Thursday's downgrade contained a veiled threat that pointed at politicians in Germany, the United Kingdom, France and the United States and plainly stated, Stop talking about making the banks responsible for their own follies -- or else.

Harvest Natural Resources, Sony Corp., Morgan Stanley, Banco Santander, Deutsche Bank, Jack in the Box, Statoil and IHS Inc. are among the companies whose shares are moving in pre-market trading Friday.

Asian stock markets declined Friday, following a slump in the Wall Street overnight, as weak manufacturing reports from Europe, China and the U.S. dampened hopes for a global economic recovery.

Moody's Investors Service downgraded 15 global financial institutions Thursday, including five of the largest U.S. banks, nine major European banks and the Royal Bank of Canada (NYSE: RY), a move that could tighten borrowing and require the companies to post billions of additional collateral.

Chinese market regulators announced Thursday they could be easing the rules that currently allow only a small group of foreign banks to invest in the national equity and bond markets, a move that is seen as part of a wider campaign to open the country's financial system to global competition. Whether by design or by coincidence, however, the move also takes a tremendous amount of pressure off the country's central bankers, who are between a rock and a hard place in deciding whether or n......

The formation of a new Greek government Wednesday staves off fears of a swift departure from the euro zone by the Hellenic Republic. But this week's election and installation of a new administration merely extends the country's economic death-spiral as its economic woes remain deep and pervasive.

First Lady Michelle Obama spent her weekend disparaging the fat paycheck, the fancy office, the impressive lines on our resumés.

The prolonged crisis in the euro zone, coupled with signs that the U.S. economic recovery is faltering, have led to speculation that the Federal Reserve will provide more monetary stimulus, most likely through extending its Operation Twist program, at the June two-day Federal Open Market Committee meeting, which concludes on Wednesday June 20.

Rajat Gupta, former Goldman Sachs Group director and head of consulting firm McKinsey & Co., was convicted Friday of insider trading by a New York federal jury in one of corporate America's most high-profile scandals.

Former Goldman Sachs director Rajat Gupta, who is accused of insider trading, will not testify in his own defense, according to a letter written by his main lawyer to the U.S. District Judge in New York.

Former Goldman Sachs Group Inc board member Rajat Gupta, who is on trial over insider trading charges, has decided not to take the risk of testifying in his own defence.

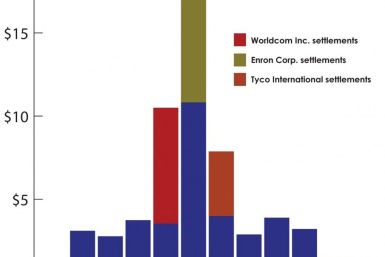

Within a week of Facebook Inc.'s (Nasdaq: FB) $16 billion initial public offering, at least six lawsuits were filed against its top officials, including CEO Mark Zuckerberg, as well as six investment banks involved in the deal. That in itself is not surprising, considering the IPO flopped. What would be surprising is if the shareholders actually get anything near what they feel they deserve.

Two Chesapeake Energy Corp. (NYSE: CHK) directors -- members of the audit committee now dealing with the personal finances of the company's CEO -- offered their resignations Friday after they attracted little support at the annual shareholders meeting.

In 2009, the Economist Intelligence Unit devised an acronym for six emerging countries, CIVETS, which includes Colombia, Indonesia, Vietnam, Egypt, Turkey and South Africa. These countries were categorized as the six countries with the best chance of high, long-term growth.

Lloyd Blankfein, the chief executive of Goldman Sachs Group Inc, told jurors at the insider-trading trial of one of the investment bank's former directors that all parts of a 2008 board meeting the two attended were confidential.

Jon Corzine, the former chief of MF Global and governor of New Jersey, could be the target of a possible lawsuit linked to the brokerage's bankruptcy and disappearence of $1.6 billion in client funds.

Mark Zuckerberg is reportedly being sued by his own investors. The most recent lawsuit claims that the Facebook co-founder sold more than $1 billion worth of the social networks stock just before prices started tumbling.

The CEO of a New York commercial mortgage company sold his personal condo at 15 Central Park West, one of the most expensive buildings in the world, for $23.3 million, according to city records filed Friday.

Shares of Facebook (Nasdaq: FB), the No. 1 social network, fell 3.4 percent again Friday, a week after their disastrous debut in their initial public offering.

Shares of Facebook (Nasdaq: FB), the No. 1 social network, rose $1.03 to close at $33.03 on Thursday. A week ago, they were priced at $38 for the IPO.

Facebook (Nasdaq: FB), the No. 1 social network, didn?t just set records for enriching inside investors like CEO Mark Zuckerberg, COO Sheryl Sandberg, Accel Partners and Digital Sky Technologies. Underwriters fared very well.

Shares of Facebook (Nasdaq: FB), the No. 1 social network, are up six cents to $32.06 in late morning trading on Thursday.