The United States enters this Labor Day faced with many problems, and the most serious of which concerns jobs -- the state of working America is in its most trying condition in generations, with the unemployment at a very high 9.1 percent, and the nation short at least 11 million jobs.

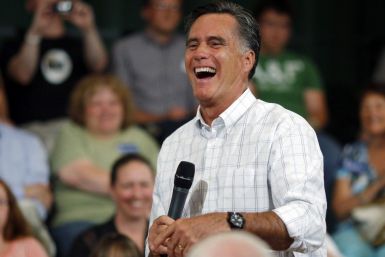

Mitt Romney promised on Friday to propose a bold jobs plan that seeks cuts in federal spending and business taxes, a reduction in burdensome regulations and a balanced budget.

Mitt Romney promised Friday to unveil his proposal to cut federal spending and business taxes in a bold jobs plan that would call for a reduction of burdensome regulations and also seek a balanced budget.

The DoJ opposes the $39-billion deal, largely on anti-trust grounds, but also cited that such a transaction would cost thousands of jobs -- in an economy that simply cannot withstand anymore job losses.

The U.S. economy created no net new jobs in August -- a disappointing report that will likely increase pressure on the U.S. Federal Reserve to deploy additional monetary tactics to help rev-up GDP growth to create the millions of jobs the nation needs. Also, the unemployment rate remained the same, at an eye-sore level of 9.1 percent.

College graduates in debt-stricken Portugal have been migrating in large numbers to its former colonies such as Brazil, Angola, and Mozambique to find work

Should the United States tolerate slightly higher inflation, in order to have the economy grow at a faster rate and create more jobs?

Portugal is mired in staggering debt, high unemployment and drastic budget cuts to social services

Government mismanagement of wartime contractors cost billions of taxpayer dollars in Iraq and Afghanistan, and without an overhaul the abuse could continue, according to a Congressionally appointed panel of investigators.

The Canadian economy shrank in the second quarter, its first quarterly fall since the 2008-09 recession, with temporary factors such as Japan's earthquake and tsunami playing a big role, Statistics Canada said on Wednesday.

Finally some good news for the American people on the U.S. economy front: Oil is on track to record in August its biggest monthly price decline since May -- something that will put more money in the pockets of consumers and also boost U.S. GDP growth, if the price reduction holds.

Despite tepid U.S. GDP growth, the U.S. job market has not collapsed, as the private sector added 91,000 jobs in August, ADP announced Wednesday.

President Barack Obama said on Tuesday there were a range of policy options available that could create up to a million new U.S. jobs, in remarks ahead of a major economic speech that he will deliver next week.

Forget the struggling economy. There's one U.S. industry -- Big Politics -- that is looking ahead to a record year in 2012.

Hong Kong shares gained for a second-straight session on Tuesday, but trading was thin as investors stayed on the sidelines ahead of economic data releases from China and the United States this week.

Gold prices jumped 2 percent Tuesday and silver surged 2.1 percent as some investors opted for the safety of precious metals and Treasuries amid continued worries about Europe's sovereign debt crisis and weakness in the American economy.

South Africa's economy grew at its slowest pace in almost two years in the second quarter as the manufacturing and mining sectors slumped after strikes, boosting the case for interest rate cuts while denting the government's job-creation hopes.

U.S. home prices dipped just 0.1 percent in June from May, according to Case-Shiller -- providing a ray of light that the U.S. housing market may be stabilizing.

Silver and gold prices rose Tuesday, lifting share prices of companies that mine the precious metals and underscoring just how tentative the U.S. economy is.

Amid a sluggish U.S. job market, a patch-work recovery in the housing market sector, and now damage from Hurricane Irene, it's understandable if U.S. investors are hesitant regarding deploying new money to the stock market. Where's the Dow Jones Industrial Average headed from here?

Even PIMCO's Bill Gross makes a wrong call every now and then. Gross, manager of the world's largest bond fund noted for calling the housing bubble early on that burst several years ago, feels like crying in his beer for betting so heavily against U.S. government related debt this year.

The rupee should strengthen for a second day on Tuesday tracking regional sharemarkets that rose on the back of a slew of positive news across the euro zone and the United States.