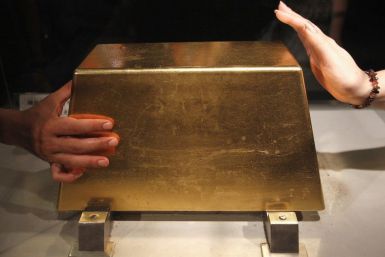

Gold strengthened further on Monday as falling equities and lingering worries about a debt crisis in Europe drew investors to the precious metal, which posted its the biggest quarterly gain this year, but a firm U.S. dollar could still cap gains.

China's factory activity picked up in September for the second month in a row and export orders strengthened, offering some reassurance that the world's second-largest economy can weather the global economic turmoil.

Help could be on the way for the protestors, as New York City labor unions and community groups have thrown their support behind Occupy Wall Street and pledged to join in a massive rally on Wednesday, Oct. 5.

Gold rose more than 1 percent on Friday but was on track for its biggest quarterly gain this year as concerns that the euro zone debt crisis was far from resolved weighed on stock markets and the euro, lifting interest in bullion as an alternative.

Russian precious metals miner Polymetal is seeking a premium listing on the London Stock Exchange, raising about $500 million in a move it hopes will catapult it into the FTSE 100 bluechip index and hand it currency for acquisitions.

Gold prices rose more than 3 percent on Tuesday as a drop in the dollar index helped the precious metal snap a four-day run of losses and after an early rout in the previous session tempted price-sensitive physical buyers back to the market.

An intensifying legal battle between Samsung Electronics Co and Apple Inc is expected to crimp growth at one of the fastest growing businesses of the Korean company, while threatening to worsen business ties with the firm's largest customer.

European shares fell on Friday after a fresh pledge of support from leading global economies to shore up the financial sector failed to placate markets, leaving them on course for a fifth straight month of losses.

Gold fell by more than 3 percent on Thursday, set for its largest monthly decline since January, after the Federal Reserve's move to boost U.S. growth lifted the dollar, which battered the commodities complex.

China's manufacturing sector contracted for a third consecutive month in September while a measure of inflation picked up, suggesting the world's No.2 economy may not be able to provide much of a counterweight to flagging U.S. and European growth.

Gold fell on Thursday, after the Federal Reserve's widely-anticipated move to boost U.S. growth lifted the dollar but pummelled global equities and hit the entire commodities complex.

Britain's top share index slipped back on Wednesday, weighed down by concerns over Greece's ability to stave off a default, as investors focused on the possibility of further economic stimulus from the U.S. Federal Reserve.

Gold's rally will extend beyond $2,000 an ounce in the next year, but won't match the torrid record-breaking climb of the last 12 months, according to gold investors and analysts attending the London Bullion Market Association's (LBMA) annual conference.

Gold's rally will extend beyond $2,000 an ounce in the next year, but won't match the torrid record-breaking climb of the last 12 months, according to gold investors and analysts attending the London Bullion Market Association's (LBMA) annual conference.

With UBS losing approximately $2 billion from unauthorized trades by a "rogue" trader, the road for recovery for the Swiss bank could be long.

Gold prices slipped below $1,800 an ounce on Thursday as stock markets extended gains, with assurances from Germany and France about keeping Greece in the euro bloc boosting appetite for assets seen as higher risk at the precious metal's expense.

Moody's cut the credit ratings of two French banks on Wednesday because of their exposure to Greece's debt, highlighting growing risks to Europe's financial sector from a deepening euro zone sovereign debt crisis.

In July, Nomura said it would seek to reduce annual expenses at its wholesale unit by about $400 million.

Bank of Nova Scotia (BNS.TO) said on Friday it will buy a near 20 percent stake in Bank of Guangzhou for about C$719 million ($722 million) to expand its footprint in China, becoming the latest foreign bank to invest in a Chinese bank before the bank does an IPO.

Major global banks have been jettisoning workers en masse for the past few months – the brutal manifestation of a grim new economic landscape.

The bank’s chief executive Stuart Gulliver warned in August that HSBC will cut up to 30,000 jobs around the world by 2013.

China's campaign to protect its maritime industry during a severe downturn will become more costly for foreign companies as Beijing grabs a bigger slice of the profits for shipping iron ore, coal and grains to the world's second largest economy.