Kingfisher Airlines on Wednesday sought further cushion from banks to ease its debt burden, but denied it was seeking another debt restructuring.

The BSE Sensex fell 0.4 percent on Monday as investors turned cautious after four straight sessions of gains, amid weak sentiment in Asian markets, with automakers among the key losers after Maruti Suzuki posted a sharp fall in quarterly profit.

The BSE Sensex rose as much as 1.9 percent on Monday, with index heavyweight Reliance Industries and banking stocks leading the gains, as investors grew optimistic about renewed efforts by European leaders to limit the region's debt crisis.

Biocon Ltd, India top biotechnology company, reported a 4 percent drop in quarterly profit due to higher energy costs and rise in wages, but said strong demand from branded formulations offered opportunities for growth.

The BSE Sensex fell more than 1.5 percent on Tuesday, dragged down by IT stocks after Tata Consultancy Services reported lower-than-expected quarterly earnings and said the outlook for pricing was tough.

The BSE Sensex pulled higher on Friday after a sluggish start as investors awaited monthly inflation, which would set the tone for the RBI's monetary stance.

Debt-strapped Kingfisher Airlines plans to exit its low-cost business in the next four months and focus on the premium model, Chairman Vijay Mallya said, breaking with rival carriers which are mostly betting on the budget space.

The BSE Sensex rose 0.73 percent on Tuesday, mirroring global market gains, after a takeover news lifted Wall Street overnight and as the Japanese economy shrank much less than expected.

The top pre-market NASDAQ Stock Market gainers are: Cintas, Motricity, Sky-mobi, Infosys Technologies, and IncrediMail. The top pre-market NASDAQ Stock Market losers are: XOMA, Cree, Rubicon Technology, Veeco Instruments, and Aixtron AG.

The BSE Sensex should open higher on Monday, with heavyweights Reliance Industries and State Bank of India in focus after their quarterly results.

The BSE Sensex was up 0.8 percent on Monday led by financial firms, but trading was choppy a day before the Reserve Bank's monetary policy and mixed Asian markets.

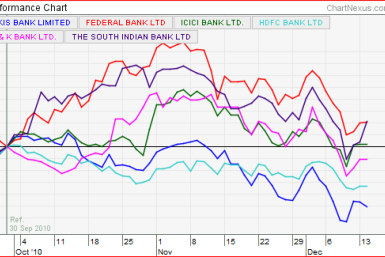

It is inevitable for Indian banks to compromise on margin as the country is going through a rising interest rate scenario, which has pushed most banks' stocks below their end-September levels, but at least three main private banks are still selling at a higher price, probably helped by valuation advantage and mostly steady pricing of deposits by Indians residing abroad.

Indian equity markets are trading lower by 29.17 points or 0.14 percent on Thursday with consumer durables, metal, healthcare and auto sectoral indices are in the gaining side and telecom, IT and realty sectoral indices are in the negative side.

India's No. 2 lender, ICICI Bank, expects to sustain 70 percent growth in its private wealth management business this year on the back of rising affluence, a senior official said on Monday.