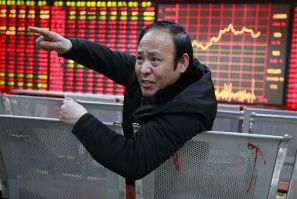

Asian markets were mixed this week as investors continued to have concerns about the faltering global economy and the mounting debt crisis in the euro zone.

Asian markets fell this week as investor sentiment turned negative with concerns of economic slowdown in China, Japan and South Korea.

Amid the mixed global cues, Indian markets opened on a positive note Tuesday morning.

Most Asian markets rose this week as investor confidence was boosted by expectations of stimulus measures from central banks globally to regain the economic growth momentum.

Most Asian markets rose this week as investor sentiment turned positive with the announcement of measures at the EU summit in Brussels aimed at alleviating the current debt crisis gripping the euro zone.

Most Asian markets fell this week as investors were worried after the U.S. Federal Reserve refused to announce a further round of quantitative easing and the HSBC Flash Purchasing Managers Index (PMI) indicated that China's manufacturing activity was faltering.

Asian markets rose this week amid hopes that central banks around the world will take coordinated stimulus measures to tackle the European financial crisis and regain global economic growth momentum.

Asian markets rose this week amid hopes that policy makers would take concrete measures to tackle the financial crisis and regain the economic growth momentum.

India's BSE Sensex rose Wednesday following positive cues from Asian markets and the rupee gaining.

India's BSE Sensex rose Tuesday, tracking positive cues from other Asian markets and following recovery staged by the rupee.

Asian markets declined this week due to increasing concerns about China's economic slowdown and heightened Spanish banking sector woes.

Asian markets fell Friday amid increasing concerns over the slowdown in economic growth in China as the country's manufacturing activity grew at a slower pace in May compared to the previous month.

Indian markets opened on a positive note Monday as Bombay Stock Exchange Sensex was trading at 16,360.34, 142.52 or points 0.90 percent up from the previous close and NSE Nifty was at 4,965.20, up 44.80 points or 0.80 percent, in the morning session.

Asian markets fell this week as they succumbed to the pressures of the euro zone debt crisis and the economic data about the U.S. missing estimates. The Chinese Shanghai Index dropped 2.1 percent and the Japanese Nikkei fell 3.8 percent. Hong Kong's Hang Seng Index plunged 5.1 percent and India's BSE Sensex slumped 0.86 percent.

Just about everything in China's economy seems to have gone backwards in April and the raft of weaker data raised fears that the world's second largest economy has yet to bottom out.

A headscratcher of a report on Chinese industrial profits intensified speculation about just what exactly central bankers in that country will come up with next as the note, by the National Bureau of Statistics (NBS), revealed data that both supporters and detractors of monetary easing in the world's second-largest economy will find justifies their rationale.

China factory activates slumped for the sixth consecutive month, albeit at a slower pace, data released by HSBC showed.

The bears were on the prowl Friday, as negative economic news out of China, Spain, and the U.S. left global investors struggling to find safe places for their cash -- and the positive developments that did surface appeared to have little effect.

Stocks and other risky assets rallied Friday, rounding out the quarter with even more price gains on a day that encapsulated the main developments of the year so far: encouraging news out of Europe, better-than-expected consumer sentiment in the United States, and the perceived and steady pull of inflation.

Equities worldwide were in sell-off mode Tuesday, as nagging uncertainty about Greece, sobering news about China's economy and traders' realization that U.S. and European central banks might be finished with cash infusions all seemed to weigh on investors.

Wall Street was set to open lower on Tuesday on renewed concerns that Greece and private bondholders may not meet a looming deadline to complete a debt swap and as caution grew over the global economic outlook after recent weak data.

China lowered its economic growth target to an eight-year-low of 7.5 percent from an 8 percent goal in place since 2005, a signal that the country's leaders are determined to scale back the reliance on external demand and foreign capital, in favor of domestic consumption.