The Gold Price rose further in London trade Thursday morning, hitting new 2011 highs for Dollar investors as Brent crude oil jumped to $119 per barrel and a raft of economic analysis warned of stagflation ahead for the global economy.

Oil prices continue to rise amidst fears that violent unrest in Libya will not only cut off supplies from that nation, but perhaps spread to other, larger oil producers, including Saudi Arabia.

Gold steadied near seven-week highs on Thursday, as investor fears over inflation stemming from the spike in crude oil were partially offset by pockets of profit-taking after the market's 6 percent rise this month.

Futures on major U.S. indices point to a lower opening on Thursday as oil prices continued surge due to continued turmoil and violence in Libya.

King Abdullah of Saudi Arabia - jointly the world's biggest oil producer alongside Russia, and so far immune to the civil unrest sweeping North Africa and the Middle East - returned from hospital treatment abroad to announce a near US$38 billion package of new housing projects, a 15% pay-rise across the board, and the kingdom's first-ever unemployment insurance.

The price of oil crude oil futures touched $100 per barrel for the first time since October 2008 on deepening worries over the political chaos and violence in oil-rich Libya.

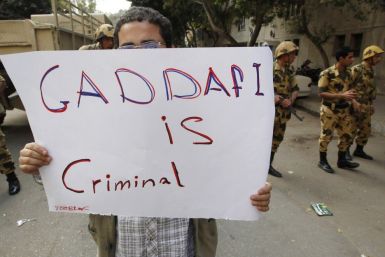

Most Asian stocks ended lower on Wednesday, led by declines from airlines as crude oil prices surged on growing fears that Libya may descend into a civil war after Colonel Moammar Gaddafi warned that he would never give up his power and would rather die a “martyr.”

A recent expedition to the bottom of the Gulf of Mexico found that last summer's oil spill will likely affect the region for several more years.

Crude oil prices have surged more than 7 percent this morning in New York trading, reaching as high as $98 per barrel, as the chaos in Libya raised fears of supply disruptions.

US stocks declined in early trade on Tuesday as political unrest in the Middle East weighed on the sentiment.

Refiners Holly and Frontier Oil agreed to merge in an all-stock deal valued at nearly $3 billion, to create an independent refiner serving the mid-continent, Rocky Mountain and Southwest refining markets.

Futures on major U.S. stock indices point to lower opening on Tuesday, following declines in European and Asian stock markets as continued political unrest in the Middle East weighed on the sentiment.

At a time when the Middle East political tensions increasingly weigh on global oil markets, Russia has made significant advances at the expense of the traditional Gulf-Arab oil exporters.

Futures on major U.S. stock indices point to lower opening on Tuesday, following declines in European and Asian stock markets as continued political unrest in the Middle East weighed on the sentiment.

Fitch Ratings on Monday downgraded Libya's credit rating by one notch to BBB in the midst of escalating violence in the oil-rich North African nation.

Oil prices have jumped in response to the growing chaos in oil producer and OPEC member Libya and the potential for the escalation of unrest in Iran, OPEC’s second biggest oil producer..

As anti-government protests sweep across Libya, even entering the once-tranquil capitol of Tripoli, and major foreign oil companies suspend or withdraw operations in the wake of civil unrest, there are many unanswered questions.

BP plc (NYSE: BP) has announced that it is suspending its drilling activities in Libya due to the rising tide of political violence in that country and also plans to evacuate non-essential staff and their families.

The Silver Price rose $1.49 per ounce from Friday's London Fix – a gain of 4.7% to new 31-year highs, and silver's fifth largest one-day move of the last 30 years in Dollars and cents. The market is starting to look towards the record high of $1430 for gold against the backdrop of silver making fresh highs.

Asian stock markets ended mixed on Monday as political unrest in the Middle East weighed on the sentiment.

U.S. stocks rose Friday, marking the third straight week of market gains, as investors warily watch continuing unrest in the Middle East and North Africa, along with the start of a two-day meeting of G20 finance ministers and central bankers in Paris.

The price of large, wholesale Gold Bars continued rising for US investors on Thursday, ending London trade at a 5-week high of $1383 per ounce as world stock markets held flat and the Dollar slipped on the currency market.