The dust of G-20 has settled. World leaders sat around a large table set this time in South Korea, searched for that magic wand in their suit pockets, and then looked at each other's face with disappointment. They didn't get one to 'calm down' the emerging fears of a 'world war' on trade and currencies. They did not 'direct' China and/or US as some hoped.

U.S. economic policy is stuck in the pre-1970s era, which had higher population growth. Before 2008, this outdated policy caused boom-and-bust cycles. Now, it is failing to boost economic growth and possibly endangering the world financial system.

The economy grew 0.4 percent in the Euroarea and the EU27 in the third quarter, a little lesser than expectations, according to a report by Eurostat.

Ireland's grip on the slippery debt-mired track is giving way fast as bond yields widened to a level with Greece’s before Athens went broke and was bailed out, fueling speculation that the country could be soon looking for international financial assistance.

The leaders of the G20 countries completed their summit in Seoul, South Korea with an agreement to push for “market-determined” currency exchange rates, to enhance exchange rate flexibility, and to establish a timetable to lay out “indicative guidelines” for global economies to confront trade imbalances by the first half of next year.

German gross domestic product (GDP) growth slowed to 0.7 percent in the third quarter after increasing sharply by a revised 2.3 percent in the second quarter.

Indian gold demand is likely to recover near to its pre-credit crunch level following the fall in demand in 2009, said World Gold Council (WGC) on Friday in a report titled India: Hear of Gold.

The euro dropped across the board on Thursday as weak data from the region showed the crisis-hit EU member countries will continue to pressurize the single currency.

Moody's Investor Service upgraded China's 3 big policy banks and Chinese government's bond rating to Aa3 from A1.

Greece's budget problems are far from over, as its deficit is likely to have narrowed much less sharply than the Government had predicted, Capital Economics said in a note. Greece will now come under heavy pressure to implement an even more draconian fiscal squeeze, Ben May, a European economist with Capital Economics, said.

At the closing plenary session of the G20 business summit in Seoul, South Korea, David Cameron, the British Prime Minister, praised the host country’s miraculous economic advances and also highlighted some major themes underlying the purpose of the G20.

DLF Limited, India’s largest real estate company, said on Thursday its consolidated net profit fell 5 percent to 4.18 billion rupees for the second quarter as compared to 4.4 billion rupees for the same quarter last year.

In a wide-ranging and rambling speech during a luncheon at the G20 Business summit in Seoul, Korea, Germany’s chancellor Angela Merkel called for a “sensible” exit strategy from the global credit crisis.

Not unexpectedly, the preliminary proposal of President’s Obama’s bipartisan Commission on Fiscal Responsibility and Reform has met with mixed reviews, from “unacceptable” to “most encouraging.”

The National Commission on Fiscal Responsibility and Reform, a bipartisan commission recently created by President Obama, unveiled a proposal that could save the U.S. government nearly $4 trillion from 2012 to 2020.

The CEO of Vestas, a major supplier of wind turbines, is asking for heads of state to meet for an hour to help come up with methods of weaning the world from fossil fuels.

Tokyo will host the Global Travel & Tourism Summit 2012 under the aegis of the World Travel & Tourism Council (WTTC) even as Japan Tourism Board celebrates its centenary year in 2012.

QE2 is a rising tide that lifts all boats. The boats, in this case, refers to asset prices. Unfortunately, some asset rallies, particularly those in consumer and industrial commodities, are bad for the real economy,

Xi Jinping will likely be China's next President. Given his background, he is likely to favor coastal regions and continue China's export-driven economic model, and therefore unlikely to pursue structural reforms like distributing income to inner regions or taking dramatic steps to cultivate domestic consumption.

Robert Prechter speaks to IBTimes about mass psychology in the financial markets and specifically about the Greek sovereign debt crisis.

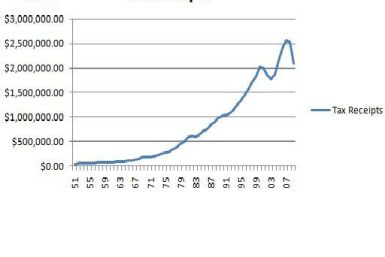

An analysis of the relationship among U.S. personal income tax rate, tax receipts, and the GDP reveals a high correlation between GDP and tax receipts. However, others correlations are noticeably weaker.

Australia's real estate market emerged relatively unscathed from the global financial crisis. But that doesn't meant there isn't a bubble, said Morgan Stanley's Gerard Minack.