis in Spain, U.S. Treasuries have been hitting historically low yields on a daily basis. Lawrence Dyer, a New York-based rates strategist for British giant bank HSBC says should soon fall to 1.32 percent or lower.

As the risk of a messy Greek exit from the euro and a general breakup of the euro zone spark global slowdown fears, panicked investors have fled the troubled euro to safe havens such as U.S. treasuries and, crucially, the dollar.

Futures on major U.S. indices point to a lower opening Friday ahead of the anticipated Bureau of Labor Statistics' Nonfarm Payrolls report, the Institute of Supply Management (ISM)'s Manufacturing Purchasing Managers Index (PMI) report, and ADP's Personal Income report.

China Thursday defended its interests in the Asia-Pacific, following US Secretary of Defense Leon Panetta's statement, ahead of his week-long visit to Singapore, Vietnam and India starting this weekend, that the US would increase its military presence in the region.

China's manufacturing activity grew at a slower pace in May compared to the previous month, increasing concerns over a slowdown in the economic growth of the country.

Asian markets fell Friday amid increasing concerns over the slowdown in economic growth in China as the country's manufacturing activity grew at a slower pace in May compared to the previous month.

Asian shares and the euro extended losses Friday as China's factory activity data delivered its weakest reading this year, highlighting concerns the worsening euro zone debt crisis will further undermine global economic growth.

Asian shares eased Friday, with China's factory activity data and a U.S. jobs report due later in the day making investors cautious as the escalating euro zone debt crisis threatened to further undermine growth worldwide.

After ditching Super Bowl ads, General Motors Co. (NYSE: GM) pivoted away from the NFL and instead entered into a five-year advertising partnership for its Chevrolet brand with the popular British soccer team Manchester United, a move meant to bolster the brand's global awareness, the company announced Thursday.