Greece's prime minister won the backing of his Cabinet Wednesday to hold a referendum on a 130 billion euro bailout package but will find the stunned euro zone leaders who engineered the deal last week harder to convince.

The Bank of Japan supplied dollars in market operations on Wednesday for the first time in more than a year, a sign of the global market strains that board member Sayuri Shirai separately said could push the yen higher again.

Greek Prime Minister George Papandreou fought off a barrage of criticism to win the backing of his Cabinet Wednesday to push ahead with a speedy referendum on the European debt bailout deal.

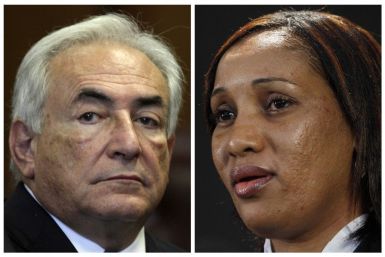

DXK is based on Strauss-Kahn's hotel maid scandal

Congolese state mining firm Gecamines has refused a request from the mines ministry to publish all revised contracts, saying it cannot do so without the permission of firms involved, according to a letter from Gecamines published on the ministry website.

The Greek government faced possible collapse on Tuesday as ruling party lawmakers demanded Prime Minister George Papandreou resign for throwing the nation's euro membership into jeopardy with a shock call for a referendum.

Kenya's central bank bared its teeth against stubbornly high inflation on Tuesday with a record rate rise that is seen supporting the shilling, boosting appetite for long-term bonds and helping secure the approval of extra funds from the IMF.

Congolese state mining firm Gecamines has refused a request from the mines ministry to publish all revised contracts, saying it cannot do so without the permission of firms involved, according to a letter from Gecamines published on the ministry website.

The International Monetary Fund on Monday trimmed its 2011 growth outlook for Kenya on Monday and backed further funds to boost the country's foreign exchange reserves to help tackle a widening balance of payments gap.

Banks led European shares lower on Monday, giving up some of last week's hefty gains as demand for detail on the recent euro zone debt deal teed up a weak end to a bumper month, with the broader market on course to snap a five-month losing streak.

Banks led European shares lower on Monday, giving up some of last week's hefty gains as demand for detail on the recent euro zone debt deal teed up a weak end to a bumper month, with the broader market on course to snap a five-month losing streak.

Micheál Martin, leader of the opposition Fianna Fail party has also delivered his congratulations to Higgins.

The “B” rating is only a few notches above the current CCC grade on Greece and it still considered “junk” or non-investment grade.

European shares extended the previous session's rally Friday, with investors still buoyant over a deal struck by euro zone leaders early Thursday to help end the bloc's two-year-old debt crisis.

The Athens Stock Exchange surged as much as 6 percent in Thursday trading.

Euro zone leaders struck a last-minute deal to limit the damage from the currency bloc's debt crisis early on Thursday but are still far from finalizing plans to slash Greece's debt burden and strengthen their rescue fund.

Britain will not contribute to a euro zone bailout fund, Chancellor George Osborne said on Thursday following a deal to address the euro zone crisis.

The dark shadow of German-driven austerity measures squeezing Greece has revived historical enmities and evoked comparisons to the massive destruction of the Mediterranean country at the hands of Nazi Germany nearly 70 years ago.

The incoming head of the European Central Bank threw the Eurozone a lifeline hours before a crucial summit on Wednesday by signaling the bank would go on buying troubled states' bonds to combat market turmoil.

The International Monetary Fund told officials of Ghana, Africa's second-largest gold producer, that they should consider hiking taxes on the mining sector to boost revenue.

Mauritania's current economic growth rate is not high enough to significantly dent poverty and the country will next year face the twin challenge of drought and uncertainty over mining revenues, the International Monetary Fund said.

Ghana, Africa's second biggest gold producer, should look at options to increase tax revenues from its mining sector, the International Monetary Fund said on Tuesday.