Asian markets rose this week amid hopes that policy makers would take concrete measures to tackle the financial crisis and regain the economic growth momentum.

In 2009, the Economist Intelligence Unit devised an acronym for six emerging countries, CIVETS, which includes Colombia, Indonesia, Vietnam, Egypt, Turkey and South Africa. These countries were categorized as the six countries with the best chance of high, long-term growth.

Crude oil futures hovered below $84 a barrel Tuesday as concerns over the euro zone debt crisis continued to weigh on the sentiment.

Futures on major U.S. indices point to a slightly higher opening Tuesday ahead of the nonmanufacturing composite index report, as well as a teleconference among G7 leaders.

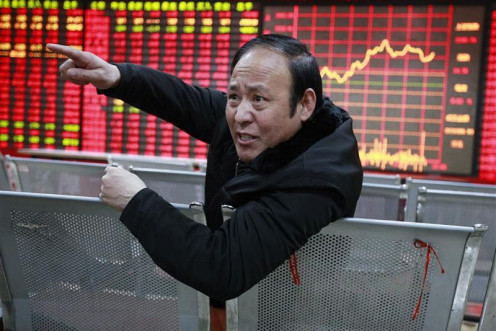

Stock markets in China and Hong Kong advanced Tuesday after data showed that the China's services industry expanded at its fastest rate in 19 months in May.

Asian markets rose Tuesday amid hopes that policy makers in Europe would take measures to stem the debt crisis and regain the economic growth momentum.

India's BSE Sensex rose Tuesday, tracking positive cues from other Asian markets and following recovery staged by the rupee.

China's services activity in May grew at the fastest rate in 19 months, according to the HSBC Purchasing Managers Index released Tuesday.

Stocks have wiped out their year-to-date gains. US payrolls are down while unemployment is up. Yields on high-demand government bonds are at record lows. Speculation abounds the US Fed might even print more money. Is it any wonder some are talking about gold?s rebound?

Asian markets declined this week due to increasing concerns about China's economic slowdown and heightened Spanish banking sector woes.

Shares of big gold mining companies rocketed higher Friday as the yellow metal regained its status as a safe-haven amid growing fear that the American economy may not be able to offset the combined drag of the euro zone crisis and sharply decelerating growth in China and India.

Following a high-volatility period over that past few days that has seen the political situation in Greece worsen, highly disappointing economic data prints in the U.S. and China and -- most prominently -- a surprise banking crisis in Spain, U.S. Treasuries have been hitting historically low yields on a daily basis. Lawrence Dyer, a New York-based rates strategist for British giant bank HSBC says should soon fall to 1.32 percent or lower.

China's manufacturing activity grew at a slower pace in May compared to the previous month, increasing concerns over a slowdown in the economic growth of the country.

The companies whose shares are moving in pre-market trading Thursday are: The Ryland Group Inc., Zynga Inc., SAP AG, HSBC Holdings plc, Neonode Inc., NCI Inc. and Amazon.com Inc.

Asian markets declined this week on increasing concerns about China's economic slowdown and Greece possibly exiting the euro zone.

Futures on major U.S. indices point to a lower opening Thursday ahead of initial jobless claims and durable orders data.

Asian markets fell Thursday on increasing concerns about the debt crisis looming over the euro zone as national leaders were unable to present specific steps to overcome the situation in Europe.

China's manufacturing activity fell in May compared to April and continued to contract for the seventh straight month, according to the preliminary HSBC Flash Purchasing Managers Index (PMI) released Thursday.

This week's economic calendar is relatively light in the U.S. with the releases of existing home sales, durable goods orders, and the University of Michigan consumer confidence survey. Attention will likely focus on data out of Europe. Euro zone PMIs, Germany IFO survey, and first-quarter gross domestic product data for the U.K. will be released.

Asian stock markets rebounded Monday after suffering heavy losses last week amid ongoing worries over the euro zone crisis.

Asian stock markets slumped Friday as renewed concerns over euro zone crisis and lackluster economic data from US dented investor sentiment.

The world's 29 largest banks will need an extra $566 billion to comply with Basel III capital rules by the end of 2018, which could dampen their ability to increase dividends and buy back shares, according to Fitch Ratings.