Corporations are booking huge third-quarter profits and sitting on gargantuan piles of cash -- and nothing could be less important.

Upbeat job market data helped stocks bounce off two days of losses on Wednesday, with a crisis meeting about Greece and the end of a U.S. monetary policy session also on investors' minds.

Stock index futures edged higher on Wednesday, following two days of sharp market losses, with developments in Greece and a U.S. monetary policy meeting in focus.

After performing better than the wider high-tech market for months, stocks in American video game manufacturers have dropped precipitously since Thursday. Is there a 1UP on the way?

Stock index futures pointed to a higher open for equities on Wall Street on Wednesday, with futures for the S&P 500, for the Dow Jones and for the Nasdaq 100 up 0.6 to 1 percent.

The major US banks were particularly hammered.

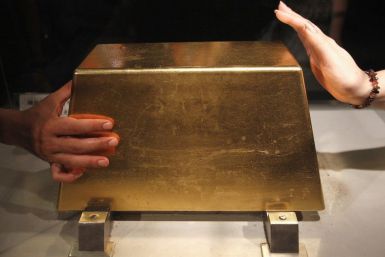

Gold prices fell sharply Tuesday but regained much of the lost ground to close down 0.8 percent on reports that retail investors are increasing their exposure to gold-back exchange-traded products.

Stock index futures tumbled on Tuesday as the deal to rescue Greece and prevent a wider sovereign debt crisis faced a new hurdle and as Asian economic data reignited fears of a slowdown in global growth.

Gold prices fell 1.5 percent Tuesday as Chinese manufacturing slowed more than expected and Greece blindsided markets with plans for a referendum on whether to accept another bailout.

Stock index futures tumbled on Tuesday as the deal to rescue Greece and prevent a wider sovereign debt crisis faced a new hurdle and as Asian economic data reignited fears of a slowdown in global growth.

Futures pointed to a lower open on Wall Street on Tuesday, adding to losses in the previous session, with the shock announcement of a Greek referendum on its bailout dragging down markets worldwide.

Gold prices fell 1.4 percent Monday as the bankruptcy of a broker-dealer heavily invested in European sovereign debt drove investors to the safety of the dollar.

Stocks fell more than 1 percent on Monday as enthusiasm over the agreement to tackle the Eurozone debt crisis waned and a spike in the U.S. dollar hurt commodity-related shares.

Stocks fell at the open on Monday as a spike in the U.S. dollar weighed on commodity prices and dried up bids on other risky assets.

Stocks fell at the open on Monday as a spike in the U.S. dollar weighed on commodity prices and dried up bids on other risky assets.

Stock index futures fell in lackluster volume on Monday, following four weeks of equities gains, as a spike in the U.S. dollar weighed on commodity prices and dried up bids on other risky assets.

Stock index futures pointed to a weaker open for equities on Wall Street on Monday, with futures for the S&P 500, the Dow Jones and the Nasdaq 100 down by between 0.6 and 0.9 percent.

U.S. and European shares took a breather on Friday after a strong rally on a long-awaited euro zone rescue deal, but a weak sale of Italian bonds showed investor confidence in the agreement was shaky.

U.S. stocks closed out a fourth week of gains in quiet fashion on Friday, edging higher as the market took a breather after rallying 3 percent on Europe's deal to stem its debt crisis.

Stocks edged lower on Friday as investors paused following a powerful rally that propelled the S&P 500 index almost 20 percent since briefly dipping into bear market territory earlier this month.

If one buys into reactions of global markets, including the New York Stock Exchange and Dow Jones Industrials Average, they could go to sleep at night with little concern that the Eurozone financial crisis is a ticking time bomb, just waiting to explode with global implications that ripple back to the U.S.

Stocks opened lower on Friday as investors booked profits a day after a powerful rally that propelled the S&P to close above its 200-day moving average for the first time since August.