While the rest of the world spirals into a debt-filled economic abyss, ultra-wealthy Persian Gulf states like Qatar and Kuwait are propped up by the high prices of crude oil and natural gas.

Physical gold is the ultimate collateral because it has no credit risk, according to the Bank of America Merrill Lynch?s Global Commodity Research team.

World stocks and the euro fell back Thursday, prompting a rush to safe-haven government bonds as concerns resurfaced about the euro zone banking system and signs of funding stress.

Crude oil historically trades at about 8 times the price of natural gas. Currently, it's trading at about 20 times natural gas. Is oil overpriced, natural gas underpriced, or is it a combination?

A reorientation of Russia to East from West could be a complete economic game-changer.

The International Energy Agency says threats to the U.S. and global economies may cut oil demand growth next year by more than 60 percent; however, the group still sees global oil demand little changed this year and in 2012.

Bank of America Merrill Lynch?s Global Commodity Research team announced that they?ve rebalanced their actively managed commodity indices in favor of non-cyclical commodities such as gold.

Gold and silver prices rose Wednesday, but a falling stock market pulled down shares of silver mining companies and left gold mining company stocks mixed in midday trading.

Oil led a rebound among commodities on Wednesday as investors went bargain hunting for riskier assets after the U.S. Federal Reserve promised to extend near-zero interest rates for two more years.

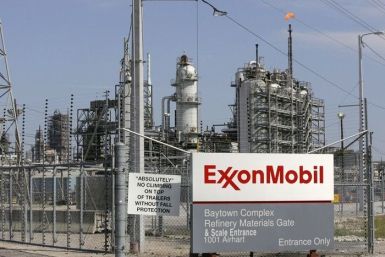

Apple Inc on Tuesday surpassed Exxon Mobile Corp, if only briefly, to become the most valuable company in the United States. With a market cap of almost $342 billion, Apple's sales have been increasing 80 percent a year, coupled with even faster profit.

U.S. stocks clawed back most of Monday's losses as a U.S. Federal Reserve promise of at least two more years of near-zero interest rates overshadowed its warning about slowing economic growth. The Fed's statement gave markets a glimmer of hope, with stocks' gains accelerating into Tuesday's close.

Gold rose Tuesday to another record high as U.S. stocks fluctuated in a narrow range and crude oil fell below $80 a barrel.

Oil and natural gas companies, whether integrated or independent, whether upstream or downstream, posted gains as investors picked up heavily discounted stocks.

U.S. stocks plummeted for the second straight session, driving the S&P 500 and the Nasdaq down 6 percent on Monday in the first session since Standard & Poor's cut the nation's perfect AAA credit rating.

U.S. stock index futures tracked a sharp drop in global equity markets on Monday after rating agency Standard & Poor's cut the top-tier AAA credit rating of the United States, rattling already-jittery investors.

In opening minutes of trading, the Dow Jones Industrial Average is down 1.2 percent, S&P 500 has slid 2.2 percent and Nasdaq has fallen 3.1 percent.

Asian shares fell on Monday and the dollar languished near a record low against the Swiss franc, as investors took fright at a downgrade of the U.S. credit rating, while gold powered to another record just short of $1,690 an ounce.

Gold jumped more than 1 percent and metals market plunged on Friday as investors sought safe havens and fled riskier assets on worries over slowing global economic growth.

U.S. stock index futures point to a lower opening on Friday as investors are cautious ahead of key U.S. monthly non-farm payrolls and unemployment data from the government.

A scary drop in stocks and commodities threatens to squeeze life out of an already faltering U.S. economy, with deal-making, investment in plants and equipment, and capital raising at risk of slowing down or freezing up.

The latest U.S. oil inventory data contradicts a widely held notion among oil traders that a huge glut of Canadian and U.S. shale crude oil is accumulating in the middle of the United States and causing the record gap in global oil benchmark prices.

Oil tumbled as much as 6 percent on Thursday, with U.S. crude crashing through technical support to its lowest since February as mounting fears of a stalled economy set off a global race from riskier assets.