In the weeks leading up to Facebook's $100 billion initial public offering, Mark Zuckerberg reportedly told Goldman Sachs, Morgan Stanley, JPMorgan Chase and the other banks involved in the action to stop leaking information to the media.

Stocks and high-yield bonds rallied in U.S. markets Friday, after yet another round of positive economic data proved a boon to investors betting that the economy will improve at a faster rate than previously forecast.

Solar power company SolarCity is expected to debut on U.S. markets in the third quarter this year and has hired Goldman Sachs to underwrite its initial public offering, a source close to the company said on Thursday.

As pro-business groups clamor to convince regulators to overhaul their draft of the controversial Volcker rule, fault lines are emerging within the opposition over just what a revamped draft should look like.

The job cuts, if they go through, would be part of thousands of other cuts which financial institutions plan to make in the near future.

Facebook filed for an initial public offering with the U.S. Securities and Exchange Commission Wednesday, for the first time doing a public financial strip tease.

Facebook unveiled plans for the biggest ever Internet IPO that could raise as much as $10 billion, but made it clear CEO Mark Zuckerberg will exercise almost complete control over the company, leaving investors with little say.

Anti-virus software maker AVG Technologies NV priced its initial public offering at $16 per share, at the low end of the expected range, according to a market source.

The head of the Commodity Futures Trading Commission has ordered an extensive review of how futures brokerages are regulated, following the collapse of MF Global three months ago, a CFTC official told Reuters on Wednesday.

Facebook is expected to submit paperwork to regulators on Wednesday morning for a $5 billion initial public offering and has selected Morgan Stanley and four other bookrunners to handle the mega-IPO, sources close to the deal told IFR.

Facebook Inc. will list a preliminary fund-raising goal of $5 billion on Wednesday, which is smaller than some earlier estimates of the offering. The public stock offering will probably value the company at $80 billion to $100 billion. But how did simple status updates and random photos of users help create what will likely be the biggest tech IPO in till date? Let's try to find out here...

Facebook is expected to submit paperwork to regulators on Wednesday morning for a $5 billion initial public offering and has selected Morgan Stanley and four other bookrunners to handle the mega-IPO, sources close to the deal told IFR.

Federal prosecutors expanded their insider trading case against former Goldman Sachs Group Inc director Rajat Gupta on Tuesday, saying the illegal activity lasted longer and involved more trades than alleged.

Within days, Facebook is expected to file for an initial public offering with the U.S. Securities and Exchange Commission, for the first time doing a public financial strip tease.

Stock index futures pointed to a higher open on Wall Street on Tuesday, with futures for the S&P 500, the Dow Jones and Nasdaq 100 indexes up 0.5-0.6 percent.

Facebook's initial public offering is likely to set a new standard for how low investment banks are willing to go on advisory fees to win big business.

Facebook Inc., the world's largest social networking site, is getting closer to its initial public offering this week as the company is reportedly planning to file papers with the U.S. financial watchdog on Wednesday. Speculation is rife that the social media giant is aiming to raise about $10 billion, which would value the company at between $75 billion and $100 billion.

Facebook plans to file documents as early as Wednesday for a highly anticipated IPO that will value the world's largest social network at between $75 billion and $100 billion, the Wall Street Journal cited unidentified sources as saying on Friday.

The names of a top executive at Berkshire Hathaway Inc. and a board member at Goldman Sachs Group Inc. surfaced on Friday as potential witnesses in the insider-trading trial of Rajat Gupta, a former director of Goldman, the Procter & Gamble Co., and other companies.

Facebook could file for its initial public offering as early as Feb.1, valuing the company as high as $100 billion, a report said.

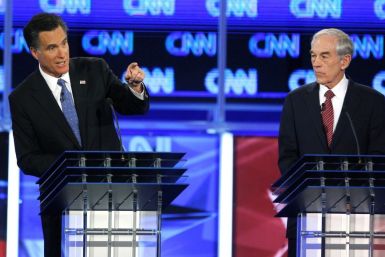

Mitt Romney, Newt Gingrich, Ron Paul and Rick Santorum faced off last night in the final GOP debate in Florida before the Jan. 31 primary. Here, find out what statements from the primary debate were true and which got the facts wrong, from Santorum on Latin America to Mitt Romney's involvement in Freddie Mac.

Facebook’s lawyers have advised the social networking giant to stop trading shares on private exchanges, which could foreshadow the company’s long-awaited initial public offering.