The U.S. Federal Reserve Wednesday lowered its view of the U.S. economy, but kept interest rate policy and its non-traditional quantitative easing policy the same. The Fed said it now sees "economic activity decelerated somewhat over the first half of the year," compared to a previous view of the "economy has been expanding moderately."

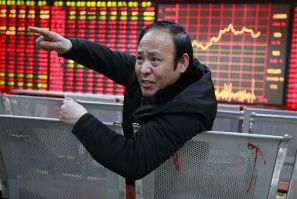

Asian markets fell Wednesday as investors were disappointed to note that the U.S. Federal Reserve Chairman Ben Bernanke did not offer any hint of monetary easing measures to rejuvenate the faltering economic growth.

The rate of inflation in China slowed down in June from the previous month, showing signs of a gradual decline in price pressure to make room for monetary easing.

European markets fell Thursday as investors were disappointed the U.S. Federal Reserve failed to announce any quantitative easing measures on Wednesday.

While chances of a third round of U.S. money-printing quantitative easing measures, or QE3, have dimmed, the World Gold Council, or WGC, remains positive on the yellow metal's outlook due to its international appeal and value in hedging against inflation and deflation.

Brazilian president Dilma Rousseff said she used an official visit to President Obama to press her concern that monetary policy pursued by the U.S. and Europe was inhibiting Brazil's economic growth.

President Obama will host Brazilian president Dilma Rousseff on Monday in an effort to strengthen ties between two of the world's largest economies.

In its latest bid to slow dollar inflows in a global currency war, Brazil has dealt an unexpected blow to its own commodity exporters, choking off medium-term trade financing at a vulnerable time for the sector.

Gold prices rose 1 percent on Monday after comments from U.S. Federal Reserve Chairman Ben Bernanke that faster growth will be needed to boost employment supported expectations that further quantitative easing measures may be necessary.

The closer the yuan is to an equilibrium, the bigger role market forces will play in the yuan exchange rate, PBOC Governor Zhou Xiaochuan said Monday. He said the central bank will allow and encourage market forces to play a bigger role while decreasing its intervention in the market in an orderly manner.

A second injection of cheap funds from the European Central Bank may give the euro a temporary boost but is likely to trigger a longer-term decline in the common currency.

A number of top Federal Reserve officials likely saw a need for additional monetary easing at the central bank's meeting last month, although there are few signals the central bank will move soon.

China's imports in January fell the most since the depths of the global financial crisis, raising concerns that demand may be weaker than previously thought even allowing for Lunar New Year factory shutdowns.

Treasury Secretary Timothy Geithner said on Thursday that key emerging-market nations must let their currencies rise in value in order permit more stable global growth.

The European Central Bank could soon bow to pressure to print money to prevent a further escalation of the euro zone's debt crisis, with respondents in a Reuters poll giving an even probability the ECB would adopt a policy of quantitative easing.

The U.S. Treasury Department said it would delay until later this year a ruling due on Saturday on whether China was manipulating its currency to gain an unfair trade advantage.

Britain's central bank left interest rates at a record low 0.5 percent for the 30th straight month on Thursday, leaving open the possibility that it may restart its quantitative easing program should the economy weaken further.

The outlook for economic growth in developed countries has got much worse in the last three months, the OECD said on Thursday and urged central banks to keep rates low and be ready to pursue other forms of easing.

Brazil vowed on Tuesday to defend its domestic industry against unfair competition and slapped import tariffs on select Chinese steel products.

China's economic growth may ease to below 9 percent in 2012, partly due to a weak global economy, a senior Chinese foreign exchange official said on Tuesday, backing market expectations that the world's No. 2 economy is set for a mild easing.

The U.S. Federal Reserve could embark on a third round of quantitative easing depending on upcoming economic data but should first confirm that inflation has eased, a senior Fed official said in the Asahi newspaper on Wednesday.

China's massive intervention in currency markets could qualify it as the most protectionist nation in history, a leading U.S. economist said on Friday.