The companies whose shares are moving in pre-market trade on Tuesday are: Chesapeake Energy, Home Depot, V.F. Corp, Hess Corp, Juniper Networks, Dean Foods, Carnival Corp, Yahoo, Jds Uniphase and Wal-Mart Stores.

John Paulson, whose firm now oversees roughly $36 billion, again counted SPDR Gold Trust (GLD.P), AngloGold Ashanti (ANGJ.J), Citigroup (C.N) and Bank of America (BAC.N) as his top four holdings.

RBC Capital Markets said banks with strongest capital and increased profitability are expected to get green light on dividends. The Federal Reserve is expected to approve dividend increases.

China used its regulatory powers to scour the books of Citibank Shanghai in a hostile and extraordinarily intrusive 2007 audit that appeared primarily aimed at controlling Citi's growth and uncovering its secrets to success, the bank's top China executive at the time told U.S. officials.

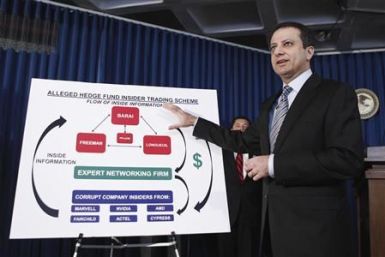

A investigation into allegations of insider trading in the hedge fund industry for the first time reached former employees of billionaire trader Steven A. Cohen's SAC Capital Advisors.

Regulators began their most forceful attempt yet to clamp down on bank bonuses since the 2007-2009 financial crisis, and warned firms they would seek to counter attempts to circumvent the reforms.

Regulators on Monday are expected to make their most forceful attempt yet to clamp down bank bonuses since the 2007-2009 financial crisis, but the proposals pale in comparison to harsher restrictions already set in Europe.

The companies whose shares are moving in pre-market trade on Monday are: Bristol Myers Squibb, Chesapeake Energy, Sprint Nextel, Valero Energy, Bank of America, Aetna, Verizon Communications, Weyerhaeuser, Nvidia and Corning.

British music company EMI Group said that Citigroup Inc. (NYSE: C) has seized control of the company from struggling financier Guy Hands, in a move that it will probably lead to the sale of EMI.

Gold Bullion prices failed to rally from last night's tumble in Asian and London trade on Friday, extending the month's sharp losses and hitting to four-month lows in the US Dollar and six-month lows against the Swiss Franc and commodity currency Aussie and Canadian Dollars.

High expectations and the somewhat difficult task to maintain rapid growth have analysts concerned about Netflix's lofty stock price.

Americans' trust in institutions of all kinds dropped last year as persistently high unemployment sapped people's confidence in business and government, a newly released study found.

Both Bush and Clinton Adminstrations were at fault, as well as former Fed Chairman Alan Greenspan and current Treasury Secretary Timothy Geithner, as well as former Treasury chief Henry Paulson, says inquiry

Firm's big bet on Citigroup pays off with a $1 billion gain.

Citigroup Inc (C.N) Chief Executive Vikram Pandit got a $1,749,999 raise on Friday.Pandit pledged in 2009 to receive an annual salary of $1 until the struggling Citigroup returned to sustained profitability.

Citigroup Inc's board raised the salary of Chief Executive Vikram Pandit to an annual base of $1.75 million, from a symbolic $1 per year, the bank said in a regulatory filing on Friday.

Nigeria has issued guidance for its $500 million debut Eurobond indicating a yield of around 7 percent, higher than that of West African peer Ghana, market sources said on Thursday.

Morgan Stanley said fourth-quarter shareholder profit surged 60 percent as rising fees from wealth management offset the weak fixed-income trading results that have marred its competitors earnings.

Michelle Obama asks American students to study in China, stressing the need for competitiveness and cooperation

Mergers and acquisitions activity in sub-Saharan Africa surged to a record $44 billion in 2010, double the value of a year earlier, Thomson Reuters data showed on Wednesday.

Gold rallied for a third consecutive session on Wednesday, boosted by broad weakness in the dollar and robust Asian consumer demand, while anticipation of more resilient global growth took platinum to 30-month highs.

US stocks traded mixed in early trade on Wednesday, following mixed earnings from financial heavyweights Goldman Sachs and Wells Fargo and a government report showed that U.S. housing starts fell more than expected in December.