U.S. oil prices shot to a 12-week high on Tuesday in a second day of frenetic spread trading, with dealers racing to claw back a record discount versus Europe's Brent as they gave in to evidence of tightening supplies.

Italian Prime Minister Silvio Berlusconi faced growing pressure Tuesday over European Union demands for economic reforms with his main coalition partner warning the government could fall over the issue.

Eurozone authorities should in future have greater powers to influence the economic policies of countries in the bloc if a member persistently fails to meet economic targets, ECB President Jean-Claude Trichet said on Monday.

Angela Merkel's supporters praised her for getting France to drop demands to use the European Central Bank to leverage euro crisis funds, but looked like making a meal out of the German parliament's new right to be consulted on how these are used.

The European Union is now discussing two options for giving the euro zone rescue fund more firepower -- an insurance model and a special investment vehicle , a paper obtained by Reuters on Monday showed.

The Eurozone's private sector tipped further into decline in October, according to business surveys on Monday that showed the bloc's economy is in serious danger of lurching from stagnation into outright recession.

As a young hockey player with dreams of making it big, Mark Carney liked to get revved up before a big game by listening to AC/DC's Hell's Bells.

France and Germany are close to a deal to leverage the euro zone bailout fund through first loss insurance for the primary bond market and a special purpose vehicle with an EFSF subordinated loan for the secondary market, euro zone officials said.

EU finance ministers outlined a deal on Saturday for recapitalizing European banks, and the leaders of Germany and France said they hoped for a breakthrough in tackling the Eurozone debt crisis at a summit on Wednesday.

Greek media identified the deceased as a middle-aged trade unionist.

The leaders of the most powerful nations in Europe, France and Germany, have reportedly agreed to increase the size of the Eurozone’s rescue fund to 2 trillion euros ($2.7 trillion) – up from the current 440 billion euro ($604 billion) lending capability -- as part of comprehensive program to find a solution to the debt crisis wreaking havoc across Europe.

A cloud of gloom hangs over Brussels ahead of yet another summit to thrash out yet another comprehensive strategy to tackle a sovereign debt crisis that Europe has failed for two years to stem, and that now threatens the world economy.

The chief public finance official of the world's largest economy said Sunday that he sees a ray of light in Europe's most recent effort to stop its sovereign debt crisis. U.S. Treasury Secretary Timothy Geithner, while attending a Group of Twenty (G20) meeting in Paris, said he is encouraged by the latest effort to address the crisis.

European Central Bank President Jean-Claude Trichet said the European Union's treaty should be changed to prevent one member state from destabilizing the rest of the bloc, while urging stronger Eurozone governance.

Ireland has come to grips with its banking problems, but it will not be able to pop the champagne until its unemployment rate starts to come down, a senior official with the International Monetary Fund said Saturday.

Thousands of people protested outside the European Central Bank (ECB) headquarters in Frankfurt, Germany, on Saturday in solidarity with the Occupy Wall Street movement.

The Italian version of the Occupy Wall Street movement turned violent Satudary as protesters in Rome burned cars and smashed shop windows.

The world's leading economies kept pressure firmly on Europe to sort out its debt crisis on Saturday with the sense of urgency to be reflected in a communique at the end of a G20 finance chiefs' meeting.

Finance ministers and central bankers from the world's top economies are set to back mandatory capital surcharges on big lenders of as much as 2.5 percent to be phased in beginning in 2016.

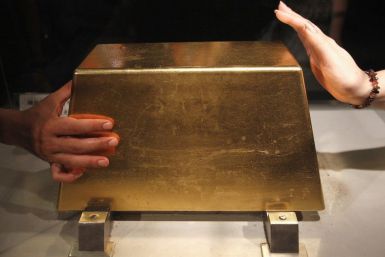

Gold prices will climb to $2,075 next year on six key variables that, UBS said Friday in a report on the precious metal.

Asian shares inched down on Friday, tracking New York and European shares lower as weak Chinese trade data raised concerns about the global economy, while the euro eased after another sovereign debt ratings downgrade.

Gold prices fell modestly Thursday as a rising dollar, boosted by signs the world's No. 2 economy is slowing, offset both steady Asian demand for jewelry and bullion as well as safe-haven buying by Euro-wary investors.