U.S. social media group Facebook seems ready to publish categories of data it collects from users, an Austrian student group lobbying for stricter privacy rules said on Tuesday.

As recently as last November, deep into the Syrian crisis, Brazil specifically rejected any foreign intervention in Syria.

Bombardment of Homs on eve of visit by Russian foreign minister Sergei Lavrov as world powers scramble for diplomatic strategy.

A Syrian regime military assault on Homs killed dozens of people on the eve of a visit to Damascus by Russia's Foreign Minister Sergei Lavrov aimed at pressing President Bashar al-Assad to end an 11-month uprising by implementing swift reform.

China on Monday barred its airlines from a European scheme to reduce carbon emissions, hardening its stance a week before a summit at which the European Union will seek Chinese help to ease its debt crisis.

German Chancellor Angela Merkel told Greece Monday to make up its mind fast on accepting the painful terms for a new EU/IMF bailout, but the country's political leaders responded by delaying their decision for yet another day.

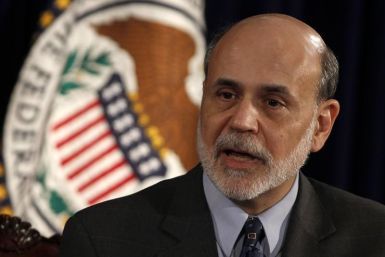

Stocks closed slightly lower on Monday as lingering questions about Europe's debt crisis and corporate earnings overshadowed growing optimism about economic growth after a five-week rally.

Chinese energy firms are deeply involved in Syria – China National Petroleum Corp. and Sinochem have heavy investments in the country.

Stocks edged lower on Monday as investors found little reason to extend a five-week rally on lingering uncertainty over whether Greece would accept the terms of a bailout.

A failure on the part of Greece's politicians to agree on an austerity framework rippled through the currency markets of London, the government halls of Budapest and the pits of the New York Stock Exchange Monday morning. The nonevent was only the headline occurrence in a morning that was also filled with contradictory, and at times despondent, statements out of Athens.

Hopes of India and the European Union striking a free trade deal at a summit this week are fading fast, with differences over duties on cars and market access for software and service companies standing in the way of an accord.

Greece let yet another deadline slip on Monday for responding to painful terms for a new EU/IMF bailout, as German Chancellor Angela Merkel made clear Europe's patience is wearing thin over drawn-out negotiations among its feuding political leaders.

European shares fell back from a six-month high early on Monday, with investors worried about whether Greece can avoid a messy default as its politicians struggled to agree austerity measures needed to secure a bailout package.

Gold prices declined Monday on concerns Greece will - despite the Eurozone's two years of efforts - default on its massive sovereign debt, with acute consequences for global economic growth.

The BSE Sensex rose more than 1 percent on Monday as surprisingly robust U.S. jobs data added to investor confidence about a turnaround in the world economy and bolstered the outlook for foreign fund investments.

Japan's Nikkei share average advanced to a three-month high on Monday as the U.S. economy showed further improvement with forecast-beating jobs data, boosting hopes for Japanese firms, which have disappointed in the latest quarterly earnings season.

Asian shares rose Monday as surprisingly robust U.S. jobs data bolstered investor risk appetite, overshadowing worries about a lack of progress in Greek debt restructuring talks that are vital to containing the euro zone debt crisis.

Greece's coalition parties must tell the European Union on Monday whether they accept the painful terms of a new bailout deal as EU patience wears thin with political dithering in Athens over implementing reforms.

Greece's coalition parties must tell the European Union by Monday whether they accept the painful terms of a new bailout deal as EU patience wears thin with political dithering in Athens over implementing reforms.

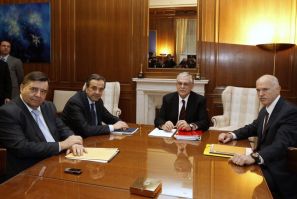

Greece's prime minister scrambled Sunday to convince lenders and politicians to sign off on a 130 billion euro rescue, after his finance minister said just hours remained to clinch a deal to avoid a messy default.

The United States is coming to be seen as a global threat, acting unilaterally with aggressive new market rules that critics say will hurt U.S. firms, foreign banks, and international markets in one swoop.

Greek Prime Minister Lucas Papademos faces the critical task of convincing international lenders and political-party leaders on Sunday to agree to the stringent terms of a 130 billion euro ($171 billion) rescue plan to stave off looming default.